Weekly Market Recap, Watchlist & Trade Highlights 07/21/25

Speculative stocks continue to rally in the nuclear, quantum and space sector

Market Recap

The market rose higher this week, closing at a new all-time high. A brief dip on Wednesday was sparked by rumors that President Trump might fire Fed Chair Jerome Powell. However, during a White House press conference, Trump clarified that there were no plans to remove Powell, easing market concerns.

NVDA 0.00%↑ and semiconductors rallied higher this week, helped by positive news that it was ready to resume sales of its H20 chips to China.

Growth momentum stocks in the small and mid-cap space are having a very strong month, with sectors like space, quantum computing, and nuclear energy seeing major rallies. While many of these names are currently extended, they continue to hold their bullish trends. This strength is evident in the ARKK 0.00%↑ ETF, which broke out in early June, but is now becoming extended from the moving averages and trading above its upper Bollinger Band.

$BTC opened higher on Monday following strong momentum from its breakout above all-time highs, but started to pull back throughout the week. Crypto-related stocks surged into Friday ahead of the much anticipated GENIUS ACT signing event but saw a sharp reversal afterward, potentially a brief "sell the news" reaction - as seen in names like COIN 0.00%↑ MSTR 0.00%↑ HOOD 0.00%↑ and CRCL 0.00%↑.

Watchlist

QuantumScape (QS 0.00%↑) began rallying in late June on heavy volume following positive news regarding its next-generation battery development. Since then, the stock has gone parabolic and is now looking extremely extended. With earnings scheduled for Wednesday, the stock is on watch for a potential exhaustion reversal short trade.

JOBY Aviation (JOBY 0.00%↑) has surged over 100% in just a few weeks after breaking out to new 52-week highs. The stock has posted multiple consecutive up days and is now significantly extended. It’s on watch for a short-term reversal setup, particularly as momentum shows signs of exhaustion.

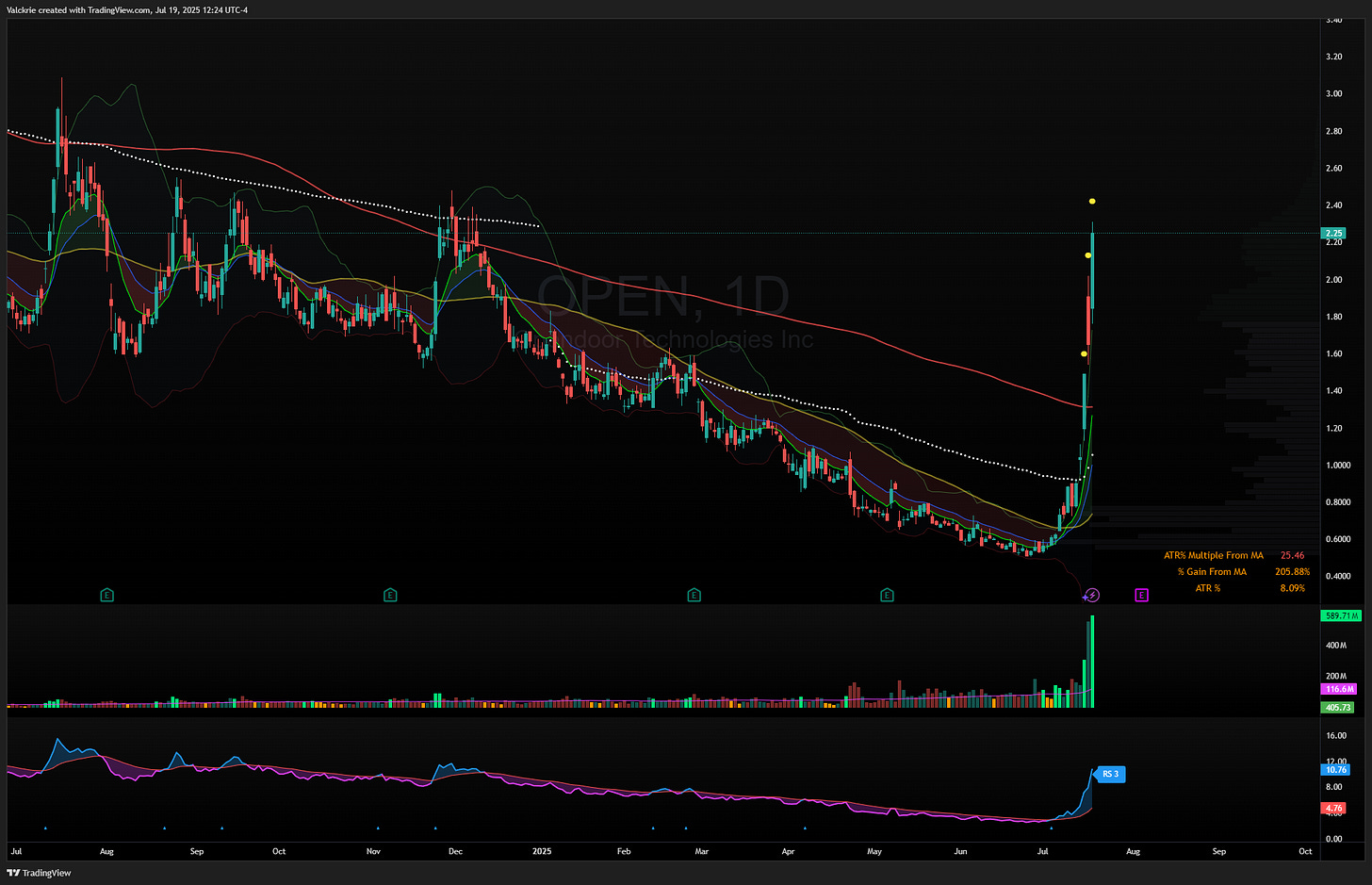

Opendoor Technologies (OPEN 0.00%↑) has been on a massive run, rallying over 300% off the July lows. Despite a brief pullback on Thursday, the stock continues to surge on rising volume. It’s seeing increased attention on Twitter, particularly from Eric Jackson of EMJ Capital, and has recently caught the eye of WallStreetBets traders. With the stock now extremely extended, it will be on watch for a momentum exhaustion reversal trade if buying pressure begins to wane.

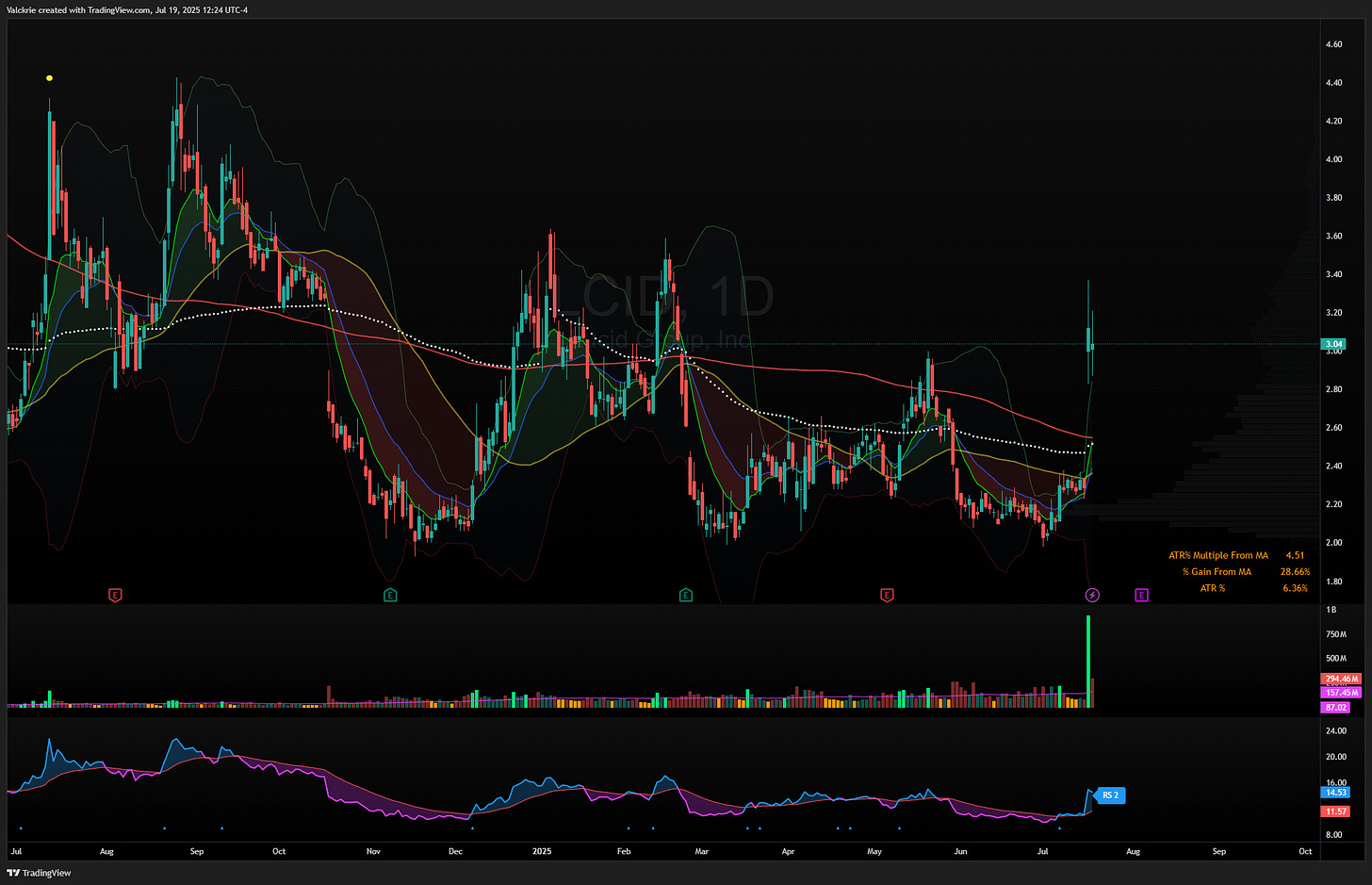

Lucid Motors (LCID 0.00%↑) traded its highest-ever volume on Thursday at nearly 1 billion shares. The stock gapped up on news of a partnership with Uber’s robotaxi program and also announced a 1-for-10 reverse stock split. If LCID begins to break out above Thursday’s highs, it could set up for a potential long trade.

AgEagle Aerial Systems (UAVS 0.00%↑) saw elevated volume on Friday after announcing that its TAC Drone received Blue UAS clearance from the Department of Defense.

IONQ 0.00%↑ and QBTS 0.00%↑ are both approaching key breakout levels, gaining strength in sympathy with RGTI 0.00%↑ which broke out earlier this week. The quantum computing space is showing coordinated strength and remains a sector to watch closely for continuation trades.

CoreWeave (CRWV 0.00%↑) has been in a steady downtrend over the past couple of weeks, showing continued weakness. It’s on watch for further selling pressure, but if a sharper flush occurs, it could set up a bounce or oversold reversal trade.

Tesla (TSLA 0.00%↑) has remained relatively quiet since the public fallout between Elon Musk and Donald Trump, following Elon’s announcement of forming a new political party. With earnings on deck this week, TSLA could break out of this low volatility phase and present a post-earnings trading opportunity.

Trade Highlights

RCAT 0.00%↑ breakout was an idea mentioned in last weeks post. The long entry was over the highs of the gap up day around $9 and also through the $9.50 prior daily pivot. The exit was on the break of the daily bar low on Friday:

CRCL 0.00%↑ breakout from a tight daily range and rallied for a few days into the GENIUS Act on Friday where it saw a reversal:

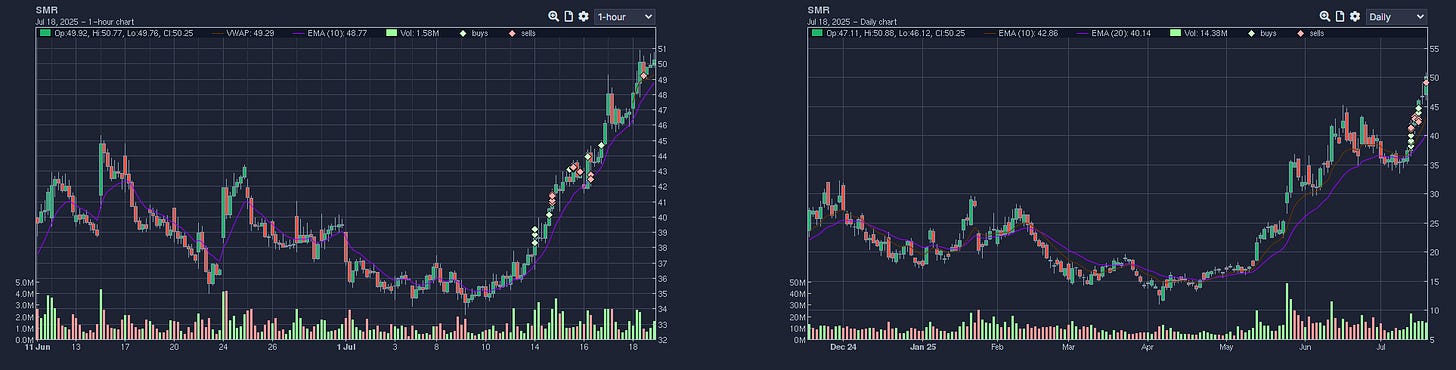

SMR 0.00%↑ breakout from a range near the 10 and 20 daily EMA area into new highs, still holding a position:

QBTS 0.00%↑ breakout over the 17.50 daily pivot level:

IREN 0.00%↑ had consolidated after a strong move up but failed to breakout on the Friday entry:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: