Narrative to Momentum - The AI Disruption Trade

How $RIME Broke Out on Volume and Catalyst

Broader Context - AI Disruption in Play

Coming into the session, the tape had already been shifting.

Over the prior week we saw:

Software sell off aggressively

Financials break down, including SCHW 0.00%↑

Freight and logistics roll over, notably CHRW 0.00%↑

There was a clear narrative developing around AI disruption across traditional industries.

Capital was rotating.

Legacy operators were under pressure.

Markets were repricing structural risk.

This backdrop mattered. The environment was already primed for structural winners and losers.

The Announcement - Quantifying the Disruption

The company’s announcement gave the narrative substance.

Algorhythm stated that its SemiCab platform, an AI-driven optimization system for shippers and carriers, allows customers to scale freight volumes by 300 to 400 percent without adding staff.

According to the company, operators using SemiCab can manage more than 2,000 loads per year versus roughly 500 loads per broker under traditional models.

The platform automates network-level planning and decision-making, lowering cost per load, reducing administrative overhead, and increasing asset utilization as volume scales.

The Wall Street Journal reported that the announcement triggered an immediate reaction across freight:

CHRW 0.00%↑ dropped 15%

LSTR 0.00%↑ fell 16%, its worst day ever

JBHT 0.00%↑ declined 5%

The disruption theme was no longer abstract. It was being priced in.

Interestingly, the stock moved the day prior but failed to sustain momentum. The reaction was there, but participation was not. It was not until the following session that price broke the prior high with real volume behind it.

The Catalyst - CEO on Fox

The spark came when the CEO appeared live on Fox TV.

Up until that point, $RIME had spent most of the session compressing between roughly 1.20 and 1.30 with limited activity.

Once the interview hit, participation changed immediately:

Heavy influx of volume

Immediate expansion in range

Sharp reclaim and hold of VWAP

Clear shift in tempo

Theme plus visibility attracts participation. Participation drives range expansion.

The Technical Inflection

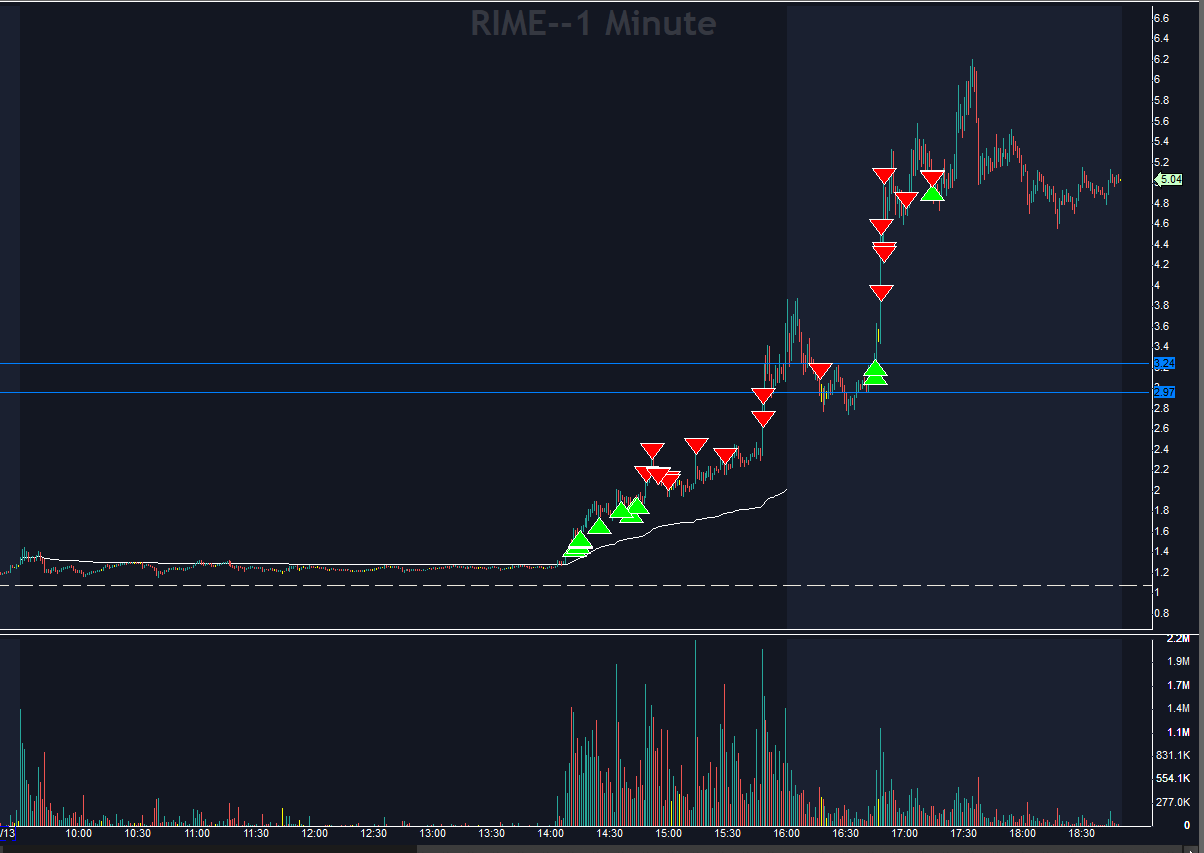

There were two key technical shifts.

The first was the intraday range expansion that followed the surge in volume. That was the initial signal that participation had changed and that the session was no longer rangebound.

However, the larger inflection came at prior day high.

When price cleared that level on sustained volume, the structure shifted decisively from expansion to confirmed trend.

The intraday break signaled opportunity.

The prior day high break confirmed acceptance.

This was not a marginal push through resistance. It was continuation with participation behind it.

That sequence - expansion first, higher timeframe level second - is what gave the move conviction.

How I Traded It

I started buying as price broke over prior day high when the alert triggered.

Rather than full size immediately, I accumulated as volume remained consistent and the breakout confirmed. The key tells:

Price holding above prior day high

Higher lows building

Respect of short-term trend structure

No sharp rejection back into the range

The 5 minute 10 EMA acted as dynamic support during the move. As long as price respected that structure, I stayed with the position.

Into strength, I sold into spikes. The goal was not to predict the top but to monetize volatility while allowing a core position to participate in continuation.

Once the stock cleared 2.50 and later 3.00, momentum had clearly taken over. At that point it becomes a management exercise rather than an anticipation exercise.

The Afterhours Secondary Trade

After the initial expansion, the stock pulled back and formed a range in afterhours.

Once it broke the upside of that range with confirmation, I took a secondary trade.

Same principles:

Break of defined range

Volume confirmation

Clear invalidation level

Continuation followed as liquidity expanded again.

Connecting the Dots in Real Time

The edge is not just in the chart. It is in connecting the dots and assessing what is truly in play and what the market cares about.

That requires consistently tracking narratives, catalysts, and shifts in participation as they develop.

Inside the discord community, we focus on identifying what is in play each day and positioning when theme, attention, and structure align.

Why This Worked

Active AI disruption theme already pressuring multiple sectors

Clear media catalyst increasing attention

Heavy volume confirming participation

Break of prior day high triggering technical flows

Structured execution with defined risk

The prior weakness in software, financials, and freight was not noise. It confirmed that positioning was already shifting around AI narratives.

RIME 0.00%↑ aligned with that narrative and provided a clean vehicle for momentum expression.

P.S. Trying a more structured trade recap format here.

If this style is useful, let me know in the comments and consider liking the post so I know to keep building on it.

Muy util, ojala siga in play esta semana proxima!

Nice breakdown. It's so important to track themes and broader market momentum these days when trading small caps. You used to be able to rely on data alone, but now the edge really lies in being in tune with where the money is flowing.