Watchlist 06/02

Week Recap, Strong Stocks to Watch, and Trade Highlights from Last Week’s Watchlist

Market

SPY 0.00%↑ ended the week with an inside week, trading within last weeks range, but not without some volatility and news throughout. On Wednesday evening, NVDA 0.00%↑ reported earnings which was initially had a positive reaction, with a rally and breakout out of recent daily highs. On top of that, later in the evening news emerged that the U.S. Court of International Trade ruled that Trump’s sweeping tariffs were unlawful. This led to a large overnight rally in the futures with NQ peaking at 2%.

However, the following day, Thursday, a federal appeals court granted an immediate administrative stay of the trade court’s decision and temporarily reinstated the tariffs while the legal process continues. Over the course of the trading day, the market retraced the entire move.

Lastly, on Friday, Trump accused China of "totally violating" a recent trade agreement and announced plans to double tariffs on steel and aluminum imports to 50%, which led to an intraday drop that eventually recovered into the close.

Technically, we remain in an uptrend above all key moving averages. Momentum has been stalling over the past couple of weeks, as many stocks either pull back or rest after a strong rally from the April lows.

The market has gained a sizable +20% in just under two months. A period of consolidation would be normal here. If the market stays within this range, I plan to be more selective with individual stocks while the overall market moves sideways. However, if we start to trend above the 595.50 area and individual stocks begin to show strength, it could signal a good time to pursue momentum long setups.

Watchlist

PLTR 0.00%↑ has been one of the strongest momentum stocks over the past few months. After consolidating for the last two weeks, it had a strong breakout on Friday, closing at an all-time high.

HIMS 0.00%↑ has been consolidating sideways for six days, closing near the top of its range and remaining above key moving averages. A breakout above this range could present a potential opportunity to enter a long position.

HOOD 0.00%↑ is another strong stock, currently closing at 52-week highs. It has had little to no pullback since breaking out from the 50 area and is trending closely with the 10 EMA.

PONY 0.00%↑ has exhibited strong momentum over the past couple of months. It first doubled from 5 to 10, then surged from 10 to 20. It has been consolidating for over three weeks now, maintaining solid volume. Additionally, it belongs to a hot sector—autonomous driving.

CRWD 0.00%↑ is another strong stock, closing near all-time highs. The daily chart shows a breakout last week from a cup and handle pattern, followed by a successful retest of the breakout level. Earnings are scheduled for Tuesday.

Trade Recaps

Last week’s watchlist delivered some solid opportunities - here are a few trades that I traded personally from my ideas:

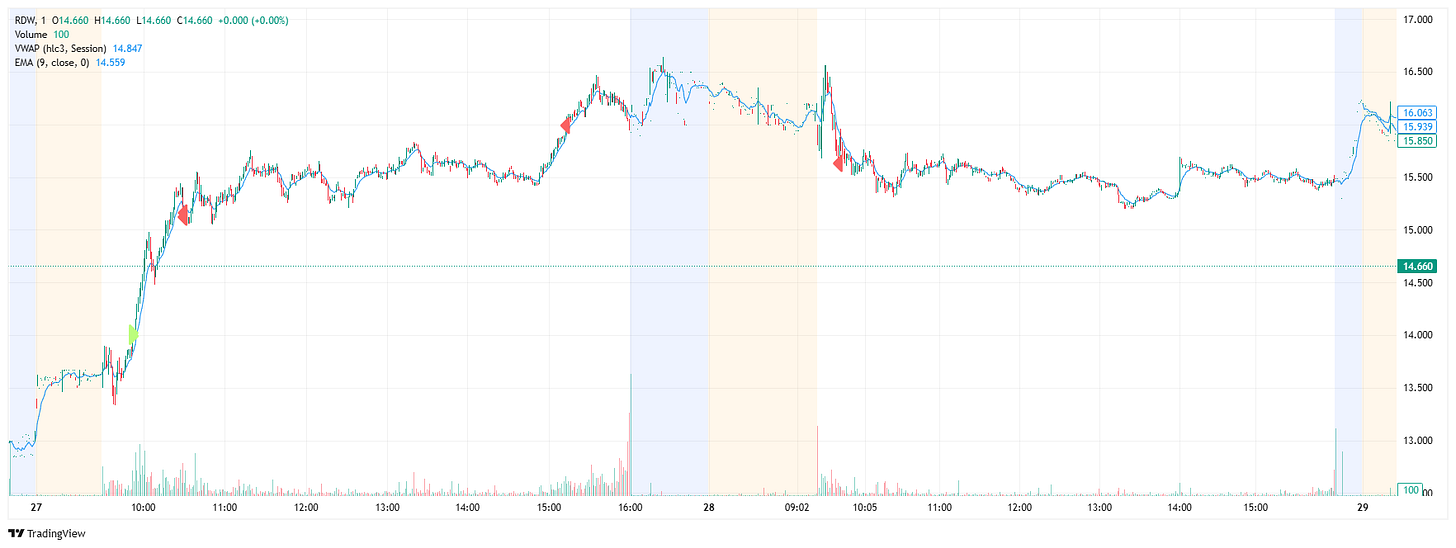

Both space stocks from the watchlist RKLB 0.00%↑ RDW 0.00%↑ had strong moves early in the week:

TSLA 0.00%↑ also offered a breakout on Monday, although it was short lived:

GME 0.00%↑ closed the swing long from breakout and it also offered a mean reversion sell the news trade:

There were also several other trade opportunities throughout the week—notably the big CRWV 0.00%↑ short on Thursday, which emerged as a high-probability setup during the day. It’s a good reminder that while watchlists provide a solid foundation, some of the best trades develop in real time.

For those who want access to these intraday ideas and real-time updates, I’m now sharing them daily in Discord. If you missed the announcement, you can find the link in my recent post: