Weekly Market Recap, Watchlist & Trade Highlights 08/11/25

Strong recovery led by megacaps and Nasdaq 100, Russell lagging, Ethereum strength

Market Recap

The market recovered strongly this week after last week’s sharp pullback. QQQ 0.00%↑ posted a new all-time high close as megacaps led the rally, with GOOGL 0.00%↑, TSLA 0.00%↑ and AAPL 0.00%↑ all making big moves, while IWM 0.00%↑ and small caps lagged.

Watchlist

Earnings season continues with some small-midcap companies reporting this week:

Some popular growth names to watch include: OKLO 0.00%↑ BBAI 0.00%↑ ASTS 0.00%↑ ACHR 0.00%↑ CRCL 0.00%↑ PONY 0.00%↑ CRWV 0.00%↑ RGTI 0.00%↑

Stocks that saw a positive reaction last week and holding a strong gap post earnings could be setup for a continuation move to the upside:

ALAB 0.00%↑ reported strong earnings last week and is holding the gap.

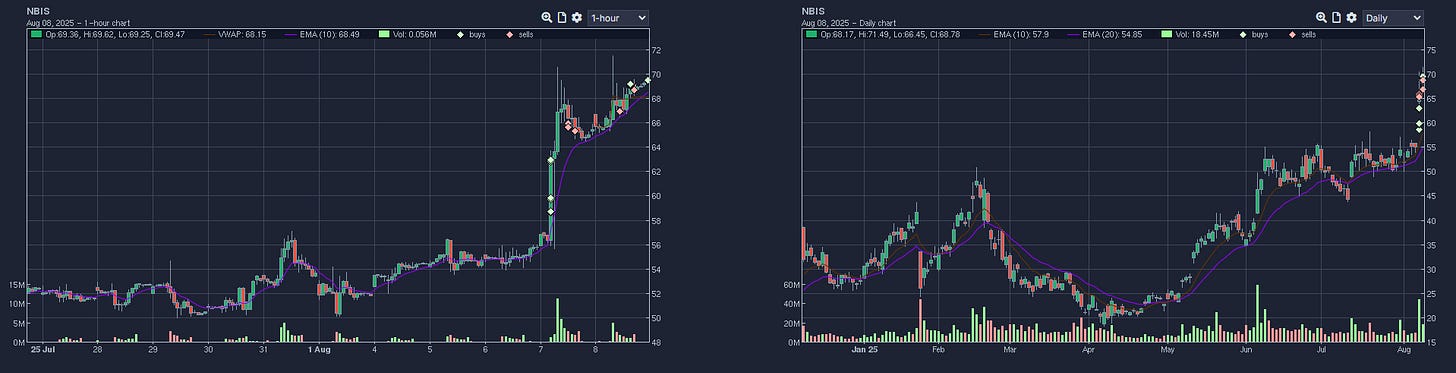

NBIS 0.00%↑ also strong earnings gap up and holding up.

LLY 0.00%↑ gapped down on earnings below major support levels and is in a clear stage 4 downtrend.

Ethereum remains a key watch after surging past the pivotal $4,000 level, marking its highest level in over 18 months.

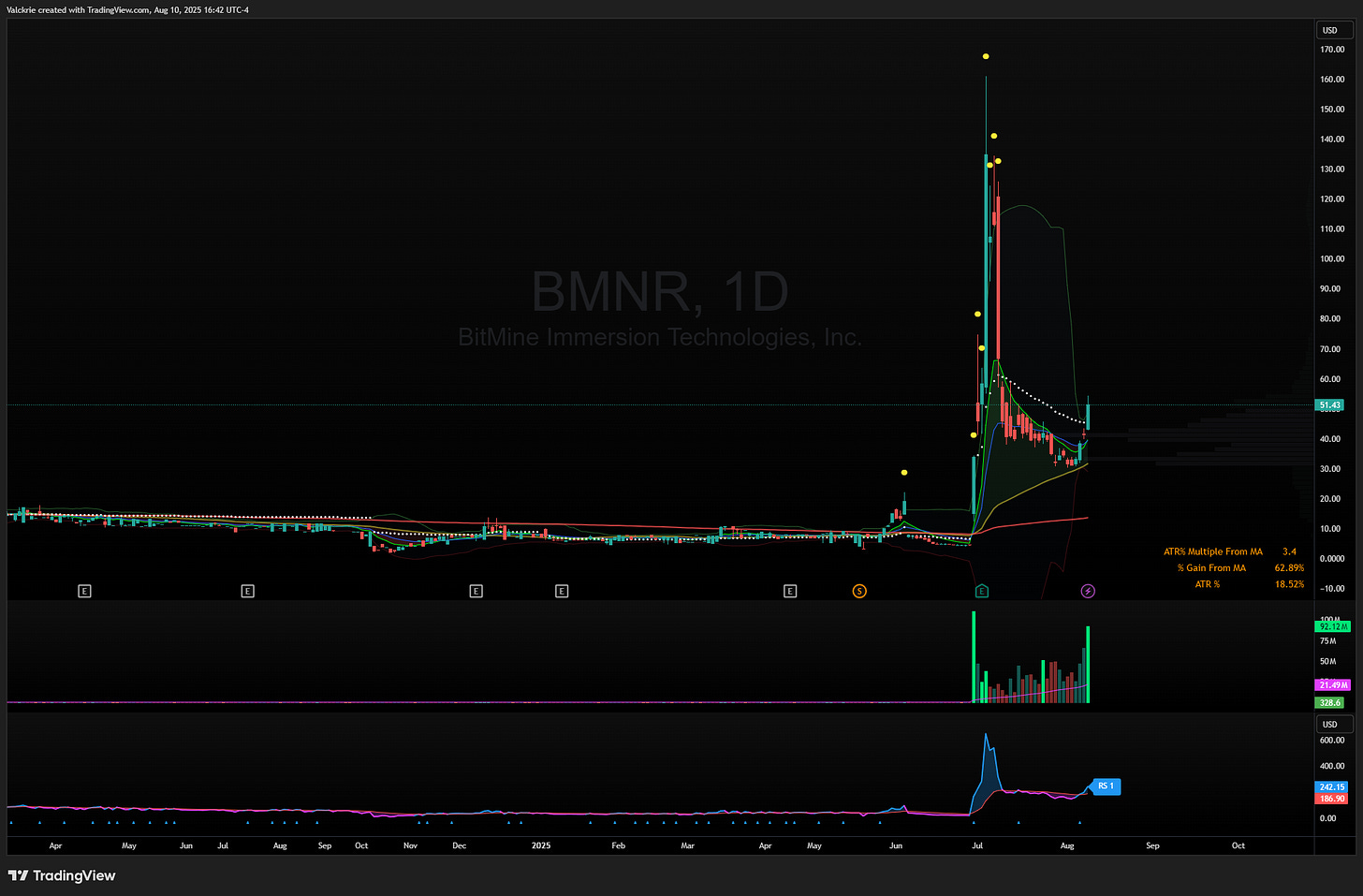

BMNR 0.00%↑ is the largest public holder of ETH, started to reverse off lows this week along with the move in ETH.

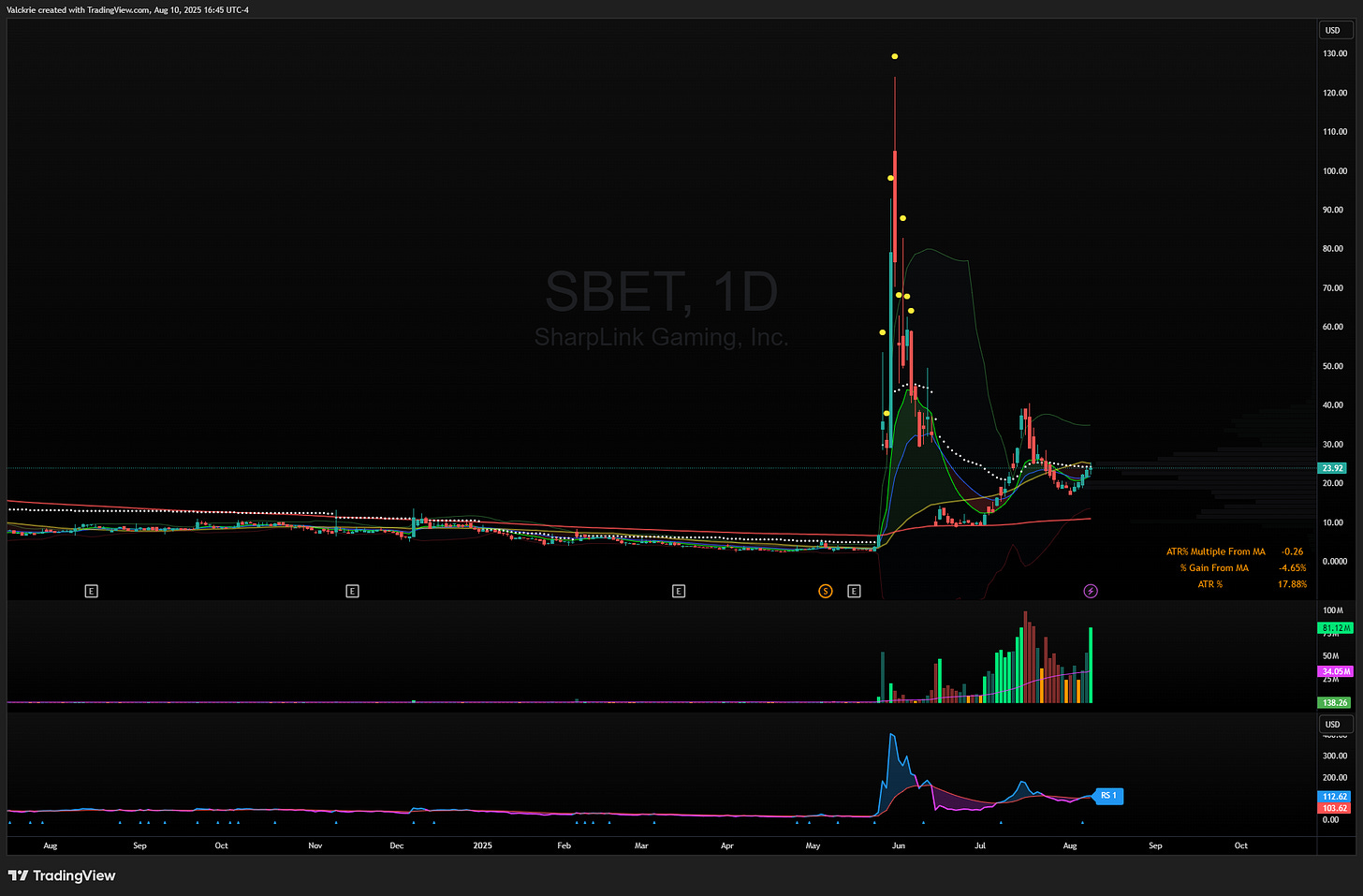

SBET 0.00%↑ is the second largest public holder of ETH and saw a similar move.

AAPL 0.00%↑ saw a large 3 day move after announcing an additional $100B investment in the U.S. If price keeps extending, it could setup for a short term pullback trade.

TSLA 0.00%↑ has shook off multiple bad news over the last few months with the public Trump fued, as well as poor earnings last quarter. It’s currently trading in a triangle wedge pattern on the daily chart, looking potentially ready for a breakout soon.

$FNMA rallied on Friday after news that the Trump admin plans to IPO Fannie Mae and Freddie Mac later this year.

Trade Highlights

NBIS 0.00%↑ daily breakout on earnings report:

BMNR 0.00%↑ breakout trades following the strength in ETH:

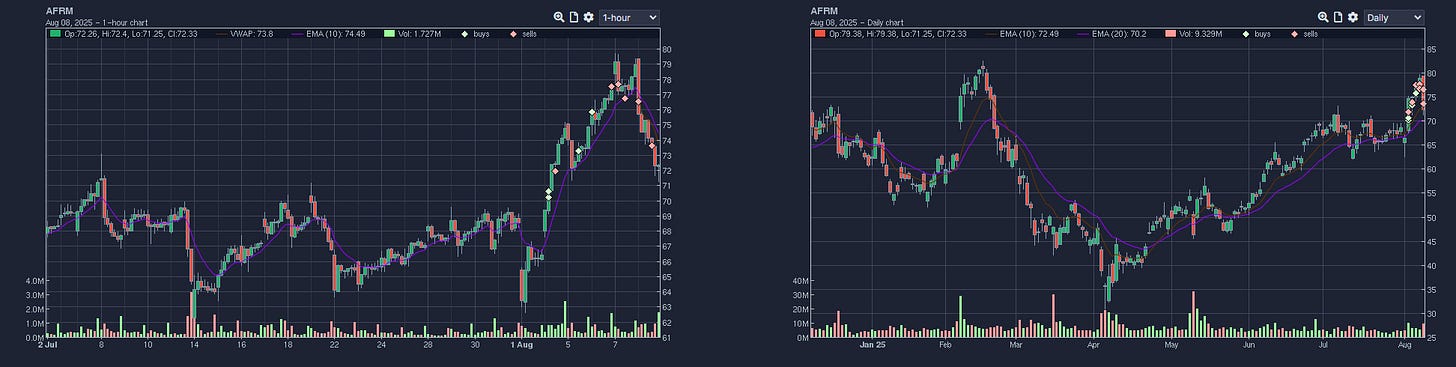

AFRM 0.00%↑ daily breakout swing trade over the $70 area:

FIG 0.00%↑ offered a good short opportuity as it broke trend beneath prior day lows, as well as breaking down under the IPO price:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: