Weekly Market Recap, Watchlist & Trade Highlights 08/18/25

Cool CPI but hot PPI, IWM breaks out, Solar surging, upcoming Powell speech at Jackson Hole

Market Recap

The SPY 0.00%↑ hit a new all-time high this week, supported by key economic data releases and shifting Fed expectations.

On Wednesday, CPI came in cooler than expected, which pushed the market to price in a 94% probability of a September rate cut. Following this, the IWM 0.00%↑ surged with a strong breakout move, as small caps benefited from easing rate expectations.

However, on Thursday, sentiment shifted after PPI data surprised to the upside, with wholesale prices rising 0.9% in July - the largest monthly increase since 2022. The market opened lower on the news, but SPY and QQQ quickly recovered from the selloff, while IWM lagged and underperformed.

Looking ahead, a key event will be Jerome Powell’s keynote address at the Jackson Hole Economic Policy Symposium on Friday, which investors will closely watch for clues on the Fed’s rate path.

Watchlist

OPEN 0.00%↑ (Opendoor Technologies) – Back on watch after a recent meme stock squeeze last month. The stock is seeing renewed attention following a CEO leadership change this week and news that legendary investor Paul Tudor Jones increased his stake.

UNH 0.00%↑ (UnitedHealth Group) – Shares jumped on Friday after filings revealed Warren Buffett and David Tepper boosted their stakes, providing a strong vote of confidence in the insurer after months of sharp declines.

TNXP 0.00%↑ (Tonix Pharmaceuticals) – Popped after the FDA approved its new drug, putting the biotech name firmly on traders’ radar.

TEM 0.00%↑ (Tempus AI) – Broke out last week on earnings and remains on watch for continuation within its new uptrend.

Solar sector (TAN 0.00%↑ RUN 0.00%↑ FSLR 0.00%↑ SEDG 0.00%↑ ENPH 0.00%↑ NXT 0.00%↑) – Surged Friday after the Treasury Department released new guidance on energy tax credits, igniting strong momentum across solar names.

CRWV 0.00%↑ (CoreWeave) – Dropped sharply last week following earnings and the expiration of its IPO lockup period. The stock found some support Friday, reversing slightly around the key $100 level.

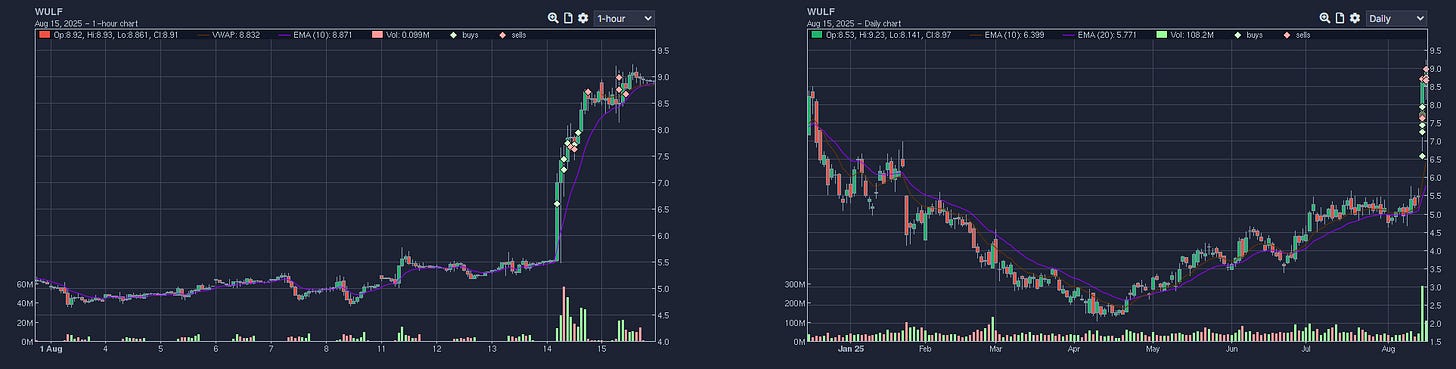

WULF 0.00%↑ (TeraWulf) – Spiked Thursday after announcing a deal with Fluidstake, with additional upside momentum from news that Google is taking an 8% stake in the company.

PONY 0.00%↑ (Pony AI) - Rallied after earnings and is starting to emerge from this daiyl consolidation base. A news catalyst or high volume breakout could trigger a new uptrend.

Trade Highlights

BLSH 0.00%↑ oversubscribed hot IPO stock, opening drive long trade:

UNH 0.00%↑ breaking news long trade on Buffett stake in afterhours:

WULF 0.00%↑ a changing fundamentals/episodic pivot daily breakout trade on Fluidstack/Google deal, the stock ended up trading the highest volume ever on that day:

PSKY 0.00%↑ intraday mean reversion short:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: