Weekly Watchlist 09/08/25

Choppy uptrend continues, rate cuts looming, upcoming IPOs

Market Recap

The week began with a gap down across the indices, which was quickly bought up. QQQ 0.00%↑ found support right at its 50-day moving average, and by the end of the week, all major indices had closed higher, despite ongoing chatter about September’s historically weak seasonality.

The key data point was Friday’s jobs report, which came in softer at 22,000 vs. 75,000 expected. Markets initially rallied on hopes that the Fed might accelerate rate cuts, but the open was followed by a sharp selloff, before retracing some losses into the close.

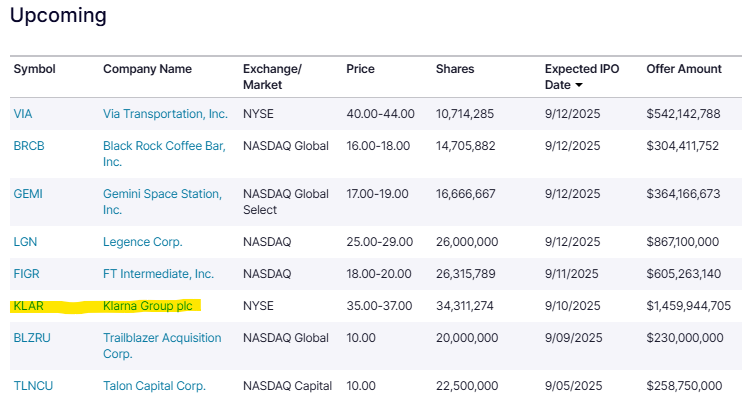

Looking ahead, this week features a pickup in IPO activity, with Klarna being the most notable. Recent hot IPOs have offered strong trading setups, so this will be a top watch for active traders.

Watchlist

OPEN 0.00%↑ – Remains one of the strongest momentum stocks in the market with heavy daily liquidity. Broke out of the $5 and $6 levels, closing at new highs. Top watch.

TSLA 0.00%↑ – Still in a lengthy monthly base. Volume picked up Friday and price is pushing toward new daily highs, setting up a potential breakout.

BABA 0.00%↑ – Consolidating after earnings.

HOOD 0.00%↑ APP 0.00%↑ - Both added to the S&P 500 on Friday. Watch for index-inclusion flows and continuation momentum.

TEM 0.00%↑ - Consolidating tightly near all-time highs; could be setting up for a breakout higher.

SOUN 0.00%↑ – Volume expanding as it pushes out of the $12–13 consolidation zone.

RBRK 0.00%↑ – Sideways for months; earnings Tuesday may be the catalyst for a directional move.

Z 0.00%↑ – Housing related names have been strong into the September rate cut narrative. Pressing toward 52-week highs.

UNH 0.00%↑ – Holding $300 support for several weeks; starting to trend higher into gap-fill levels above.

SNDK 0.00%↑ - Strong run but getting extended short term, could offer a potential short trade setup.

Trade Highlights

$FNMA offered a textbook daily breakout setup this week through the $11.50 and $12 level:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: