Weekly Watchlist 09/15/25

Stocks break out to all time highs ahead of anticipated rate cut at FOMC meeting next week

Market Recap

The major indices pushed to new all-time highs this week, and it was also an opportunitic trading week, with many individual stocks seeing huge moves.

On the macro front, PPI came in cooler Wednesday and CPI was neutral Thursday, keeping inflation concerns in check. This fueled a rally into next week’s widely anticipated Fed rate decision (FOMC Wednesday). Futures are currently pricing in a 93% probability of a 25bps cut and a 7% probability of a 50bps cut.

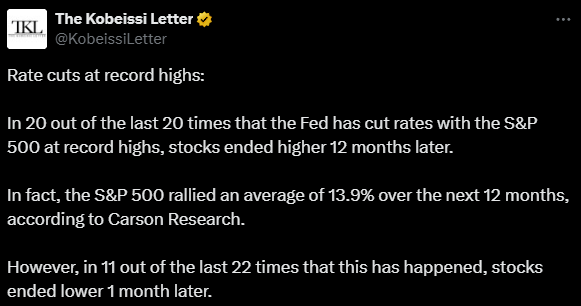

As highlighted by Carson Research, rate cuts have historically been bullish when the S&P 500 is at record highs. That said, traders should watch for short-term volatility or profit-taking into the announcement, with the potential for a modest “sell the news” reaction before the broader uptrend resumes.

Watchlist

Robotics

TSLA 0.00%↑ – Broke out of a multi-month base with an explosive move Friday. Historically, Tesla breakouts from long consolidations (e.g. Nov ’24 election, June ’24) have led to sustained uptrends.

SERV 0.00%↑ – Cleared a multi-month consolidation, closing above key $12 resistance Friday.

RR 0.00%↑ – Continues its strong uptrend off the major volume breakout last month.

Quantum Computing

IONQ 0.00%↑ – Explosive breakout Friday on acquisition news.

RGTI 0.00%↑ – Broke out alongside sector strength.

QUBT 0.00%↑ QBTS 0.00%↑ – Remain on watch as lagging plays within the group.

Datacenters / AI Infrastructure

NBIS 0.00%↑ – Landed a $17B, 5-year deal with Microsoft. After gapping up Tuesday, it’s consolidated sideways following a convertible notes offering. Key to watch if it holds gap support and reclaims $100.

CRWV 0.00%↑ – Building higher lows; potential new uptrend if it clears the $125 area and reclaims the 50-DMA.

BTDR 0.00%↑ – Multi-month consolidation breakout.

BITF 0.00%↑ HIVE 0.00%↑ – Explosive breakouts last week; extended in the short term, potential for pullback setups.

CIFR 0.00%↑ IREN 0.00%↑ HUT 0.00%↑ WULF 0.00%↑ APLD 0.00%↑ – Already broke out last week and remain in strong uptrends.

Crypto

ETHA 0.00%↑ – Breaking out from a consolidation zone.

BMNR 0.00%↑ SBET 0.00%↑ BTCS 0.00%↑ – Ethereum treasury crypto stocks rallied Friday in sympathy with ETH.

Others

OPEN 0.00%↑ – Broke out Thursday after naming a new CEO (ex-Shopify COO) and with founders rejoining the board.

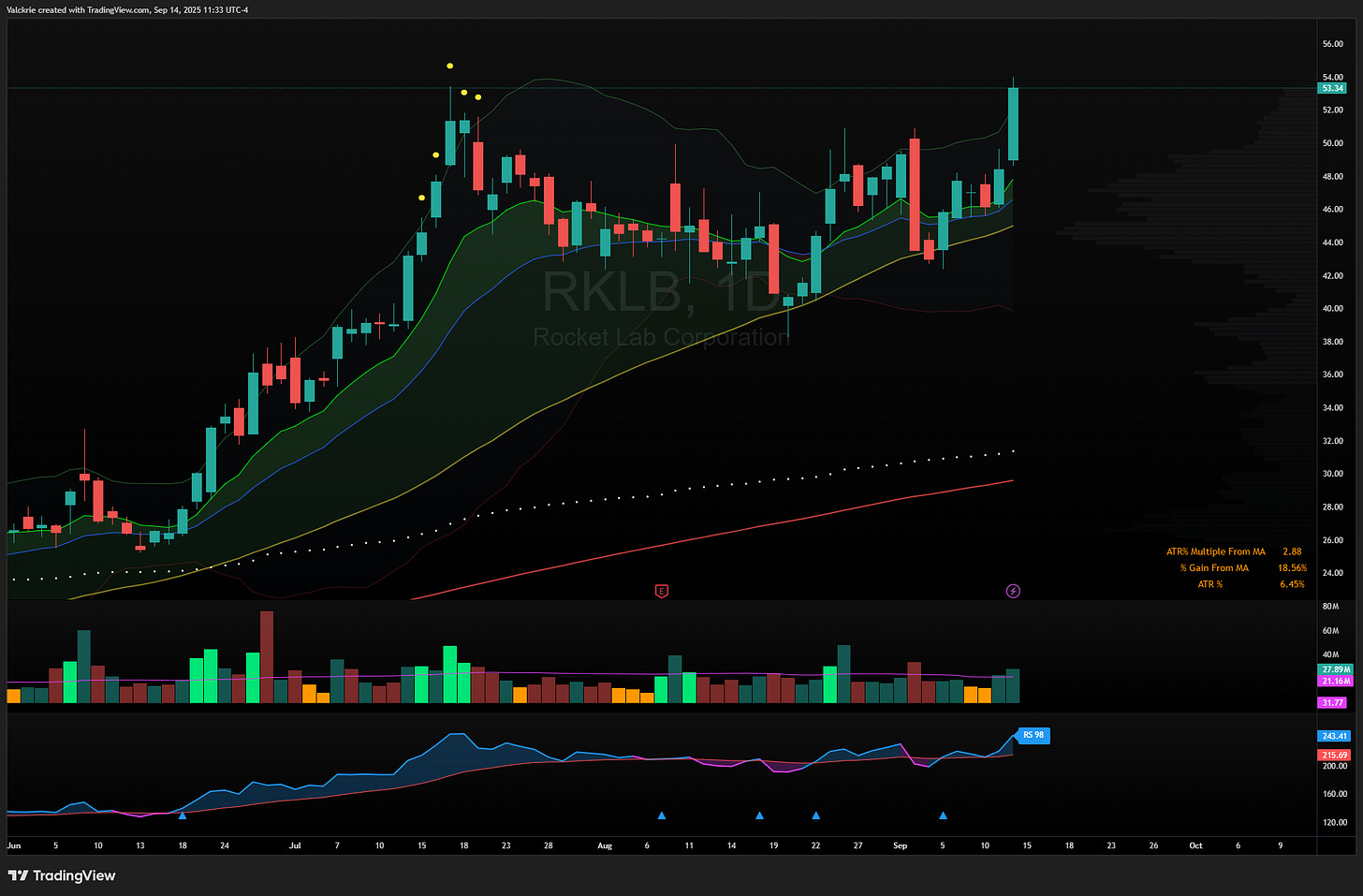

RKLB 0.00%↑ – All-time high breakout.

TEM 0.00%↑ – Near all-time high breakout.

WOLF 0.00%↑ – Rallied on bankruptcy reorg news.

QS 0.00%↑ – Reclaimed the 50-SMA.

Trade Highlights

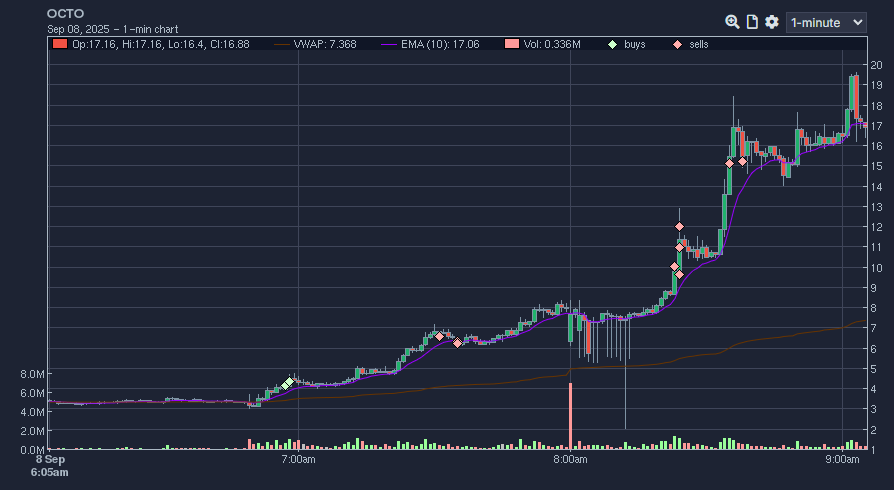

OCTO 0.00%↑ long after news of a PIPE investment turning the company into a Worldcoin treasury with Dan Ives as chairman, and Tom Lee investing. The stock peaked at $80 later in the day!

OPEN 0.00%↑ afterhours news on new CEO appointment:

NBIS 0.00%↑ afterhours news on huge deal with Microsoft. Initial buy on news around 70 and rebought a few times around $90 selling into $100 while retaining a core position:

TSLA 0.00%↑ breakout (still holding a position):

IONQ 0.00%↑ breakout:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

Nice recap. Very simple and thorough