Weekly Watchlist 09/29/25

Orderly pullback as speculative stocks cool down

Market Recap

The market experienced a steady pullback this week. On Tuesday, Jerome Powell remarked that equities are “fairly highly valued,” which added weight to the retracement.

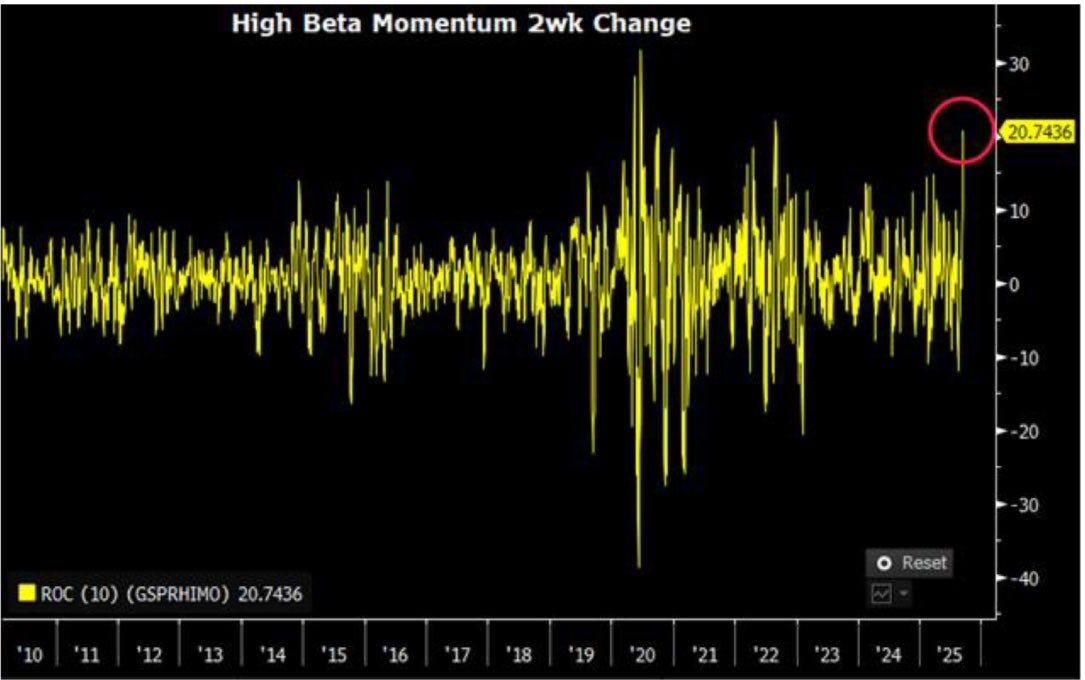

High-beta momentum stocks, which just had their strongest two-week run since 2021, naturally saw some cooling after the rally in speculative names. OKLO 0.00%↑ one of the standout momentum plays, corrected nearly 20% in a single session.

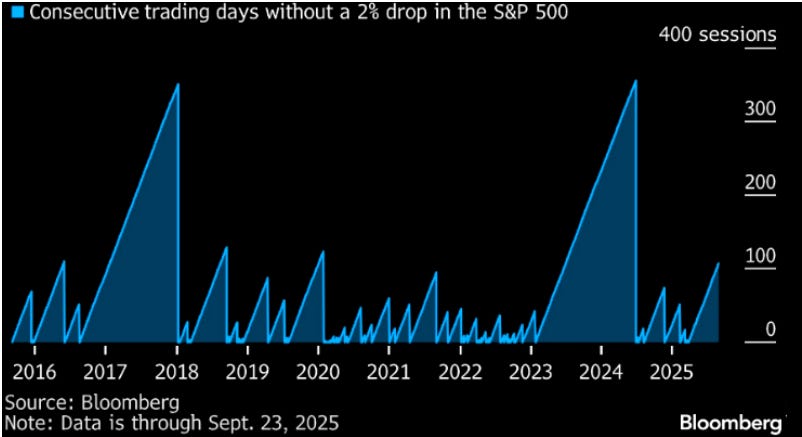

The S&P 500 hasn’t registered a -2% daily move in quite some time, something worth monitoring as the odds of a pullback start to build.

For now, the SPY 0.00%↑ pullback has been orderly, finding support at the 20-day EMA while notably holding above the low set on the FOMC rate-cut day.

Watchlist

Relative Strength Leaders

TSLA 0.00%↑ remains a standout during the short 3-day market pullback, showing resilience and looking poised for another leg higher.

INTC 0.00%↑ is rallying following Nvidia’s $5B investment.

Data Center / Former Crypto Miners

Former crypto mining stocks transitioning into HPC/data center operations have been among the strongest performers.

WGMI 0.00%↑ ETF recently broke out to all-time highs and may be entering its first pullback.

Notable names to watch: IREN 0.00%↑ CIFR 0.00%↑ RIOT 0.00%↑

NBIS 0.00%↑ continues to be a strong performer in the data center theme.

Consolidating Names

Several high-momentum stocks are digesting recent gains and pulling back, but could become constructive in the coming days/weeks:

NVDA 0.00%↑ the leader of the AI stocks remains in a consolidation range worth watching on either side.

Quantum / High-Momentum Watchlist

Quantum stocks and high-beta momentum plays like OKLO 0.00%↑ are currently digesting, awaiting their next move:

Trade Highlights

LAC 0.00%↑ Lithium Americas shares are trading higher after Reuters reported Trump officials are seeking an equity stake in the company as part of a renegotiation of a $2.26 billion loan for the Thacker Pass lithium project.

MSTR 0.00%↑ breakdown from daily level:

CIFR 0.00%↑ the stock had run up 100% into this deal, likely priced in short term with buy the rumor sell the news effect. Market was also weak and they dropped a convertible offering immediately after the deal to raise capital, good long term, but can be short term sell pressure:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: