Weekly Watchlist 10/06/25

Market climbs despite government shutdown, Quantum stocks heating up

Market Recap

The week started with some minor volatility after the government shutdown at midnight on Tuesday, which initially sent markets lower at Wednesday’s open. However, equities staged a strong recovery into the end of the week, despite an afternoon selloff on Friday.

A major highlight came from OpenAI’s secondary share sale, which reportedly increased its valuation to $500 billion, making it one of the world’s most valuable private companies. The news fueled renewed enthusiasm across AI-related stocks, with NVDA 0.00%↑ hitting a new all-time high.

Within the “Magnificent 7”, performance was mixed:

Leaders: NVDA 0.00%↑ and GOOGL 0.00%↑ remain in strong uptrends.

Neutral: MSFT 0.00%↑ continues to consolidate sideways.

Weaker names: AMZN 0.00%↑ and META 0.00%↑ are in short-term downtrends but could find support near key longer-term moving averages.

PLTR 0.00%↑ sold off sharply on Friday following reports that Anduril and Palantir’s battlefield communication systems have significant technical flaws.

Healthcare stocks surged midweek after reports that the Trump administration reached agreements to reduce certain tariffs, lifting sentiment across the sector, with PFE 0.00%↑ among notable gainers.

Some speculative sectors, particularly the quantum computing group, could be close to getting overheated soon, signalling potential near-term froth in momentum stocks.

Despite that, the major indices remain in clear uptrends and are not yet overextended. One thing to note is that the volatility index (VIX) VXX 0.00%↑ has not declined during this rally, suggesting that hedging activity remains elevated even as prices climb.

Watchlist

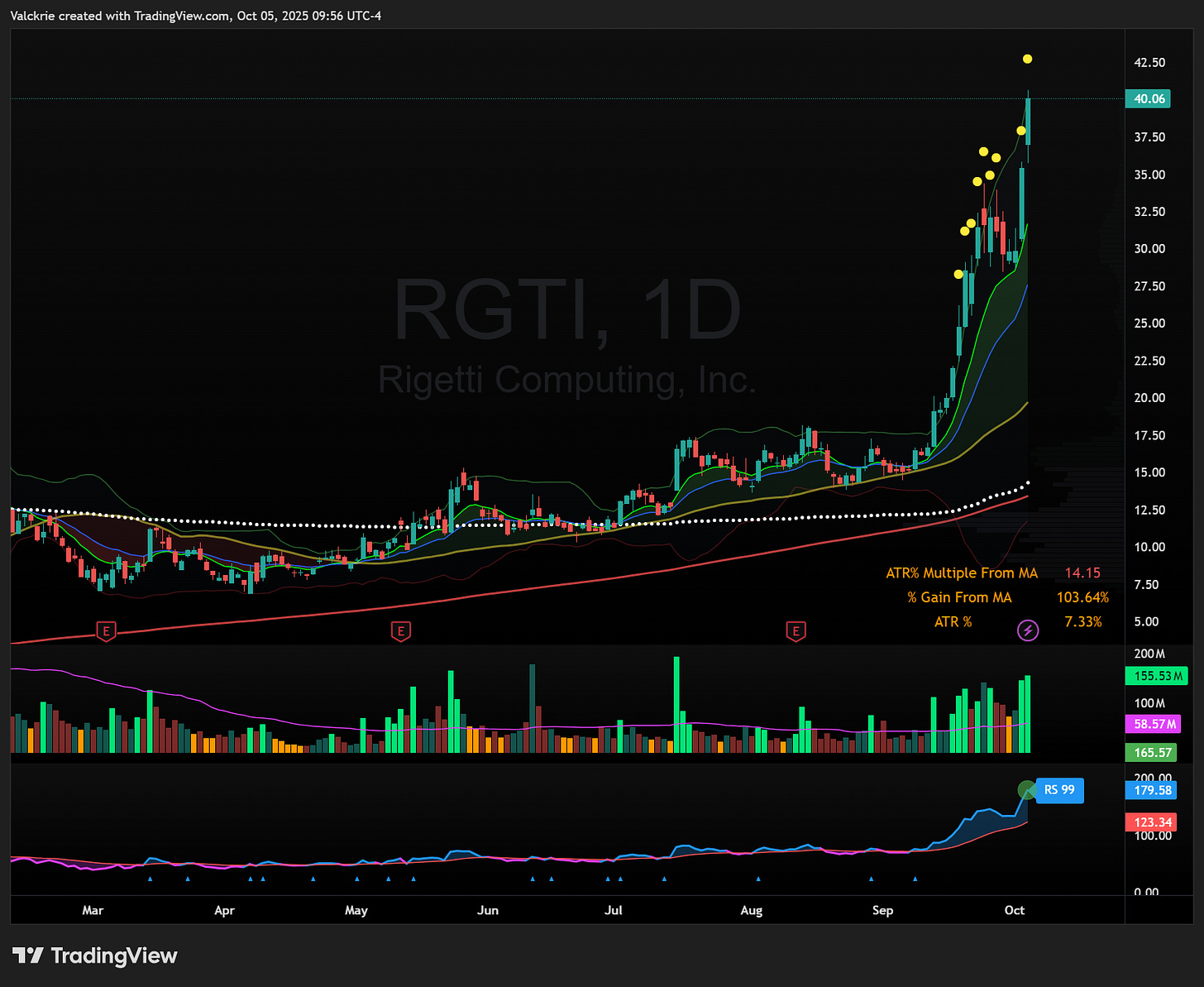

Quantum stocks broke out to new all-time highs this week, led by RGTI 0.00%↑ which showed the most relative strength, the only stock that held the fastest moving average (10EMA. Despite many investors remaining fundamentally bearish on these overvalued names, the technical uptrends remain intact. If these stocks continue rallying sharply over the next few days, watch for signs of exhaustion and potential short setups. QBTS 0.00%↑ IONQ 0.00%↑ QUBT 0.00%↑

PLTR 0.00%↑ came close to breaking out to new all-time highs but sold off on Friday. It remains one of the key leaders in the AI software space. The stock found support near its rising 50-day SMA, an area that has held for months. It may need a few sessions before showing its next direction, a bounce or a deeper pullback.

CRWV 0.00%↑ has struggled to make upside progress despite announcing multiple new deals. Price action remains relatively tight, and the broader trend is still intact to the upside. The stock stays on watch for a potential breakout if volume picks up and buyers step back in.

DFLI 0.00%↑ a microcap stock, is getting extended after a strong recent run. If it pushes sharply higher again, it could become a short reversal setup.

CRML 0.00%↑ made headlines Friday after-hours following reports of a Trump administration stake. The news could bring strong interest and volatility into next week.

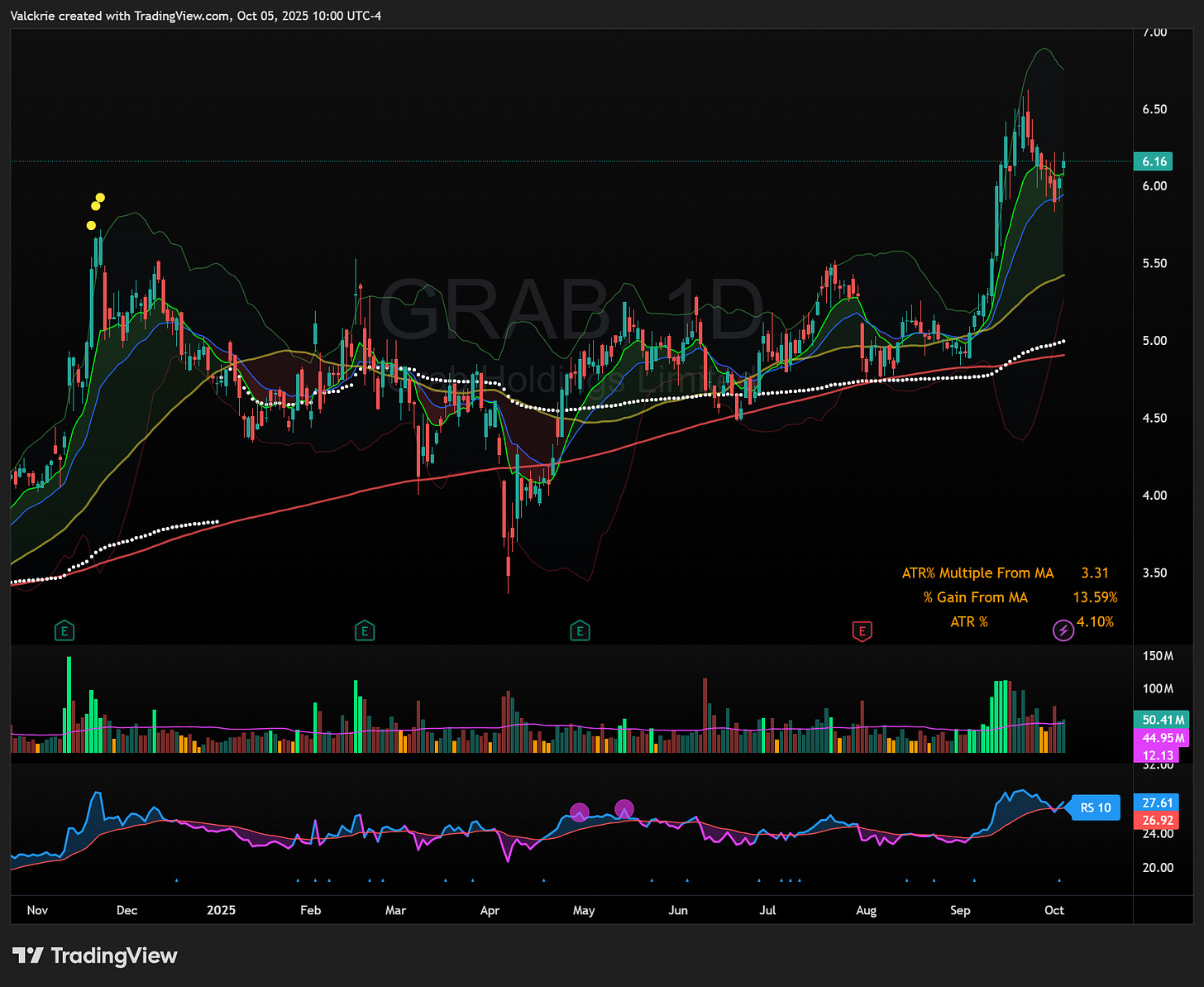

GRAB 0.00%↑ is entering a Stage 2 uptrend, and undergoing its first pullback to short term key moving averages. This area could offer a solid entry opportunity for those not already involved. Since the company operates mainly in Southeast Asia, the stock tends to have a lower beta compared to many U.S. momentum names.

RUM 0.00%↑ surged after announcing a partnership with Perplexity. The gap-up day highs serve as a key level to watch for potential continuation momentum.

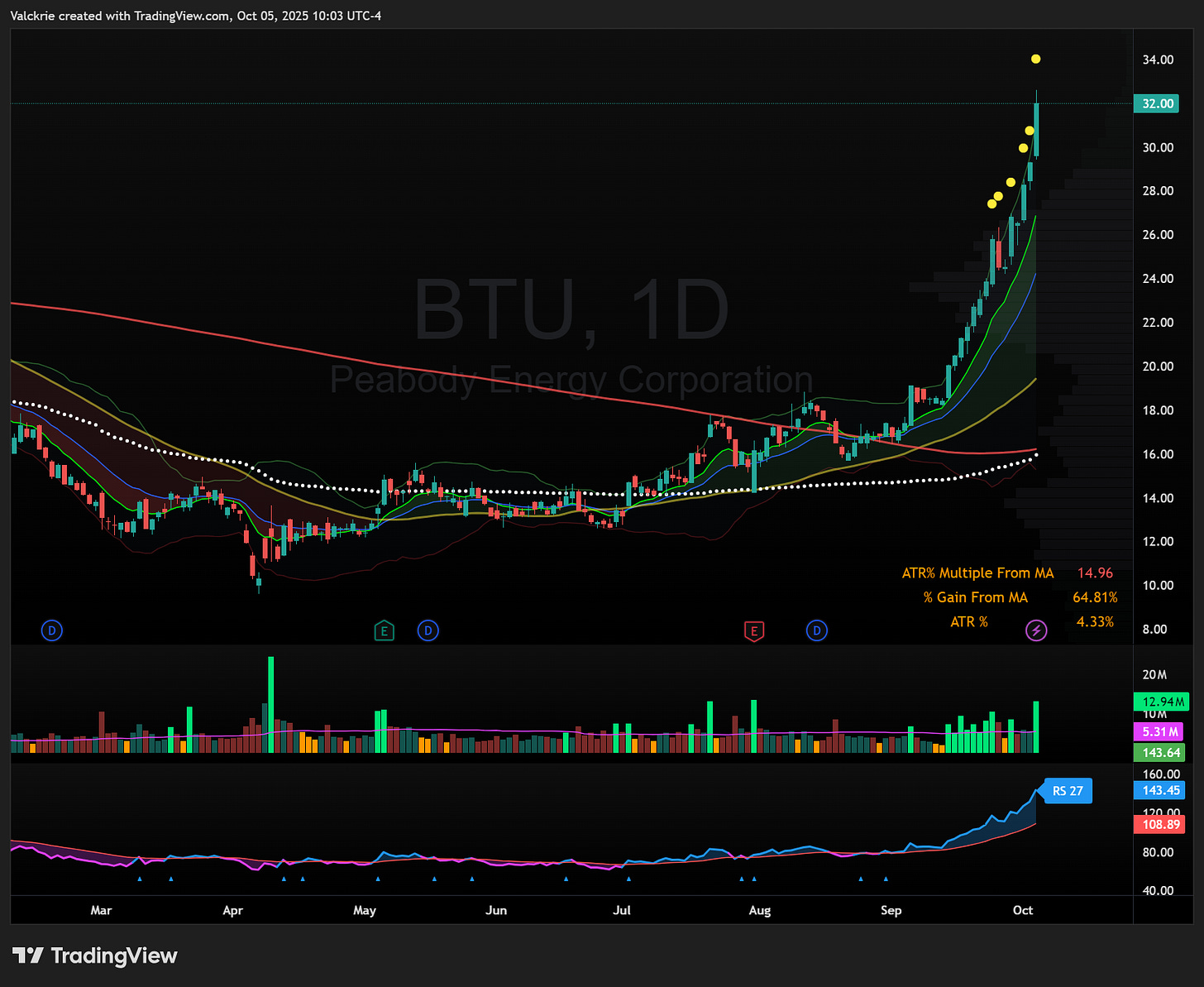

BTU 0.00%↑ an energy stock that is making a steep rally up, few more sessions could turn into a parabolic short.

Some other strong momentum stocks to keep on watch RR 0.00%↑ RKLB 0.00%↑ JOBY 0.00%↑ ACHR 0.00%↑

Trade Highlights

USAR 0.00%↑ all time high breakout over 19/20 area:

ETSY 0.00%↑ OpenAI news of integrating Etsy into ChatGPT searches, after selling into first day move, remainder position was roundtripped:

SHOP 0.00%↑ same news with OpenAI but this move continued:

CRML 0.00%↑ afterhours news of Trump admin stake:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

Great breakdown of the quantum sector! I agree that RGTI showed the strongest relative strength this week. What's interessting about QUBT specifically is how it's managed to hang on despite being the most overvalued of the bunch in terms of actual product developement. Your point about watching for exhaustion setups is smart because these names are definately running hot. I'm curious if you think the potential government backing could extend the rally beyond what technicals alone would suggest, or if that's already priced in? The VIX remaining elevated during this rally is pretty notable too.