Weekly Watchlist 10/13/25

Volatility hits the market as Trump retaliates with tarriff threats again

Market Recap

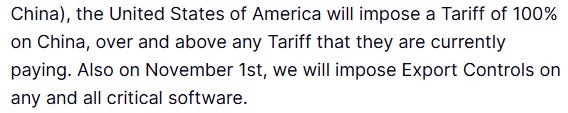

Markets were hit by a wave of volatility on Friday after President Trump posted on social media that he was considering increasing tariffs on Chinese products. The comments came in response to an earlier announcement from China’s Commerce Ministry requiring foreign suppliers to obtain approval to export products containing rare-earth materials. Later in the day, after hours, Trump suggested potential tariffs could rise to as high as 100%, amplifying market fears.

The Nasdaq 100 (QQQ) closed down -3.47%, marking its largest single-day decline since the tariff flare-ups in April.

During a subsequent White House press conference, however, Trump clarified that his meeting with President Xi had not been canceled, prompting a modest late-session rebound into the 8:00 p.m. close.

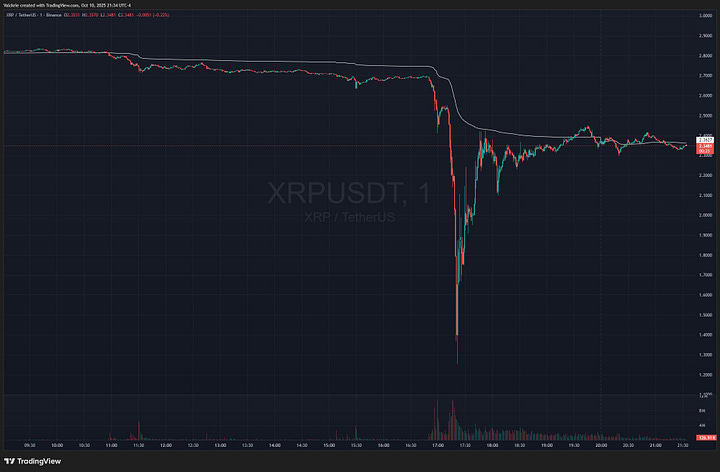

The crypto space experienced one of its most severe liquidation events ever. Bitcoin (BTC) futures on Binance saw an intraday reversal of nearly $20,000 from high to low.

Major altcoins also suffered steep declines, XRP dropped from $2.70 to $1.26, while several memecoins, including Trumpcoin, plunged over -80%.

On Sunday, China released a statement clarifying the new export control measures, a potential sign of de-escalation.

The Sunday evening futures open will be the first key test of sentiment for the week ahead.

Traders should stay alert for any new statements or posts from President Trump during this volatile period. De-esclatory news could see the market bouncing from oversold conditions, while any escalations could lead to further downside.

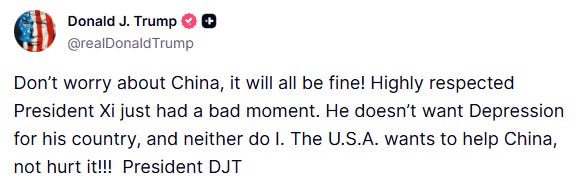

In fact, at the time of writing, President Trump has just posted on Truth Social, urging people “not to worry about China.” This underscores the importance of staying alert to rapidly changing news developments.

Watchlist

China Sector

BABA 0.00%↑ KWEB 0.00%↑ – One of the hardest-hit were China tech names; potential bounce play if tensions ease.

Semiconductors

SMH 0.00%↑ SOXL 0.00%↑ NVDA 0.00%↑ – Semi’s capitulated into Friday afterhours.

AMD 0.00%↑ – Notable due to having positive news earlier in the week with OpenAI partnership. Gap-up low at $203 key support zone to watch if it holds.

Crypto Stocks / ETFs

Crypto related stocks and ETFs were also sold on Friday afterhours during the crypto liquidation. Depending where the underlying crypto spot opens, these could also be in play. COIN 0.00%↑ CRCL 0.00%↑ MSTR 0.00%↑

Spot ETFs IBIT 0.00%↑ ETHA 0.00%↑ SOLT 0.00%↑

Leveraged ETFs BITX 0.00%↑ ETHU 0.00%↑ SOLZ 0.00%↑ XXRP 0.00%↑

Relative Strength

Certain stocks displayed relative strength on Friday and were less affected by the selloff.

OKLO 0.00%↑ BE 0.00%↑ NBIS 0.00%↑

MP 0.00%↑ USAR 0.00%↑ Rare earth stocks potential beneficiary of geopolitical diversification.

Individual Technical Setups

TSLA 0.00%↑ – Broke key support and short term MAs from the overall market selloff.

OPEN 0.00%↑ – Trading below 10/20-day MAs for first time since August breakout; potential short-term weakness.

STX 0.00%↑ – Down ~18% from highs with consecutive red days, if this has a steeper selloff could find a potential bounce trade near the 50SMA support zone.

Trade Highlights

AMD 0.00%↑ offered multiple trade opportunities this week after major news on Monday: “AMD To Supply OpenAi Hundreds Of Thousands Of AI Chips; AMD Expects $100B+ Revenue From OpenAi, Others As Result Of Deal; OpenAi Recieves Warrant For To Buy Up To 10% AMD Stake At 1 Cent/Share”

STX 0.00%↑ short on an overextended daily chart, the stock continued to decline even after the initial covers.

ORCL 0.00%↑ breaking news trade “Oracle Lost Nearly $100M From Rentals Of Blackwell Chips In Most Recent Quarter”

BBAI 0.00%↑ was a great daily breakout setup that ended up failing due to the market sellof on Friday:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

Solid recap of an incredibly volatile week. Your point about the BBAI breakout failing due to the Friday tariff selloff really captures how fragile technical setups can be when macro headwinds hit. That daily chart you posted showed a textbook setup before the market-wide dump - really demonstrates the importance of position sizing and being aware of the broader environment even on strong technical plays. I also found your breakdown of the China sector bounce opportunity thoughtful - the de-escalation potential could create some interesting plays if tensions ease. The way you've organized this watchlist by category (semiconductors, crypto, relative strength) makes it very actionable for traders trying to naviage this messy tape. Appreciate the thoroughness.

BBAI's failed breakout is a perfect example of why you can't trade in a vacuum. The setup was clean but the macro environment killed it before it had a chance to run. What's interesting though is how quickly it recovered structure on Monday once the tariff noise calmed down. These false breaks often create the best setups once the external pressure lifts, especally if the underlying fundamentals haven't changed.