Weekly Watchlist 10/20/25

Market consolidates rangebound after volatility spike, Gold goes parabolic, speculative stocks pull back

Market Recap

After last week’s volatile sell-off on Friday, markets remained largely rangebound. Over the weekend, sentiment improved as former President Trump made de-escalatory comments, saying “not to worry about China.” Futures gapped up on Sunday’s open and maintained a steady rebound throughout the day.

However, by Tuesday morning, indices retested Friday’s lows, which held, providing a key technical support level for the week.

Later in the week, renewed concerns hit regional banks after Zions Bancorporation ZION 0.00%↑ reported a $50 million loss on a bad loan, triggering another wave of selling across the market. This culminated in a gapdown with VIX peaking at 29 early Friday morning, which felt extremely elevated despite the SPY 0.00%↑ only -3% off all time highs. The week closed with a strong rebound as Trump made more positive comments regarding China tariffs, and regional bank woes seemingly calmed.

In the high-growth space, momentum names that had recently gone parabolic pulled back sharply, including the rare earth metals group such as USAR 0.00%↑ UAMY 0.00%↑ CRML 0.00%↑ ABAT 0.00%↑.

Similarly, quantum computing and data center plays such as RGTI 0.00%↑ IONQ 0.00%↑ QBTS 0.00%↑ IREN 0.00%↑ BITF 0.00%↑ also faced heavy derisking pressure, reflecting a broader rotation out of speculative sectors.

Overall, markets appear to be consolidating following last week’s volatility, with earnings season starting again, as well as awaiting geopolitical headlines, as Trump and Xi are scheduled to meet in South Korea at the end of the month.

Watchlist

Signs of Gold Exhaustion After Historic Rally

One of last week’s standout developments was gold’s sharp reversal following a record 9 consecutive weeks of gains, a streak seen only a handful of times in history, the last being August 2020. Historical data shows that forward returns after such extended runs have tended to be negative, suggesting high probability of a medium-term top.

In addition, social media footage showed long queues at gold exchanges, signaling potential retail euphoria. Combined with a technical overextension and parabolic price action, Friday’s large reversal may mark the start of a pullback phase.

This week, traders should monitor whether lower highs start to form and whether gold begins to mean revert toward key moving averages such as the 10 EMA and 20 EMA.

Key Trading Vehicles

Spot/ETF: GLD 0.00%↑ $GC

Leveraged/Inverse ETFs: UGL 0.00%↑ GLL 0.00%↑

Gold Miners: GDX 0.00%↑ NUGT 0.00%↑

Individual Miners: NEM 0.00%↑ HMY 0.00%↑ HL 0.00%↑

Earnings Watch

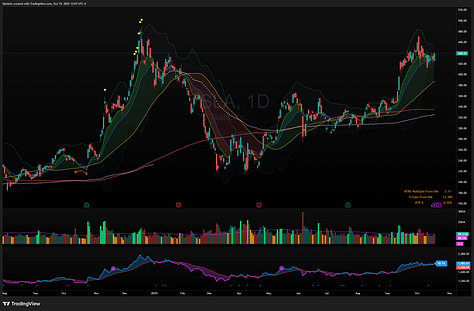

Mega-cap earnings kick off this week with market focus on NFLX 0.00%↑ and TSLA 0.00%↑.

Other stocks of interest are VRT 0.00%↑, GEV 0.00%↑ and INTC 0.00%↑ in the AI infrastructure space.

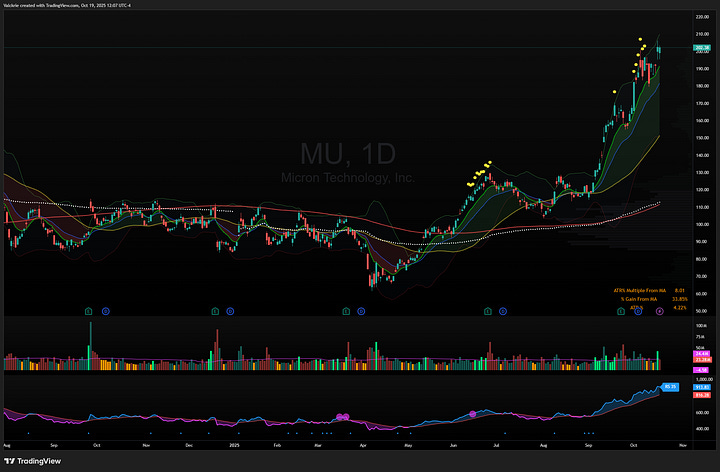

Relative Strength Stocks

Some stocks are showing relative strength, holding up during the latest market pullback:

MU 0.00%↑ AMD 0.00%↑ GOOGL 0.00%↑ TSLA 0.00%↑ CELH 0.00%↑

Momentum Basket

Remains on watch to see if they display continued weakness or start to bounce

IONQ 0.00%↑ QBTS 0.00%↑ RGTI 0.00%↑ IREN 0.00%↑ BITF 0.00%↑

OPEN 0.00%↑ - watching $7 support area with the 50SMA nearly catching up:

Microcaps

Trade Highlights

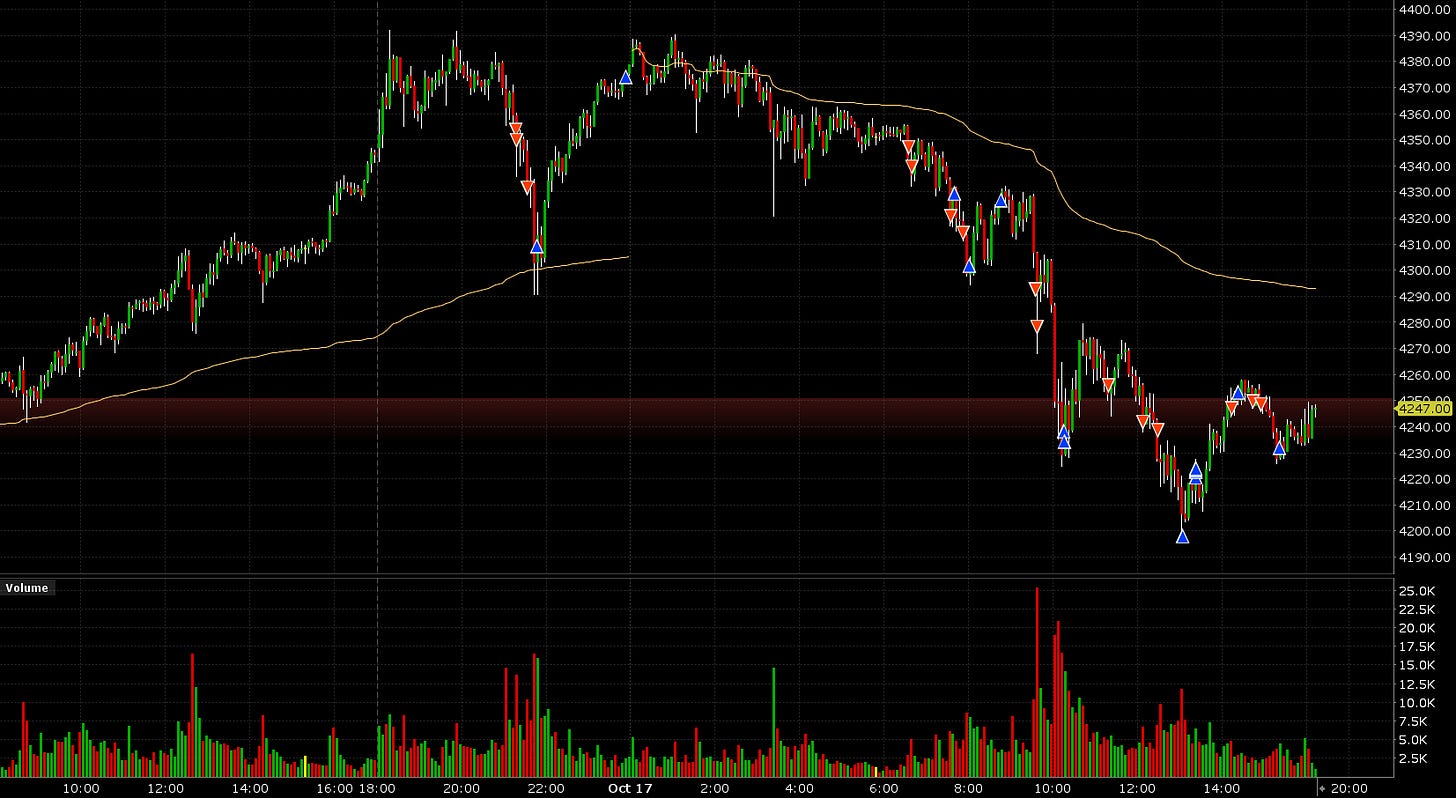

Gold reversal short on futures and GLL 0.00%↑ inverse ETF (still holding a position):

VXX 0.00%↑ short on Tuesdays market double bottom:

CRML 0.00%↑ UAMY 0.00%↑ metals short after daily parabolic move:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: