Weekly Outlook 11/03/25

Fed cuts rates, Trump makes China deal and another week of growth stock earnings

Market Recap

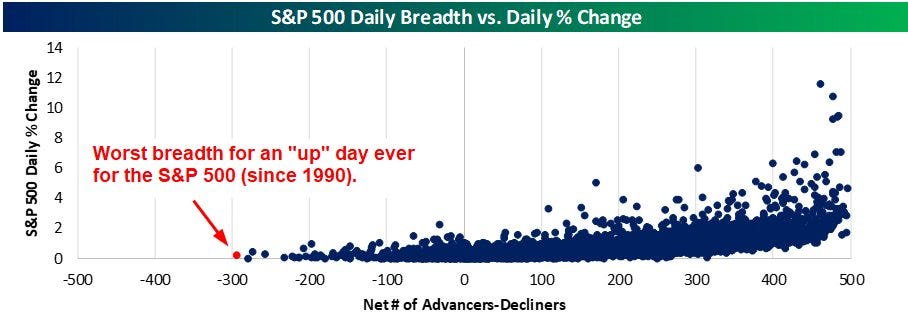

This week was marked by poor market breadth as the megacap rally, especially as NVDA 0.00%↑ seemed to attract most market participants’ liquidity and attention. IWM 0.00%↑ gapped up along with SPY 0.00%↑ and QQQ 0.00%↑ to start the week but sold off steadily through midweek before showing signs of a potential bounce on Friday, closing the session positive.

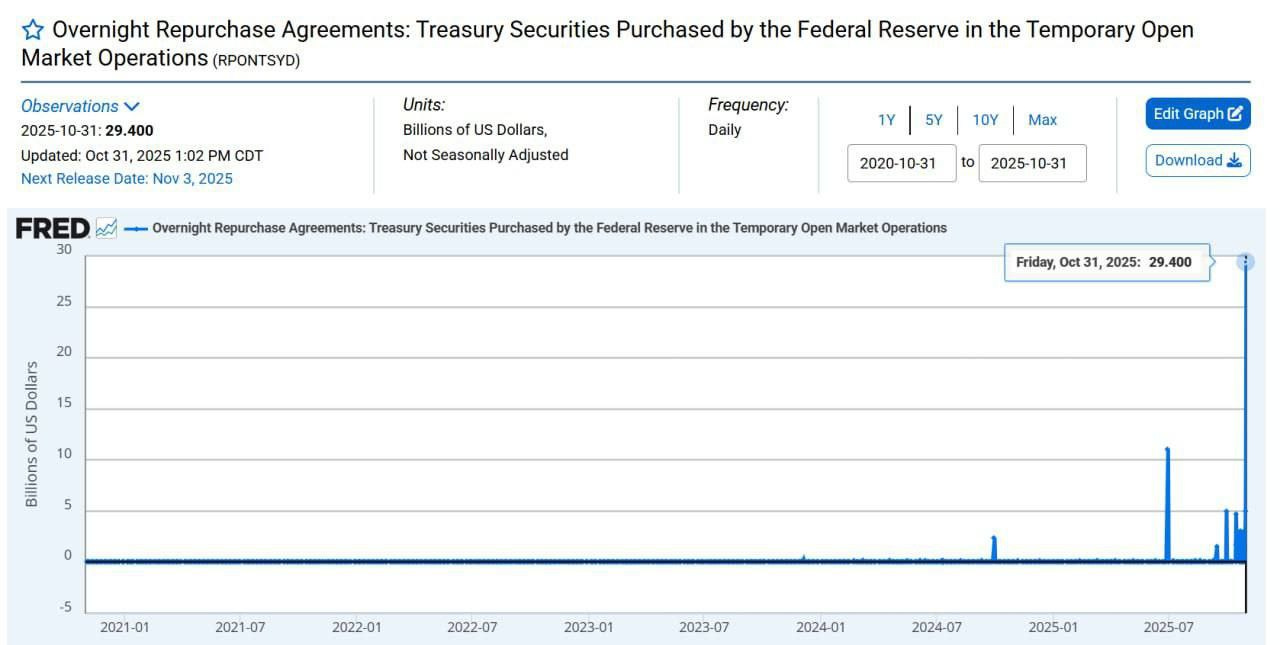

On the macro front, the Fed delivered a 25 bps rate cut as widely expected. However, Chair Powell struck a slightly hawkish tone, noting that a December cut was “far from guaranteed.” Despite that, the Fed’s actions in the Temporary Open Market Operations suggested a possible end to quantitative tightening, as liquidity injections into the banking system pointed to a more supportive stance beneath the surface.

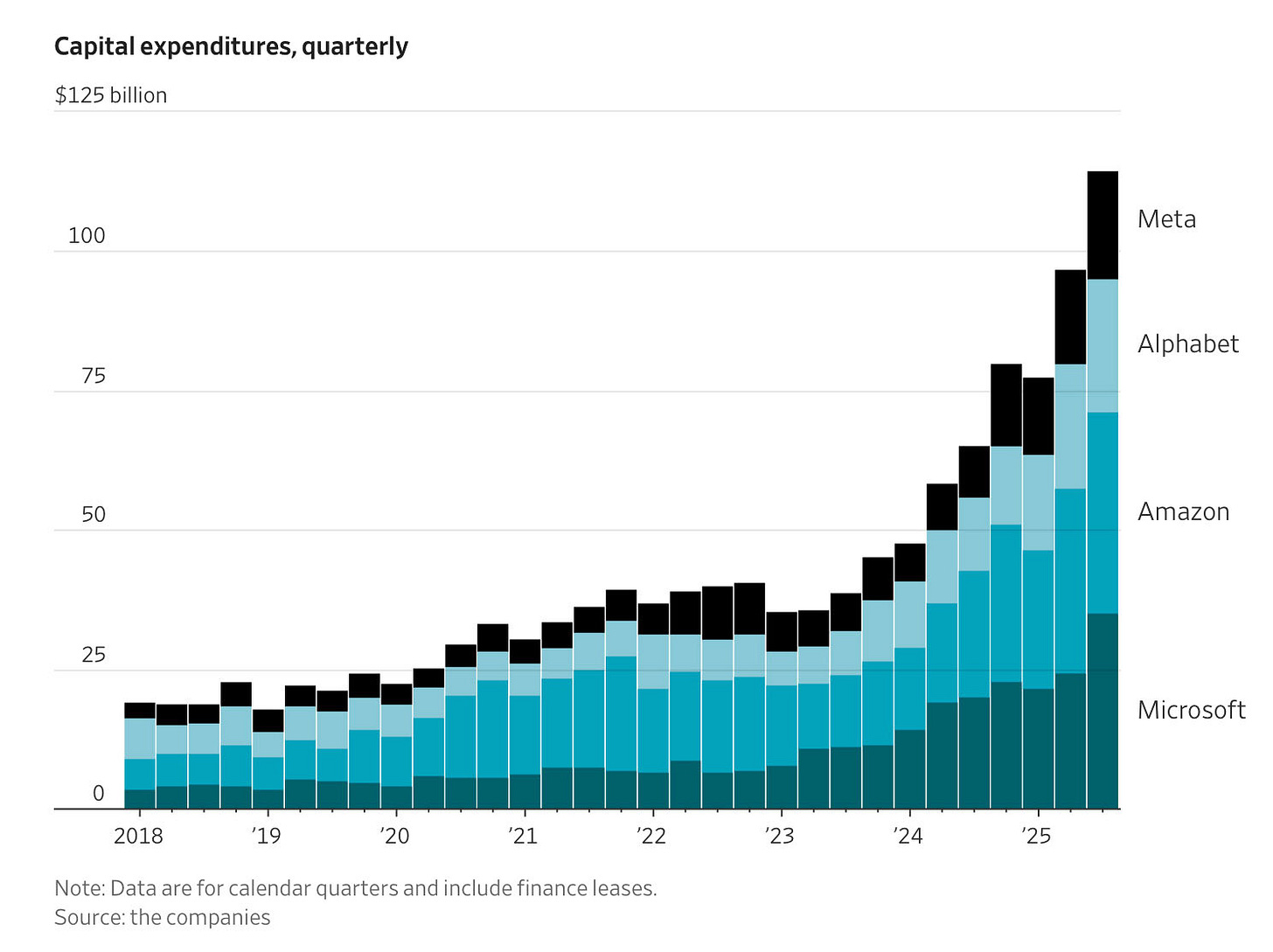

Megacap tech earnings dominated the week, with several companies continuing to ramp up capital expenditures, particularly in AI-related infrastructure, further reinforcing the AI bull market.

Over the weekend, the White House released a fact sheet titled “President Donald J. Trump Strikes Deal on Economic and Trade Relations with China,” which could bring some positive sentiment heading into the new week.

Watchlist

It will be another busy week of earnings, with many popular growth and momentum names set to report. Some notable ones to watch include:

Monday: CIFR PLTR HIMS NVTS

Tuesday: UBER SHOP SPOT HUT AMD ANET SMCI ALAB BYND UPST

Wednesday: CCJ DOCN HOOD IONQ APP QCOM ARM FIG

Thursday: QBTS OSCR VST DDOG OPEN MP IREN SOUN DKNG SMR ACHR INOD

Friday: CEG

TSLA 0.00%↑ remains in a sideways consolidation range as investors await the upcoming shareholder meeting on November 6. This event will be key, with two major focus points: the potential approval of Elon Musk’s pay package and the planned demonstration of Optimus V3. Either development could serve as a catalyst for renewed momentum, potentially setting up a breakout toward all-time highs if market sentiment turns positive.

Datacenters remain a strong group, supported by ongoing capex spending tailwinds reported by the major hyperscalers. Many names in the sector bounced back sharply following the recent market pullback and now appear to be consolidating, potentially setting up for the next leg higher as AI infrastructure demand continues to expand. NBIS 0.00%↑ IREN 0.00%↑ APLD 0.00%↑ HUT 0.00%↑

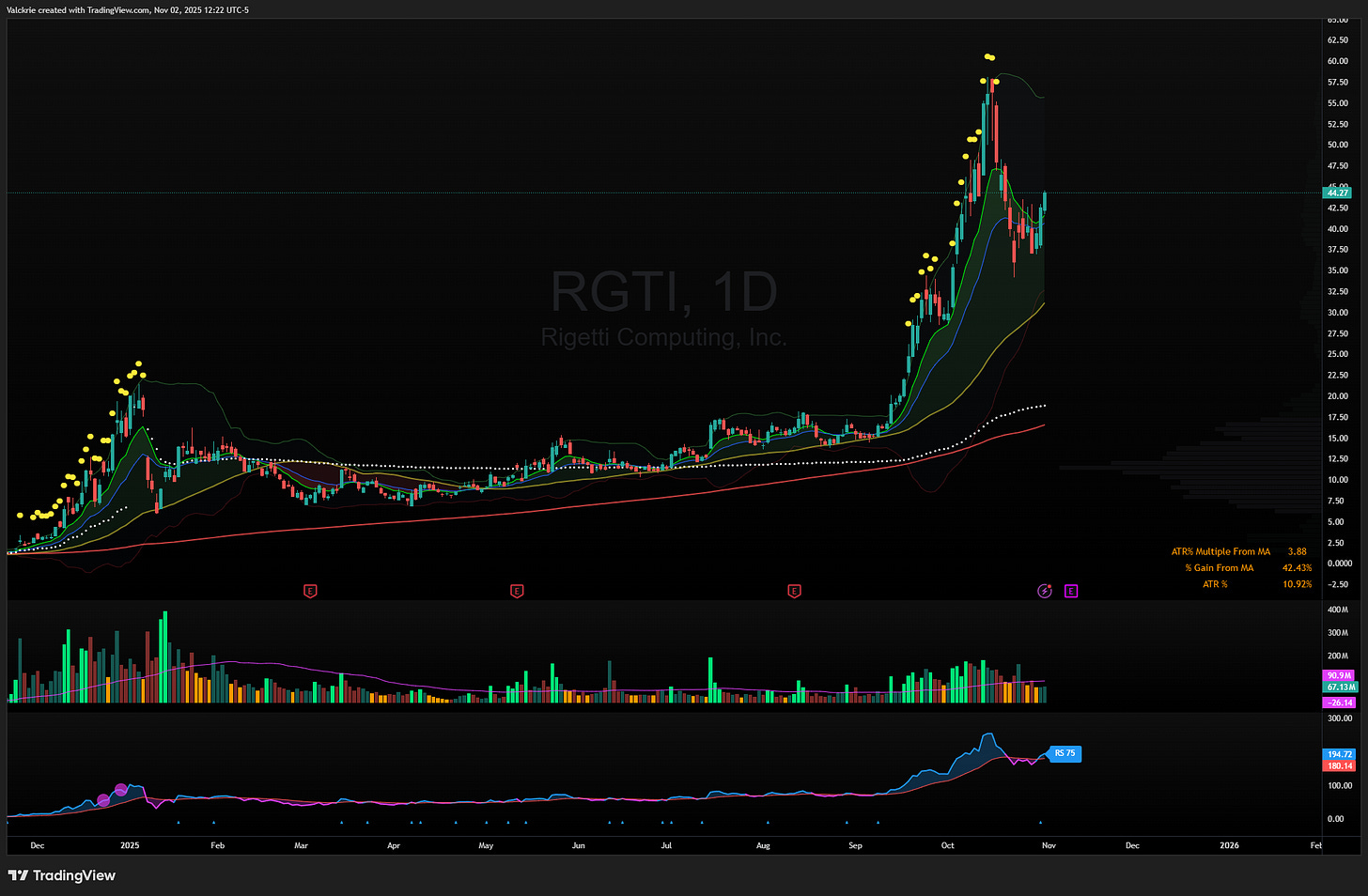

The quantum computing sector is back on watch as several names begin to rally following their recent pullbacks. IONQ is set to report this week, which could serve as a key sentiment driver for the group. Given the depth of the prior corrections, it will be important to see whether these stocks stall at lower highs, signaling continued weakness in the broader trend, or if they can break to new highs and reestablish momentum. RGTI 0.00%↑ QBTS 0.00%↑ IONQ 0.00%↑ QUBT 0.00%↑ LAES 0.00%↑

Trade Highlights

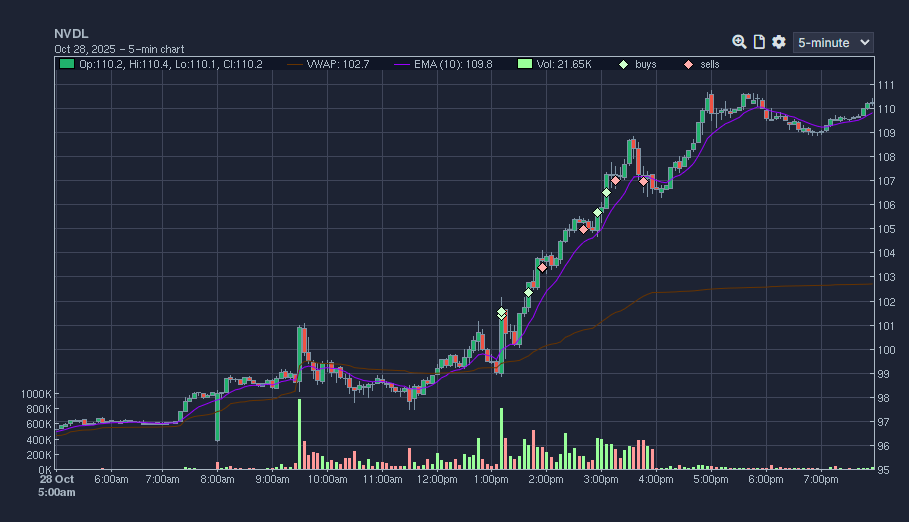

NVDA 0.00%↑ rally after Jensen announced over $500bn in bookings backlog during GTC conference:

PYPL 0.00%↑ breakout after partnering with OpenAI integrating wallet into ChatGPT:

QCOM 0.00%↑ news that it would enter the AI chip market:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

INOD's Thursday earnings could be anohter important read on the datacenter cooling infrastructure demand that's been ramping alongside all the AI capex. With hyperscalers continuing to expand at this pace, thermal management becomes a critical bottleneck that can't be ignored. If they show strong bookings growth tied to new datacenter builds, it validates that the spending isn't just going to chips and servers but also the supporting infrastructure needed to keep them running.

AMD reporting Tuesday is probably the most critcal earnings for semiconductors this week. Coming after strong datacenter capex guidance from hyperscalers, AMD needs to show they're actually capturing that spending with MI300 deployments. The OpenAI partnership news already boosted sentiment but earnings will determine if the revenue materializes or if it's still mostly forward-looking. If they deliver strong guidance alongside ANET and SMCI beats, it could validate the entire AI infrastructure buildout thesis heading into year-end.