Weekly Outlook 11/10/25

Market pulls back but closes the week with a strong 50-SMA bounce

Market Recap

Following last week’s weak breadth and underlying market softness, both SPY and QQQ broke down from their recent consolidations and slipped below short-term moving averages. Speculative growth stocks extended their declines, with the quantum computing sector hit particularly hard. Crypto also came under pressure, making fresh lows below the liquidation prices from last month.

In Asia, the Nikkei and Kospi also pulled back after a strong rally for the past couple of months.

Late week, $QQQ experienced a sharp two-day selloff, dropping about 2% on Thursday and another 2% on Friday before finding support at its 50-day moving average and staging a midday bullish reversal. With the broad market bounce and strong hammer candles being formed across multiple indices ($SPY $QQQ $IWM $ARKK) Friday’s low acts as a tradeable low and line in the sand to hold if the market uptrend is to continue.

Watchlist

During the selloff many of the leading AI megacap stocks held at prior support levels, making it a clear pivot point in the coming weeks, along with the 50sma low in the indices. If these support levels break, the market could see further downside, but as long as they hold, the market should stabilize.

PLTR: Palantir once again found solid buying support around the 170 area. This level has now held three times over the past month, with repeated daily wick candles suggesting that buyers are consistently stepping in at this zone.

NVDA: Nvidia held the 180 area after giving back its recent rally that was driven by optimism around a backlog guidance raise and speculation over potentially relaxed China chip restrictions. With no actual easing of restrictions materializing, the stock has returned to roughly where it was before that move. Holding 180 remains technically important, as it marks a key support level that could determine whether Nvidia stabilizes.

HOOD: Robinhood reported a strong quarter with a double beat on earnings, but the stock couldn’t escape the weight of the broader market selloff. It pulled back sharply before finding support near 121, forming a double bottom at its prior low. Holding this level keeps the intermediate trend constructive, forming a support from the low end of range.

RDDT: Reddit also delivered an earnings beat but was caught in the market-wide weakness that pressured most growth names. The stock has retraced to retest its 200-day moving average and the gap from its previous earnings release. RDDT remains on watch if it can get above 200 and trade back into the upper end of range.

TSLA: Also pulled back with the market, despite Elon’s pay package vote passing during the shareholder meeting. The stock remains in a consolidation range for now. A breakout above the 470 remains on the table in the coming weeks.

Earnings

Despite the overall market weakness, a few stocks delivered positive earnings reactions, hinting at a possible rotation into fresh names following the recent pullback. Some notable examples include:

$EOSE broke out of daily flag pattern.

$GH consolidating earnings gap, notably green daily candles closing above the open every day and also wicks showing buying support.

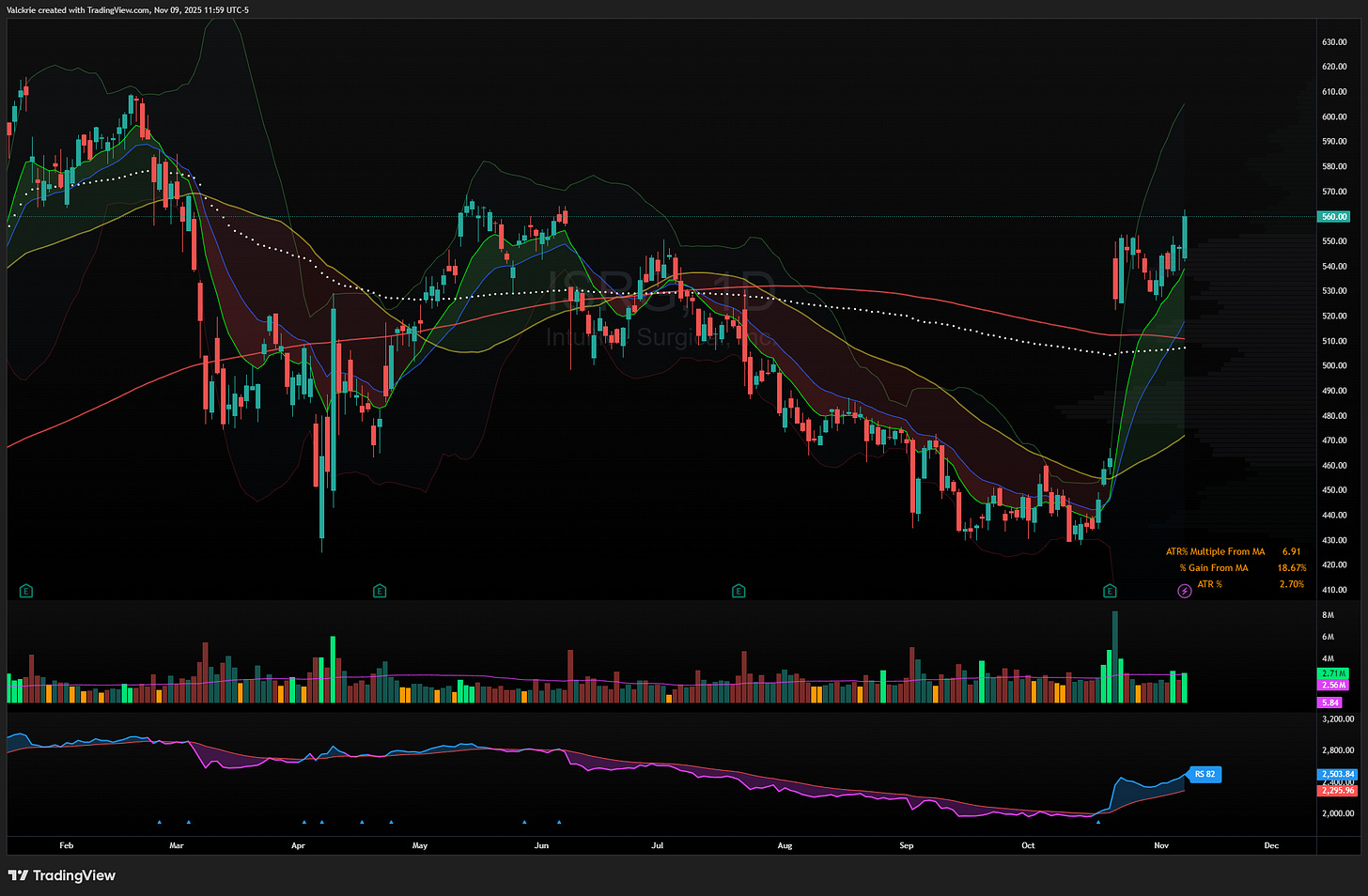

$ISRG broke out to new highs after consolidating the earnings gap.

$W digesting recent earnings gap with sideways consolidation. Bigger picture the stock is emerging from a lengthy 2 year base spanning back to 2023.

$LITE $LMND $COHR $EOSE $RIVN $FSLY $LYFT $SEDG $ISRG $GH $OPEN $SKYT $EOSE $SES $W

Next week earnings to watch for:

Monday: RGTI CRWV BTDR BBAI RKLB ASTS WULF MVST

Tuesday: NBIS SE BYND OKLO

Wednesday: CRCL GRAL SERV

Thursday: BITF JD BILI CSIQ RCAT AMAT NU TMC

Crypto

Crypto showed signs of a potential low forming, with Bitcoin holding near the 100k level and Ethereum stabilizing around its 200-day moving average.

COIN: Coinbase displayed notable relative strength within the sector, maintaining support around 300 throughout the recent crypto pullback. While both BTC and ETH made new lows, COIN held firm, bouncing off its 200-day moving average and reclaiming ground after briefly undercutting 300. It remains one to watch for confirmation of a higher low and potential upside follow-through.

BMNR: Potential leveraged vehicle to gain exposure to a possible ETH rebound.

Misc.

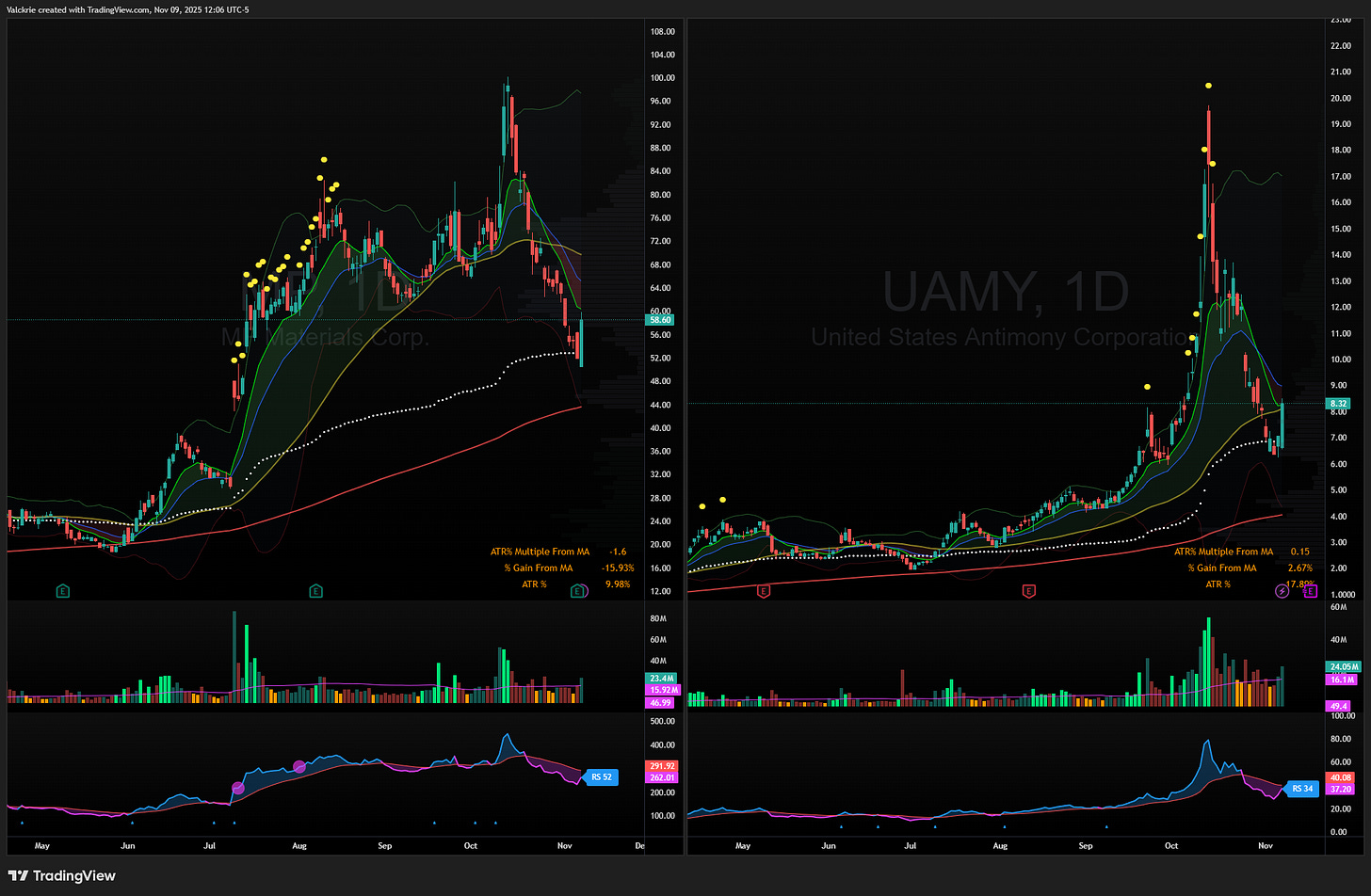

Rare earth metal stocks had a strong bounce on Friday $MP $UAMY after correcting over 50% from highs in an almost straight line down.

$SNDK is one of the strongest stocks in the market right now, having defied any market pullbacks over the last few weeks. Volume finally started increase on Friday. On watch for a parabolic move and reversal short.

Trade Highlights

$RGTI breakdown short via $RGTZ

$PLTR 170 bounce

$NVDA 180 bounce

$LITE earnings breakout

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

That 121 double bottom on Robinhood is textbook technical setup after strong earnings. The broader market selloff creating this entry point despite the beat shows how much sentiment matters in the short term. If the 121 support holds and market conditions stabilze, this could be an attractive risk/reward given the earnings strength. Crypto exposure remains a wildcard for upside though.

The 170 support zone for Palantir is becoming increasingly significant as buyers defend it three times now. Those repeaed wick candles show real institutional interest stepping in at this price, which suggests conviction. Given the strong fundamentals you highlighted with gross margins and free cash flow, this technical level paired with improving business metrics makes for a solid setup if it holds.