Weekly Outlook 11/17/25

Government shutdown ends, hawkfish fed speak and AI debt woes rattle the market

Market Recap

Markets opened the week with a Sunday gap higher after Friday’s strong reversal off the 50-day moving average, but momentum quickly shifted as tech began to lag and capital rotated into other areas like healthcare $XLV and even the $DIA which pushed to new all time highs.

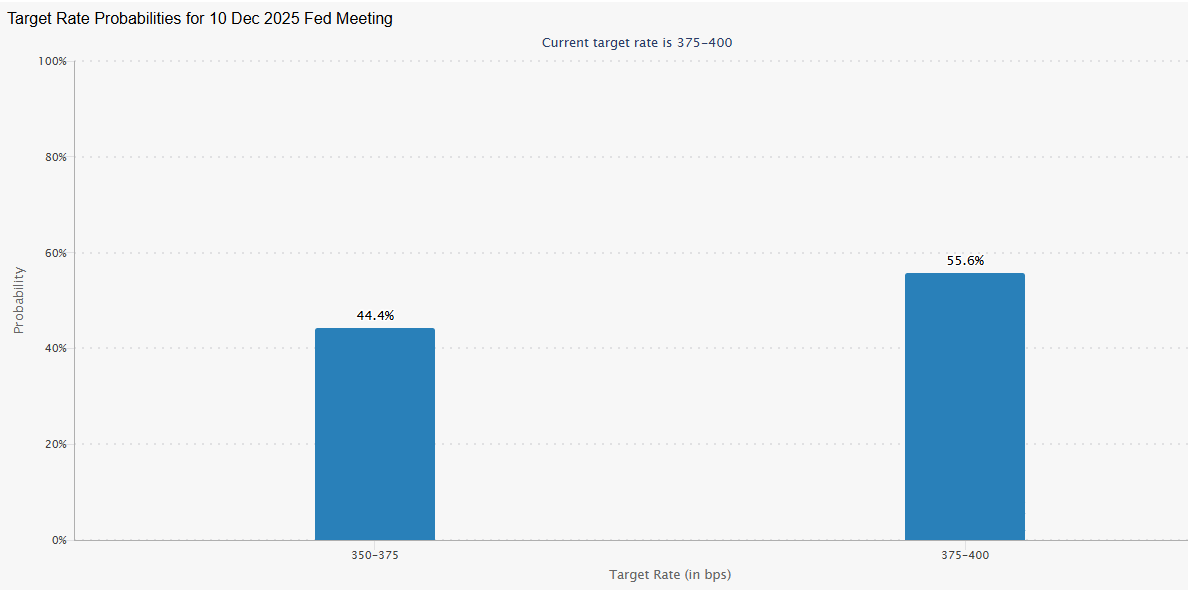

Early optimism that the government would soon reopen helped fuel the initial rally, but that narrative faded into a mild sell the news reaction, compounded by several hawkish Fed comments that pushed the odds of a December rate cut down to 44 percent.

By Thursday the market appeared to be replaying last week’s weakness, with $QQQ posting another sharp 2% drop and setting up a gap down on Friday. Momentum continued to unwind, especially in the recently high flying data center names that extended their pullback through multiple sessions. The pressure finally climaxed in a wave of premarket capitulation on Friday before a reversal took hold at the open, giving the market a notable bounce to close the week. Once again, Friday’s low of $QQQ 600 area will act as a key level for sentiment to stay positive as it has showed strong support and buying pressure multiple times over the last month.

Watchlist

As earnings season winds down, attention turns to one of the most important reports of every season: $NVDA. With results due on Wednesday, the event could act as a potential sentiment pivot for the AI trade, and the reaction plays an important role in shaping the market’s tone through the remainder of the week.

Technically, $NVDA has been acting similar to the indices, holding the $180 area of support multiple times, which will be a key level to watch during the earnings reaction.

$ORCL - Another developing story has been the sharp rise in Oracle’s credit default swap spreads, reflecting growing investor concern about its rapidly expanding debt load tied to AI investment. Since September earnings the stock has trended lower while CDS spreads have pushed steadily higher.

With the broader market bouncing, Oracle finding support near its 200 day moving average, and the speed of the recent spread surge, Friday may have marked a potential inflection point. Fear often peaks near bottoms, and Oracle is a name worth keeping an eye on next week.

How Oracle trades from here will likely influence the broader data center basket, including names like $CRWV and $NBIS, both of which finally caught a bounce on Friday along with the overall market after extended downtrends. If Oracle can stabilize, it could help anchor sentiment in this group, which has been unwinding for weeks and is searching for signs of a durable bottom.

$IREN $CIFR $APLD

$SNDK remains one of the strongest stocks in the market, which saw some weakness on Thursday along with the broader market. Remains on watch for a sign of reversal of the trend that has been holding since September.

Crypto has remained one of the weaker sectors, holding a firm downtrend below the 200 day simple moving average since the major liquidation event in October. Bitcoin and Ethereum are worth monitoring for potential capitulation moves

Some crypto stocks like MSTR and CRCL are also in steep downtrends and could be vehicles to trade the overall crypto move.

OPEN Opendoor has been rallying since earnings after announcing a special dividend of tradeable warrants to shareholders, which has a record date of 18th November 2025. Given the existing rally into this date, there could be a sell the news trade here.

Quantum stocks experienced a relief bounce on Friday after retracing back to their September breakout levels. $IONQ in particular bounced at its 200 day moving average, making the group worth watching to see if this signals a larger rebound or if Friday’s move proves to be a short lived bounce.

Trade Highlights

One of the better trade opportunities last week was the gap down bounce in the overall market, and individual stocks on that day:

$APLD

$RGTI

$VXX short after the market bounced:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

Something to watch regarding quant names: SuperCompute25 (SC25) November 18–20.

It's interesting how clearly you've articulated the market's rotational dinamics, and I'd add that the high volatility in data center names makes sence given the computational load scaling demands of current AI models.