Weekly Outlook 01/05/26

New Year starts with megacaps selloff, underlying smallcap rotation and weekend Venezuela escalations

Market Recap

The market began the shortened holiday week on the back foot, with weakness building into an extremely poor breadth day on New Year’s Eve, the final trading session of the year.

The first day of the new year then brought heightened volatility and disperion in the market, highlighted by sharp selloffs in megacap stocks MAGS 0.00%↑ and software IGV 0.00%↑, while the SMH 0.00%↑ rallied to an all time high.

QQQ 0.00%↑ also experienced an intraday drop -2% from highs to lows, but overall remains in a tightening wedge formation on the daily chart, which could resolve in a directional move in the coming weeks.

Despite the turbulence, the VIX finished lower on the day, and small caps notably diverged from the weakness, with IWM 0.00%↑ outperforming and closing up 1%. Under the surface, market breadth was actually constructive, as many speculative small and mid cap stocks rallied strongly, likely reflecting the unwind of late December tax loss selling and subsequent repurchasing to start the new year.

Watchlist

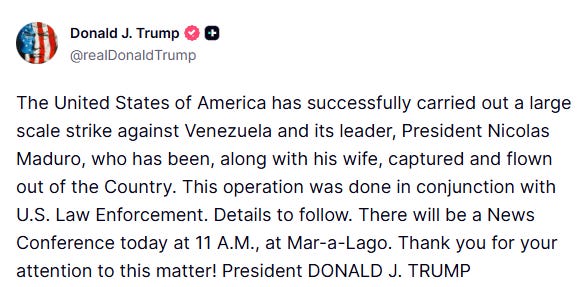

Looking ahead, the major headline over the weekend was the US military operation in Venezuela and the capture of President Maduro, which puts crude oil futures and oil related equities firmly on watch amid discussion of US companies potentially entering and expanding production in the country.

Rising geopolitical tensions also keep precious metals in focus. Gold GLD 0.00%↑, Silver SLV 0.00%↑, and Platinum PPLT 0.00%↑ all experienced parabolic blowoff style reversals at the end of last year. Gold is currently trading below its short term 10 and 20 day EMAs after failing to make a new high in December, while Silver has so far held the key 70 support area following its reversal, with a decisive break of that level opening the door for a potential short setup.

On the equity side, several sectors showed pockets of strength on Friday, suggesting selective rotation beneath the surface despite broader uncertainty. Rather than a single dominant theme, buying was spread across multiple areas, reinforcing the idea that capital is beginning to move more tactically as traders position for the next directional move in the market.

Space

Several space stocks were higher on Friday, with RKLB 0.00%↑ emerging as one of the key leaders in the sector. The potential SpaceX IPO this year remains a major driving narrative and ongoing tailwind for the group.

SIDU 0.00%↑ a microcap space stock that continues to rally despite multiple offerings the week prior, contributing to the short squeeze. Another move higher next week and could be a potential short trade.

Other notable stocks: RDW 0.00%↑ PL 0.00%↑ LUNR 0.00%↑ ASTS 0.00%↑ SATS 0.00%↑ VSAT 0.00%↑ BKSY 0.00%↑ VOYG 0.00%↑ FLY 0.00%↑ ARKX 0.00%↑

Datacenters

IREN 0.00%↑ looks to be forming the first higher low and potential break of downtrend since the pullback in November. HUT 0.00%↑ has showed relative strength and is nearer to the highs for a potential breakout.

Memory

Memory stocks continue their ascent after a strong end to last year. While MU 0.00%↑ has already broken out, SNDK 0.00%↑ is near ATH and WDC 0.00%↑ also has a breakout level.

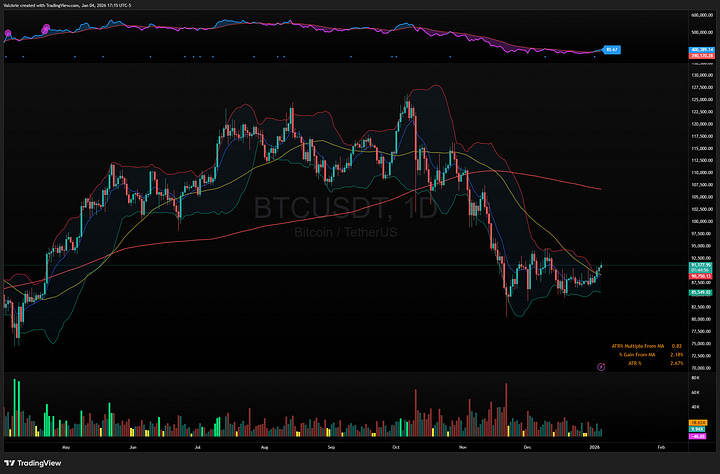

Crypto

$BTC and $ETH are trying to rally after being in a tight consolidaton range for last couple of weeks. They are also trying to break the downtrend and perhaps flip the 50-SMA.

Misc.

Other stocks that were strong on Friday and continue to be on watch:

RR 0.00%↑ SERV 0.00%↑ SYM 0.00%↑ robotics group

BE 0.00%↑ SEI 0.00%↑ renewable energy/storage stocks

ONDS 0.00%↑ drones

BABA 0.00%↑ BIDU 0.00%↑ China sector

RDDT 0.00%↑ ALAB 0.00%↑ AI stocks that showed relative strength

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

Thank You and Happy New Year!

The divergence between megacap selloff and small cap strength you highlight is significant, especially given the breadth collapse on Dec 31. What's intresting is how the space sector is responding to the SpaceX IPO narrative as a rising tide, with ASTS and RKLB both showing substantial moves despite having very different business models and risk profiles. The Venezuela situation creating potential oil sector trades while simultaneously supporting precious metals is one of those rare setups where multiple uncorrelated themes converge. I've noticed similar rotation patterns during other periods where tax-loss selling unwinds meet geopolitical catalysts, usually creates short-term mispricings that persist for a few weeks befor mean reversion kicks in.