Weekly Outlook 12/01/25

Short but strong Thanksgiving week, Google TPUs challenge Nvidia

Market Recap

It was a short but strong Thanksgiving week, with the major indices rallying right from Monday’s open. For the week the indices closed up:

SPY 0.00%↑ +3.70%

QQQ 0.00%↑ +4.96%

IWM 0.00%↑ +5.61%

A standout development came from RSP 0.00%↑, the equal weighted S&P 500 index, which closed at a new all time high. This signaled a meaningful improvement in market breadth, with more individual stocks participating in the move rather than the narrow megacap driven strength seen earlier a few weeks ago. Broader participation also showed up in the rising high low ratio and the increase in the percentage of stocks trading above their 40 day moving average.

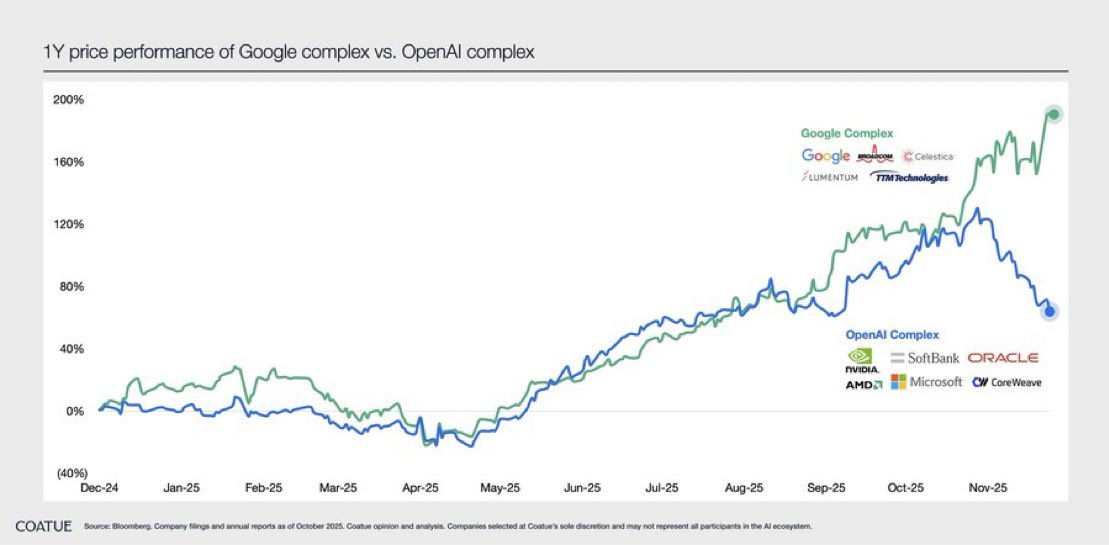

Another key storyline over the past two weeks has been the release of Google’s Gemini 3, which some argue outperforms the latest ChatGPT 5. What’s more, is that the model was trained on Google’s own cloud TPUs (tensor processing units), a demonstration that perhaps other chips can finally challenge Nvidia’s GPU dominance. As a result, we saw outperformance in the basket of stocks related to Google, compared to weakness in OpenAI and Nvidia over the recent weeks.

As a reminder, there is still a Black Friday sale for 20% off on joining the community - deal ends Monday midnight:

Watchlist

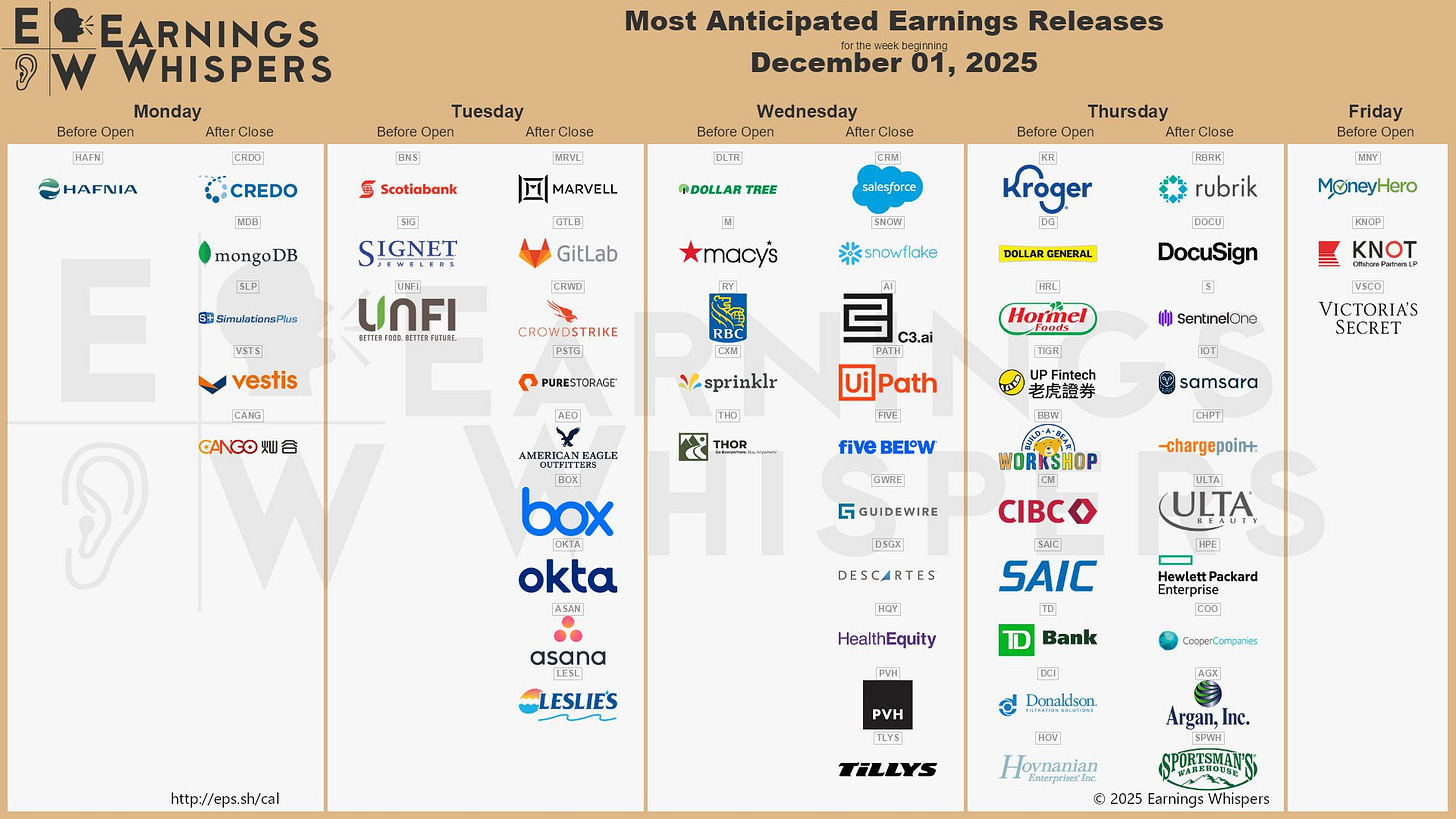

This week many cloud software and cybersecurity companies report earnings, some notable ones include MDB 0.00%↑ CRWD 0.00%↑ OKTA 0.00%↑ SNOW 0.00%↑ RBRK 0.00%↑ S 0.00%↑

Some key stocks to watch in the AI basket: CRDO 0.00%↑ MRVL 0.00%↑ PSTG 0.00%↑ CRM 0.00%↑ AI 0.00%↑ PATH 0.00%↑ IOT 0.00%↑

Datacenters remain an important sector to monitor as demand tied to AI infrastructure continues to grow. Recently, performance within the group has started to diverge, with names like WULF 0.00%↑ and CIFR 0.00%↑ rebounding more quickly than others such as IREN 0.00%↑ and NBIS 0.00%↑. This is likely due to the positioning of these companies within the shifting hardware landscape - both CIFR and WULF have partnerships with Fluidstack and Google, and as Google’s TPUs gain favor as an alternative to traditional GPU based workloads, datacenters capable of hosting TPUs have shown stronger relative performance. In contrast, operators such as NBIS and IREN remain more closely tied to NVDA 0.00%↑ driven GPU demand, which may explain their slower recovery compared to the TPU aligned names.

Homebuilders were among the strongest groups to rally since last Friday, when Fed Williams’ comments boosted expectations for a possible December rate cut. Because the sector is highly sensitive to interest rate movements, the jump in rate cut probabilities helped fuel outsized strength in names like LEN 0.00%↑ and TOL 0.00%↑, as well as the broader homebuilding ETFs XHB 0.00%↑ and ITB 0.00%↑.

Crypto participated in the broader market bounce as well, although both BTC and ETH remain below their 200 day simple moving averages, which keeps them in higher timeframe downtrends. In the short term, a more sustained recovery would require prices to close back above the declining 20 day EMA.

Silver SLV 0.00%↑ broke out to new highs this week, whilst gold GLD 0.00%↑ appears to be setting up along a similar trajectory. Notable that gold miners GDX 0.00%↑ have already made a local new high.

Overall, many individual stocks are starting to look more constructive in step with the broader market rally. Another group that stood out was renewable energy and energy storage, which showed clear relative strength as buyers rotated back into growth oriented themes. TE 0.00%↑ EOSE 0.00%↑ BE 0.00%↑ SEI 0.00%↑ FLNC 0.00%↑

Within software, RDDT 0.00%↑ and APP 0.00%↑ also recovered well, both displaying strong rebounds after several weeks of choppy action.

Trade Highlights

GOOGL 0.00%↑ despite the strong news flow, price was short term extended above the daily bollinger bands:

OPENZ 0.00%↑ was an interesting trade this week as on the first two days of trading it spiked on the open and showed some price dislocation versus the other lower strike warrants: