Weekly Outlook 01/12/26

Markets push to all time highs, Trump policy headlines ignite optimism across defense and housing sectors

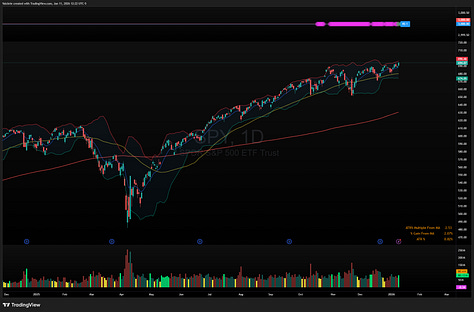

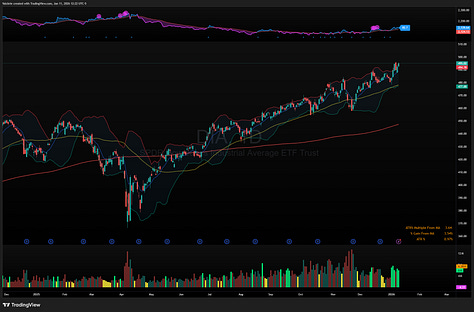

Market Recap

All major U.S. indices SPY 0.00%↑, IWM 0.00%↑, DIA 0.00%↑ finished the week at all-time highs, with the exception of QQQ 0.00%↑ which continues to lag on a relative basis, but remains in a well-defined uptrend and appears coiled for a potential upside breakout once it clears the $629 level.

Since the start of the year small caps IWM 0.00%↑ have been outperforming, with the ratio chart suggesting a potential turning point and a period of continued outperformance.

In crypto, both Bitcoin and Ethereum remain range-bound. Upside range levels are clearly defined and worth monitoring should a breakout attempt emerge.

Watchlist

Several different sectors are being catalyzed by recent actions and proposals from Trump, creating fresh narratives across the market.

Defense

Trump has floated a proposed $1.5T defense budget for FY 2027, a substantial increase from the $901B 2026 defense bill, reigniting interest across the defense complex. Many stocks in this sector saw strong rallies this week, but are short term extended: KTOS 0.00%↑ KRMN 0.00%↑ AVAV 0.00%↑

Space

Adjacent to aerospace & defense is the space sector, which continues to benefit from expectations of a potential SpaceX IPO later in the year at a valuation north of $1T.

RKLB 0.00%↑ broke out early in the week and consolidated for a few days

ASTS 0.00%↑ is approaching all time highs but, albeit with wide and loose price action

FLY 0.00%↑ is a recent IPO that is coming off lows into an uptrend

RDW 0.00%↑ has notably seen a huge volume surge in the last few weeks

Housing

Trump announced plans for U.S. housing agencies such as Fannie Mae and Freddie Mac to purchase $200B in mortgage bonds, with the stated goal of lowering mortgage rates and improving affordability. He also proposed banning large institutional investors from buying single-family homes, aiming to reserve supply for individual buyers. While critics note institutions represent only about 1% of the market, the proposal aligns with his broader housing affordability narrative.

RKT 0.00%↑ made new 52 week highs on Friday

OPEN 0.00%↑ rallied to close above the 50-SMA for the first time since November

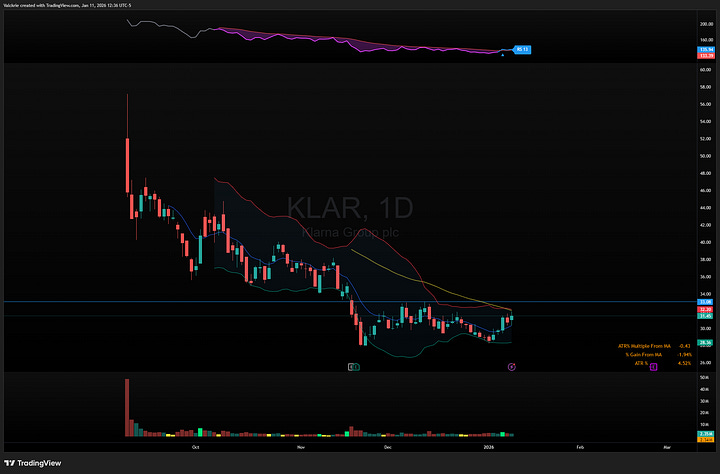

Credit Cards

Trump has called for a one-year cap on credit-card interest rates at 10%, proposed to begin January 20, 2026. While the measure would require Congressional approval, it has drawn bipartisan attention despite past legislative attempts stalling. Companies exposed to this narrative include V 0.00%↑ and MA 0.00%↑ as affected incumbents, whilst buy now pay later (BNPL) companies could potentially benefit:

AFRM 0.00%↑ regained its uptrend since December

KLAR 0.00%↑ is a recent IPO that has a sideways range for the last 2 months

AI Infrastructure

Meta META 0.00%↑ signed 20-year power purchase agreements with Vistra VST 0.00%↑, committing to buy electricity from three nuclear plants in Ohio and Pennsylvania. The deal covers more than 2,600 MW of zero-carbon nuclear power, reigniting the nuclear energy sector.

VST 0.00%↑ had been in a 4 month downtrend and gapped up, but still closed under the 200-SMA

OKLO 0.00%↑ retraced over 60% from the highs in October but has been rallying since the new year

IMSR 0.00%↑ is an under-the-radar de-SPAC nuclear stock that also had positive news this week

Energy storage

Adjacent to that theme, renewable energy and energy storage stocks are also seeing increased momentum, with names such as FLNC 0.00%↑ EOSE 0.00%↑ BE 0.00%↑ moving alongside the broader energy and infrastructure narrative.

Datacenters

Datacenter stocks themselves remain in consolidation ranges on the daily technicals:

ORCL 0.00%↑ has been sideways and saw a rally on Friday into the $200 area

CRWV 0.00%↑ has been consolidating in a tight range

APLD 0.00%↑ rallied after earnings

HUT 0.00%↑ is at 52 week highs

IREN 0.00%↑ NBIS 0.00%↑ and CIFR 0.00%↑ all continuing to base

Memory

Memory stocks remain a leading group and one of the strongest momentum areas in the market with SNDK 0.00%↑ and MU 0.00%↑ breaking out strongly last week.

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: