Weekly Outlook 01/26/26

Tariff volatility, Silver and Gold go parabolic, Trump invests in rare earth minerals

Market Recap

U.S. equity markets saw a sharp selloff to start the week after Trump threatened new tariffs on several European nations as part of his broader Greenland strategy, reigniting fears of an escalating trade conflict and weighing heavily on the indices, with QQQ 0.00%↑ gapping down and closing weak on Tuesday.

Sentiment shifted later in the week as markets rebounded strongly after Trump backed away from the proposed tariffs and signaled progress toward a framework agreement, sparking a classic relief rally across both U.S. and European equities.

Even with the rebound, SPY 0.00%↑ and QQQ 0.00%↑ remain rangebound, and overall conditions continue to be choppy, with only a narrow group of stocks sustaining clean trends.

During the early week volatility, gold and other safe haven assets surged, and despite the easing of tariff threats, precious metals continued higher into the end of the week. Silver and gold once again took center stage, with silver breaking above the $100 level for the first time on record and gold pushing close to the $5000 area.

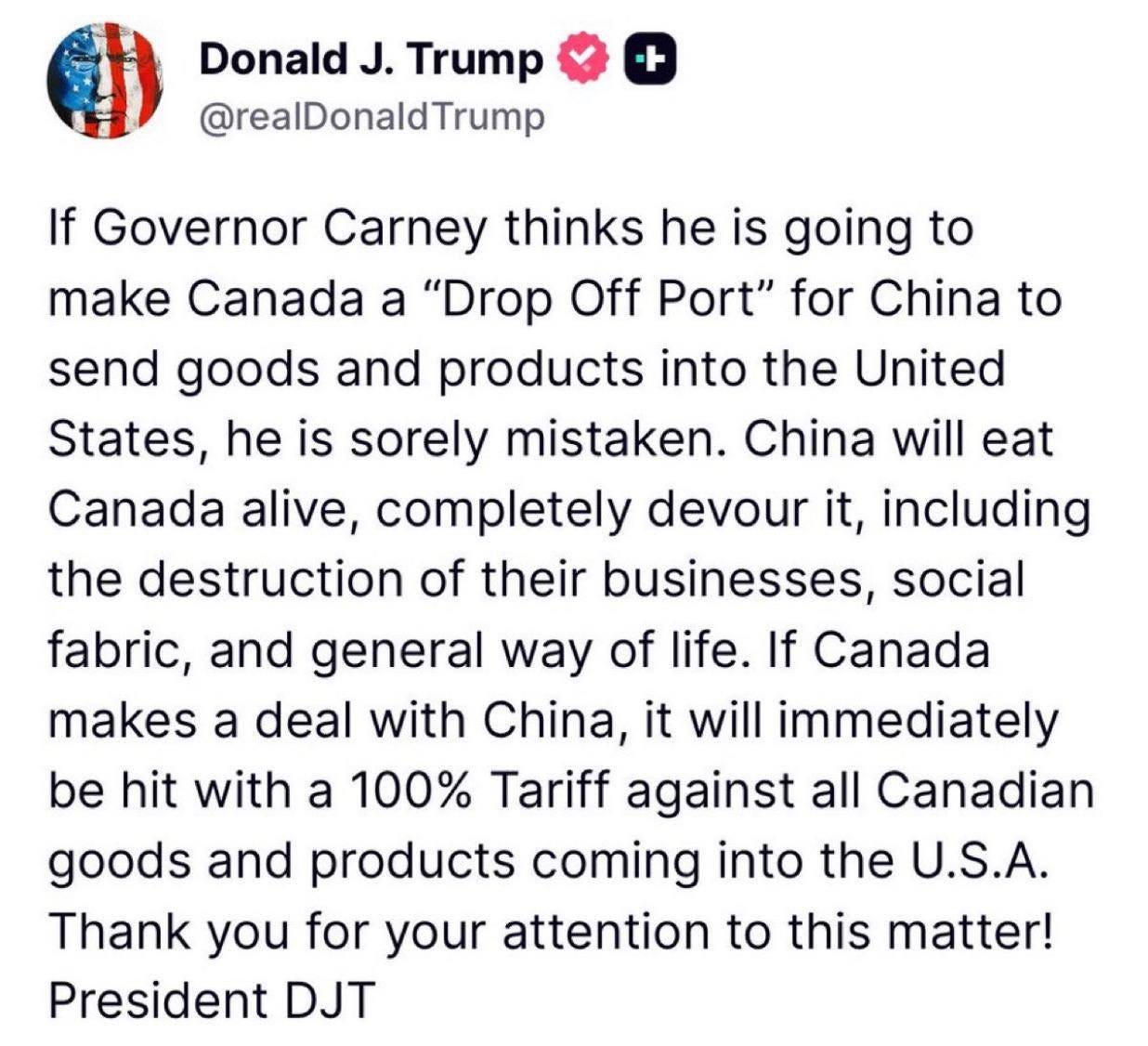

Over the weekend, trade tensions resurfaced as Trump threatened to impose 100% tariffs on Canadian imports if Canada proceeds with a trade deal with China, adding another layer of uncertainty heading into the new week.

Watchlist

Earnings season is starting with many heavyweights reporting this week. Some key stocks to watch will be: MSFT 0.00%↑ META 0.00%↑ TSLA 0.00%↑ SNDK 0.00%↑ AAPL 0.00%↑ WDC 0.00%↑ STX 0.00%↑

Silver and gold will be closely watched if price accelerates into a potential parabolic short. However, if price consolidates instead, the trend could extend further to the upside.

Mining stocks also saw strength this week, with HYMC 0.00%↑ extending its rally, while smaller microcap names such as NAMM 0.00%↑ and BGL 0.00%↑ showed notable movement.

In crypto, $BTC failed a range breakout earlier in the month and is now breaking down, trading back below the 50-SMA. $ETH looks similar, with both appearing vulnerable to a retest of recent lows. Stocks tied to crypto price action to watch include COIN 0.00%↑, HOOD 0.00%↑, MSTR 0.00%↑ and CRCL 0.00%↑.

Rare earth stocks are also on watch following reports of the Trump administration investing $1.6B into USAR 0.00%↑. Other names in the sector to monitor include TMC 0.00%↑ CRML 0.00%↑ UAMY 0.00%↑ and TMQ 0.00%↑.

Keeping in mind the selectivity and choppiness of the current environment, datacenter stocks did show some strength on Friday, though they remain rangebound overall and could have breakout potential depending on how the week develops: APLD 0.00%↑ HUT 0.00%↑ GLXY 0.00%↑ IREN 0.00%↑.

If the market sees further weakness, the quantum sector looks technically weak and could set up potential breakdown trades alongside broader market pressure: RGTI 0.00%↑ QBTS 0.00%↑ QUBT 0.00%↑ IONQ 0.00%↑.

BNAI 0.00%↑ is a microcap stock that surged from $11 to $68 in after-hours trading on Friday, making it a highly volatile stock to monitor this week.

IBRX 0.00%↑ is an extended biotech name that is running into resistance around the $8 level and could see downside if momentum fades after its recent run.

Markets don’t wait for weekly posts. For those looking to follow the market more actively each day, a daily livestream runs every morning at the market open, offering real-time commentary, screen sharing, trade ideas, and watchlists within the Discord community. Check out the link below: