Weekly Outlook 02/02/26

Silver and Gold crash, hawkish fed nomination, mixed tech earnings

Market Recap

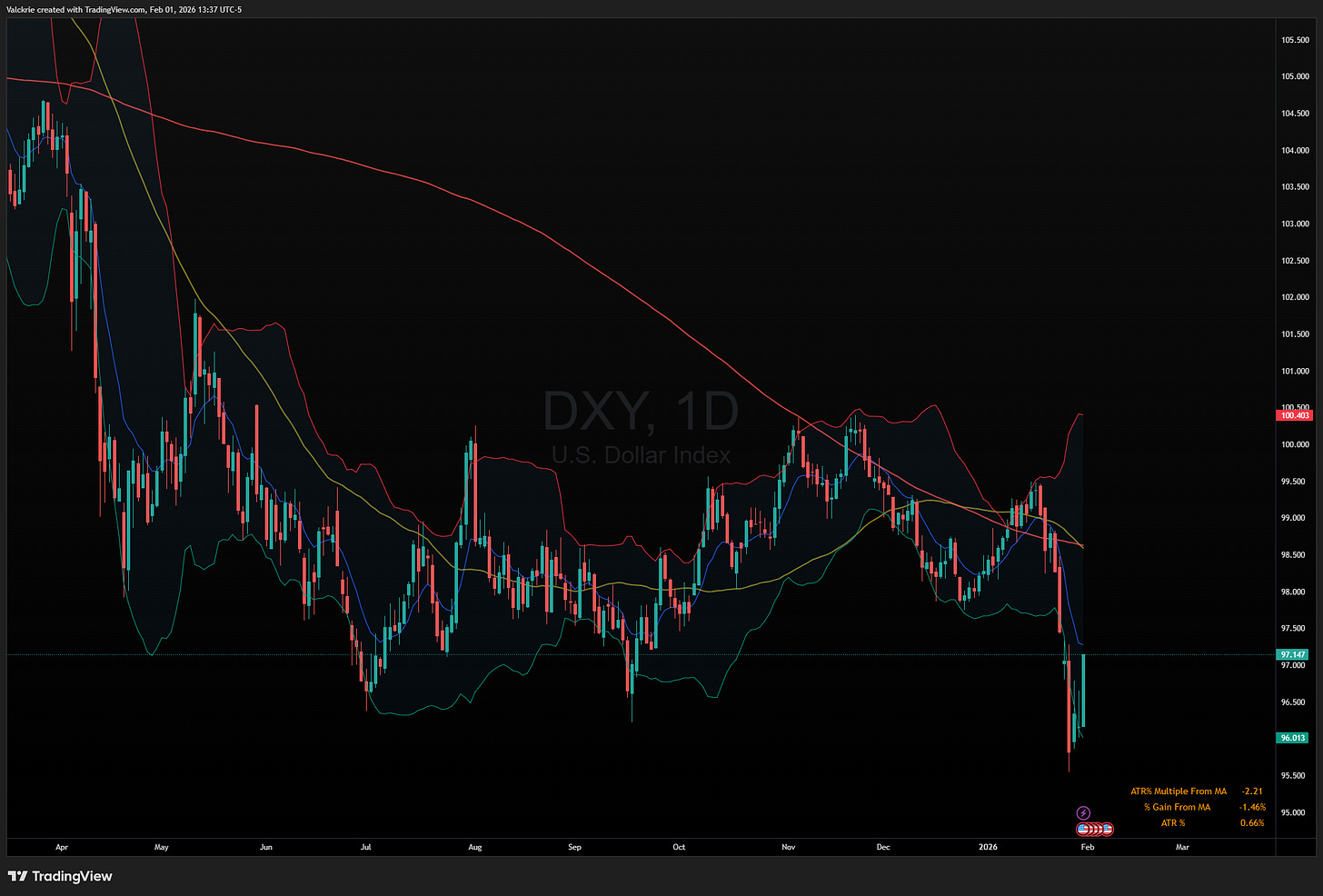

The week began with precious metals continuing their parabolic advance, while the dollar broke down on Tuesday before recovering as the week progressed.

The major inflection point came with sharp pullbacks across metals, where silver, despite a large drop early Monday, initially found support from continued strength in gold. I noted on X that both metals were getting extended enough to watch for a possible parabolic short setup:

Gold then accelerated higher before both metals reversed aggressively on Thursday, culminating in a historic and record breaking collapse in silver SLV 0.00%↑ of roughly -30% in a single session, a move that was exacerbated by leveraged ETF rebalancing flows in AGQ 0.00%↑.

Equities also came under pressure following the nomination of Kevin Warsh to the Federal Reserve, who is widely viewed as more hawkish, and it remains to be seen whether part of the broader selloff was driven by spillover deleveraging tied to the violent metals unwind as markets head into next week.

Earnings were mixed across technology, with META 0.00%↑ reporting strong results and being rewarded, MSFT 0.00%↑ beating expectations but selling off alongside a weak software sector, TSLA 0.00%↑ trading largely flat, and SNDK 0.00%↑ posting blowout earnings but facing profit taking after its recent run.

Watchlist

Earnings season continues, with several notable companies in the AI space reporting this week:

PLTR 0.00%↑ AMD 0.00%↑ GOOGL 0.00%↑ AMZN 0.00%↑ IREN 0.00%↑ BE 0.00%↑

Metals remain a top watch. After a historic drop from extreme upside extension, they are arguably now extended to the downside in the short term. One potential trade this week is a bounce in silver SLV 0.00%↑ and gold GLD 0.00%↑, which already began on Friday as the deleveraging-driven selling pressure appeared to exhaust.

Meanwhile in equities the major indices SPY 0.00%↑ and QQQ 0.00%↑ remain mostly rangebound. IWM 0.00%↑ continues to pull back on the small-cap side, while ARKK 0.00%↑ has broken down from its range and is now hovering right around the 200-SMA, a popular gauge for growth stocks and speculative appetite.

Crypto saw renewed breakdowns as $BTC and $ETH fell below their recent daily ranges after months of persistent relative weakness.

Several crypto-related stocks also made new lows, including CRCL 0.00%↑ MSTR 0.00%↑ and BMNR 0.00%↑.

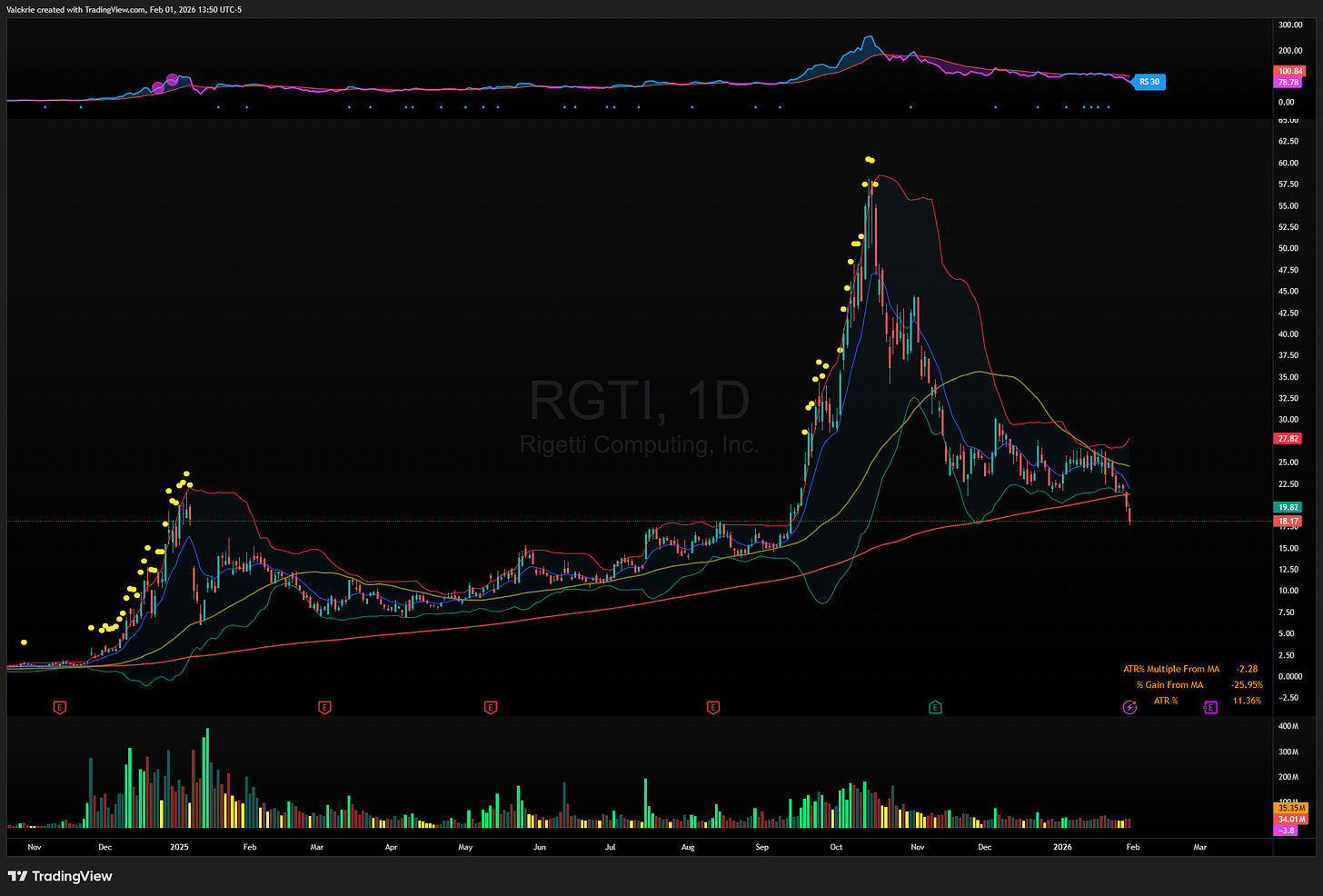

Another sector that broke down was quantum stocks, with the major names in the group losing the 200-SMA. RGTI 0.00%↑ triggered a clean technical breakdown (trade recap below), while IONQ 0.00%↑ QUBT 0.00%↑ and QBTS 0.00%↑ also broke key long-term levels.

Overall, there is a lack of bullish setups heading into the week following last week’s weak market action. Many sectors have rolled over, with charts firmly in downtrends.

That said, conditions can change quickly, especially with earnings acting as potential catalysts to renew enthusiasm in select names. With capital flowing out of the metals trade, it will be important to watch where that money rotates next, if anywhere at all.

Trade Highlights

UGL 0.00%↑ Gold parabolic short:

AGQ 0.00%↑ Silver overnight short:

RGT 0.00%↑ breakdown:

CRML 0.00%↑ breaking news trade afterhours:

Markets don’t wait for weekly posts. For those looking to follow the market more actively each day, a daily livestream runs every morning at the market open, offering real-time commentary, screen sharing, trade ideas, and watchlists within the Discord community. Check out the link below:

Strong breakdown analysis on quantum names. That sector-wide breach of the 200-SMA across QBTS, IONQ and QUBT tells alot about how quickly speculative appetite can evaporate when momentum rolls over. The metals deleveraging probably amplified risk-off flows everywhere. Been watching how capital rotates post-selloff and honestly not seeing clear winners yet, the breadth is just weak. earnings szn might shake things up but technically most setups look damaged rn.