Weekly Outlook 11/24/25

Market reacts negatively to NVDA earnings, dovish Fed comments stage a relief bounce

Market Recap

The market started the week on shaky footing despite last Friday’s strong bounce, which closely mirrored the prior Friday’s action. Instead of building on that strength, Monday opened with a gap down, breaking the pattern of generally positive Mondays seen in recent months and offering no follow through from the bounce. Selling pressure continued through the week and the major indexes slipped below the 50 day simple moving average.

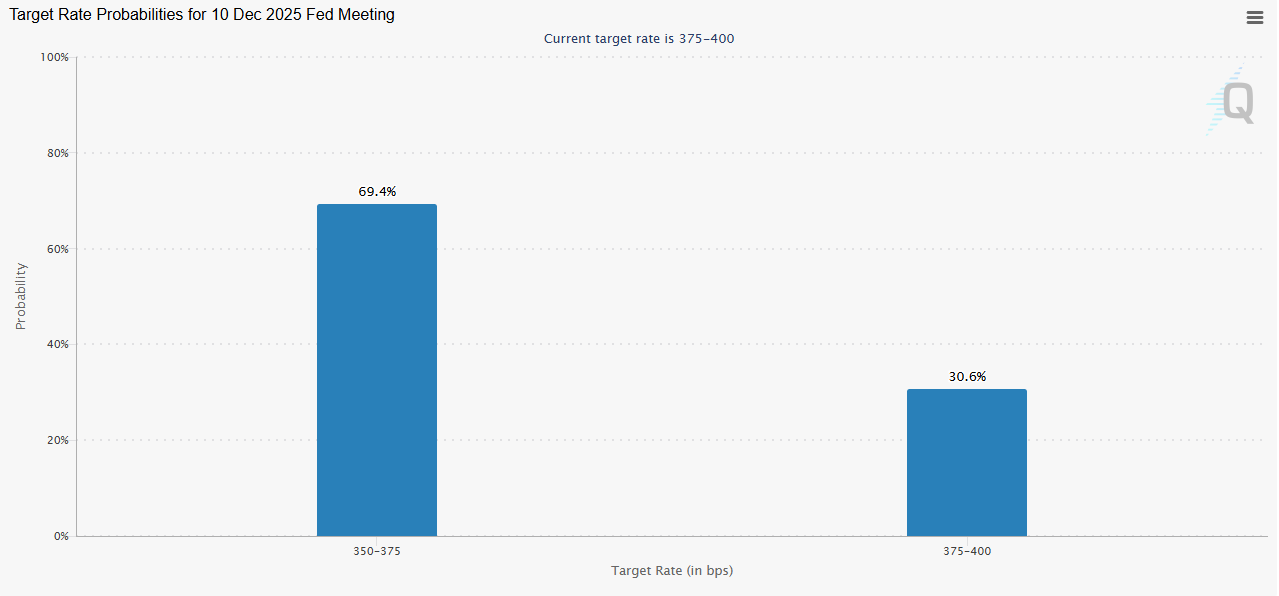

The main event came Wednesday with NVDA 0.00%↑ earnings, which beat expectations, yet the market reacted with an unusually sharp selloff. QQQ 0.00%↑ fell about -4% from intraday high to low, a move that has occurred only a handful of times in history, and finished roughly -2% below Wednesday’s close as selling spread broadly across equities. Friday brought a modest relief bounce after dovish comments from Fed Williams pushed the probability of a rate cut from about 40 percent last week to around 70 percent early in the session, helping IWM 0.00%↑ outperform.

Even so, IWM 0.00%↑ still printed an inside day, and both SPY 0.00%↑ and QQQ 0.00%↑ remain well below Thursday’s highs, suggesting no meaningful trend shift yet and that more time is needed to clarify market direction. One of the notable areas showing strength was homebuilders ITB 0.00%↑.

Watchlist

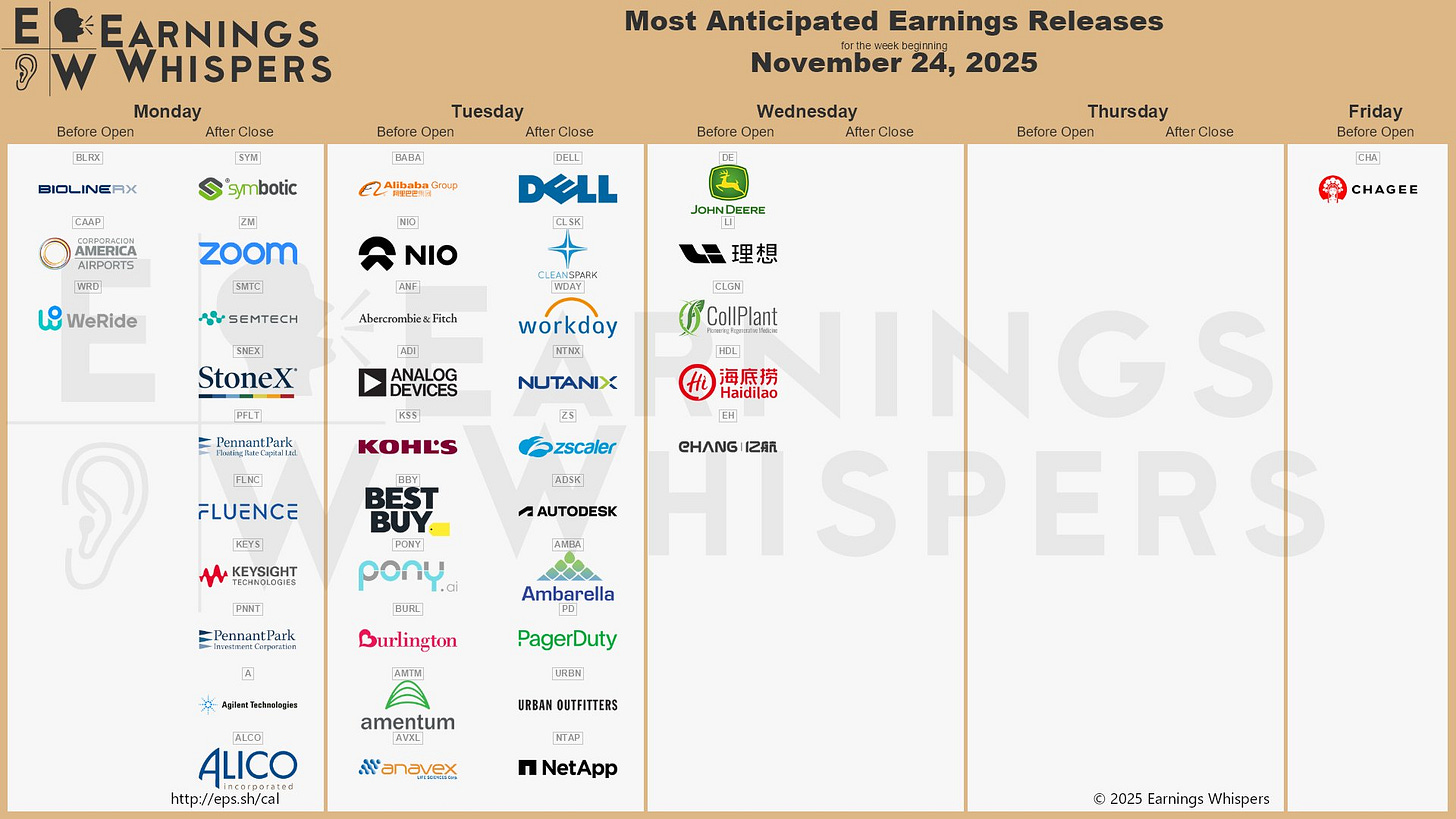

Earnings season is winding down, with only a small number of companies set to report in the days ahead. It will also be a shortened week, as the market closes for Thanksgiving on the 27th and operates for only a half session on Friday.

With the broader market in a short term downtrend and still working through a correction, conditions remain unfavorable for momentum based swing trading on the long side. Elevated volatility continues to push many individual stocks into tight correlation with the major indexes. As a result, most of the focus for now will be short term trading on AI related large cap stocks, some of which have are in extended downtrends. In the meantime, it’s also worth tracking relative strength in sectors, such as XBI 0.00%↑, XLV 0.00%↑ and PPH 0.00%↑ which are outperforming currently.

NVDA 0.00%↑ remains on watch after the earnings move and as a gauge of overall AI-sector sentiment. $180 was a key support level which it narrowly closed under on Friday.

PLTR 0.00%↑ broke the major $170 support level for the last month and is close to the 200-SMA.

ORCL 0.00%↑ continued its sell-off on Friday after breaking below the 200-SMA; a sharper downside move could set up a mean-reversion bounce.

$BTC nearly reached 80,000 on Friday morning, a notable support zone from earlier in the year. IBIT 0.00%↑ ETHA 0.00%↑

CRCL 0.00%↑ showed relative strength intraday on Friday and is trading near its IPO lows.

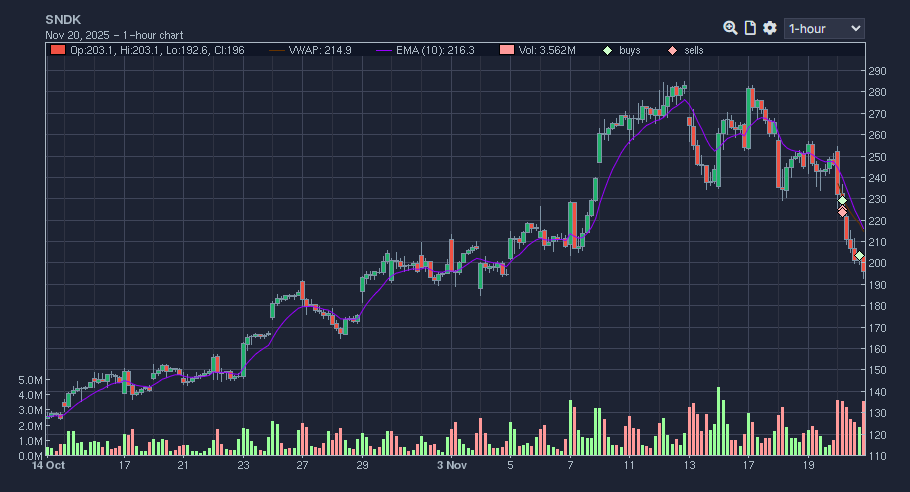

SNDK 0.00%↑ finally broke the extended uptrend over the last 2 months, closing under the 10-EMA that has been holding the entire uptrend. It bounced after becoming short term stretched to the downside along with the market, but could see resistance if it rallies into the 230-240 area now that momentum has shifted.

BE 0.00%↑ made a sharp 2-day move to the downside during the market selloff. Offers large intraday range and volatility to trade.

Trade Highlights

SNDK 0.00%↑ short as it finally broke the daily uptrend

BE 0.00%↑ bounce after a large two day decline

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: