Weekly Outlook 12/15/25

IWM all time highs after rate cut, Space sector ignites, whilst tech and AI basket suffer losses

Market Recap

IWM 0.00%↑ continued to outperform this week, breaking out to fresh all time highs after the Fed delivered its final interest rate cut of the year on Wednesday, with Powell striking a more dovish tone than many market participants had expected.

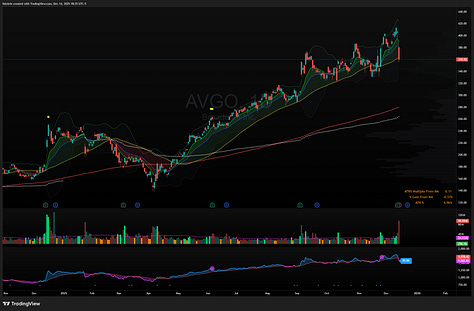

In contrast, technology showed notable weakness, as the Nasdaq 100 QQQ 0.00%↑ reacted poorly to earnings from two major AI heavyweights. Oracle ORCL 0.00%↑ raised its fiscal 2026 capex forecast by another $15b at a time when the market has been punishing elevated spending, and later in the week rumors circulated that some of its OpenAI related data center projects could be delayed until 2028, though those reports were later refuted. Broadcom AVGO 0.00%↑ also sold off despite beating earnings expectations, reinforcing the market tone for AI stocks currently.

ARKK 0.00%↑, often used as a barometer for growth oriented stocks, failed to reclaim its 50 day simple moving average, suggesting that additional consolidation may still be needed before a new uptrend can develop.

Outside of equities, Silver SLV 0.00%↑ continued its strength by breaking out to new highs, before pulling back at the end of the week.

Watchlist

Space stocks were among the strongest sectors last week following rumors of a potential SpaceX IPO in 2026 targeting a $1.5T valuation, after the most recent share sale valued the company at roughly $850B.

RKLB 0.00%↑ shares rose as the company, which has the second-highest number of U.S. space vehicle launches, continued to gain momentum.

PL 0.00%↑ delivered strong earnings and broke out from its recent consolidation range.

DXYZ 0.00%↑, a closed-end fund with roughly 23% of its holdings tied to SpaceX exposure, saw a major rally over the past week but became short-term stretched to the upside.

As one of the main driving market narratives, the AI and semiconductor sectors remain key areas to watch. Both NVDA 0.00%↑ and AMD 0.00%↑ are trading below their 50-SMA and printed bearish engulfing candles on Friday, leaving the group looking vulnerable.

ORCL 0.00%↑ the $186 price level is now a significant level to monitor, as it held twice last week following earnings and also marked the November low.

AVGO 0.00%↑ remains on watch post-earnings.

IREN 0.00%↑ looks vulnerable after closing at the lower end of its recent range, with the $40 area acting as a key level.

Weed stocks surged as Trump is expected to sign executive order to reclassify marijuana as soon as Monday: MSOS 0.00%↑ TLRY 0.00%↑ CGC 0.00%↑

OPEN 0.00%↑ has been trading in a tight range over the last couple of weeks and is starting to break support levels:

TSLA 0.00%↑ displayed notable relative strength on Friday closing near the highs when the market was selling off. The question remains if the stock can rally while the indices are weak.

Trade Highlights

PL 0.00%↑ earnings breakout:

CGC 0.00%↑ weed sector breakout:

DXYZ 0.00%↑ extended short:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

Thanks! Have a great week