Weekly Outlook 12/22/25

Softer CPI and OpenAI funding round sparks potential Santa rally, datacenters bounce and space stocks surge

Market Recap

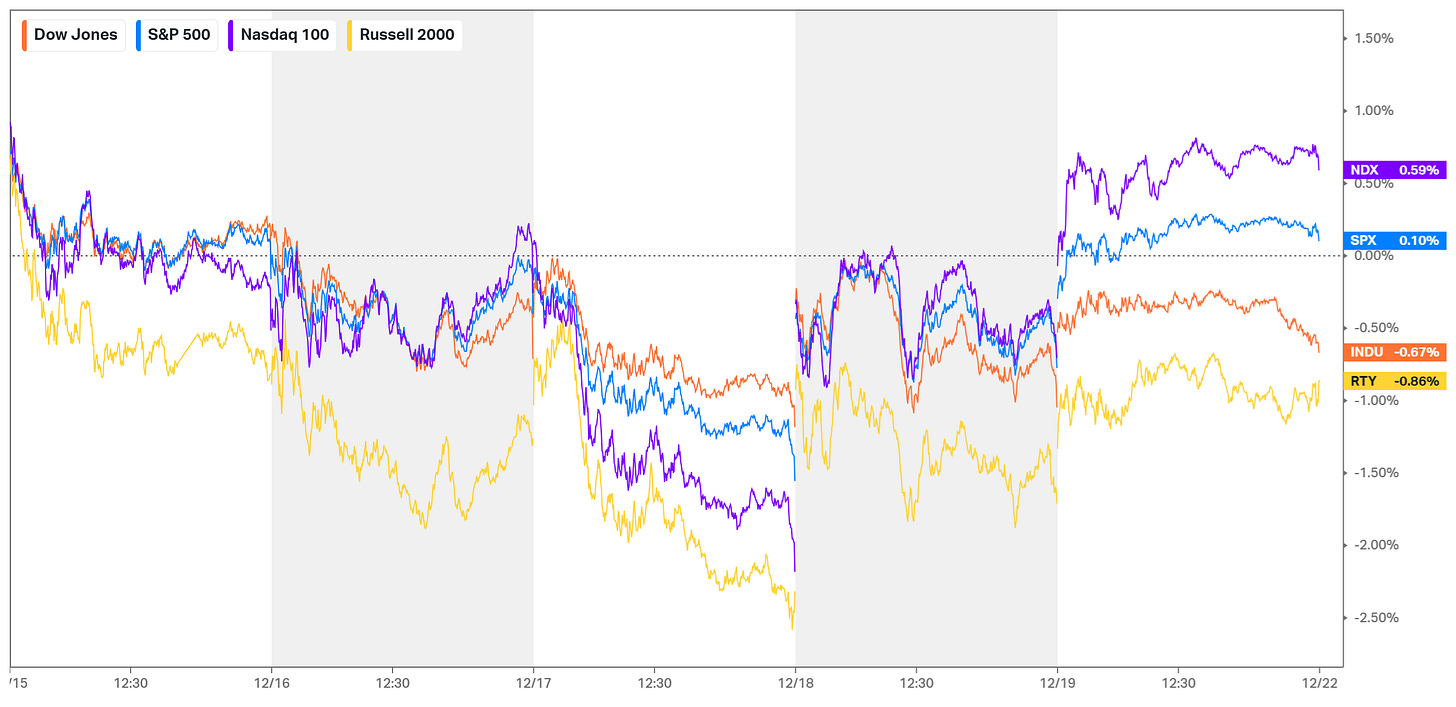

Following on from last week’s weak close, the market gapped up on Monday but sold off steadily throughout the session, starting the week on a negative note. The selling pressure intensified into Wednesday, with QQQ 0.00%↑ finishing down roughly 2% from open to close after overnight news that China had built a new working prototype of an EUV lithography machine. That headline weighed heavily on semiconductors, with ASML 0.00%↑ and NVDA 0.00%↑ among the hardest hit. Datacenter stocks were also caught in the downdraft, as ORCL 0.00%↑ continued to slide amid negative headlines, including renewed rumors of datacenter delays despite company refutations, along with reports that Blue Owl Capital had backed out of funding Oracle’s planned $10B Michigan datacenter.

Thursday marked a sharp turnaround, as the market gapped higher following softer than expected CPI inflation data. Adding to the positive shift in sentiment, MU 0.00%↑ delivered standout earnings, widely viewed as one of the largest beats and surprises in US semiconductor history, second only to NVDA 0.00%↑’s breakout moment in 2023. The week finished on a strong note, with Friday seeing QQQ 0.00%↑ break its short term downtrend as price rallied back above the 50 day SMA as well as the shorter term 10 and 20 EMAs. That move was further supported by news of a reported $100B OpenAI funding round valuing the company at around $830B, which appeared to ease investor concerns and helped Oracle bounce as a significant portion of its backlog is tied to OpenAI.

Watchlist

ORCL 0.00%↑ and CRWV 0.00%↑ had strong sessions on Friday following news from OpenAI’s funding round and could see further upside as they rally off recent lows. Other stocks in the data-center group that tend to move in tandem remain on watch, including NBIS 0.00%↑ IREN 0.00%↑ WULF 0.00%↑ CIFR 0.00%↑ APLD 0.00%↑.

PLTR 0.00%↑ broke out from a consolidation range on Friday and has shown clear relative strength versus the broader market over the past couple of weeks.

TSLA 0.00%↑ remains strong, consolidating near all-time highs.

RIVN 0.00%↑ is breaking out from a lengthy stage 1 base, making new 52-week highs and trading at levels not seen since early 2024. The move is supported by several fundamentals, including posting its first-ever consolidated gross profit in Q3 2025, a shift toward higher-margin autonomy and AI initiatives, an improved funding position and capital discipline highlighted by the Volkswagen partnership, and anticipated strong demand for the more affordable R2 platform.

RKLB 0.00%↑ closed at an all time high, as it continues to gain attention after winning its largest-ever contract, an SDA Tracking Layer Tranche 3 prime award worth roughly $816M to design and build 18 missile-warning and tracking satellites. This follows a prior $515M SDA Transport Layer Tranche 2 contract, bringing total SDA contract value to more than $1.3B. The win places Rocket Lab alongside major defense primes such as Lockheed Martin and Northrop Grumman, reinforcing its position as a credible new entrant among incumbents.

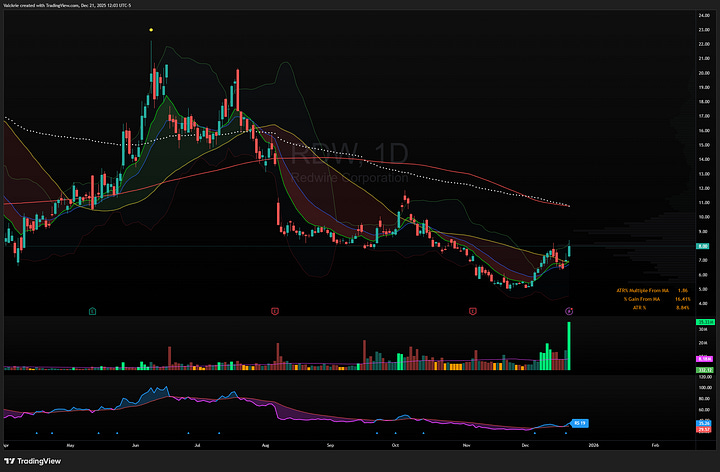

The broader space theme continues to see strong volume and gains, with the major narrative into 2026 centered around a potential SpaceX IPO. Other names to watch within the space theme include LUNR 0.00%↑ PL 0.00%↑ BKSY 0.00%↑ and RDW 0.00%↑.

DJT 0.00%↑ shares are trading higher after Trump Media & Technology Group signed a merger agreement with TAE Technologies. The stock has seen heavy volume over the past two sessions but remains in a longer-term downtrend.

Trade Highlights

DXYZ 0.00%↑ was technically extended and continued to fall after exhausting momentum last Friday:

MSOS 0.00%↑ sold off on Thursday, resulting in a sell the news event as President Trump considered an executive order to reclassify marijuana:

PLTR 0.00%↑ daily breakout:

RKLB 0.00%↑ breakout:

CRWV 0.00%↑ rally from lows:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: