Weekly Outlook 12/29/25

Silver goes parabolic

Market Recap

It was a shortened holiday week, but the market still managed to close strongly, with the SPY 0.00%↑ closing at an all time high, aligning well with seasonal tendencies that historically favour positive returns during this period. On the equity side, trading conditions were relatively low volatility and sideways, shaped by a mix of tax loss harvesting and early window dressing activity. Space related stocks pulled back after their strong prior rally, taking a breather as momentum cooled.

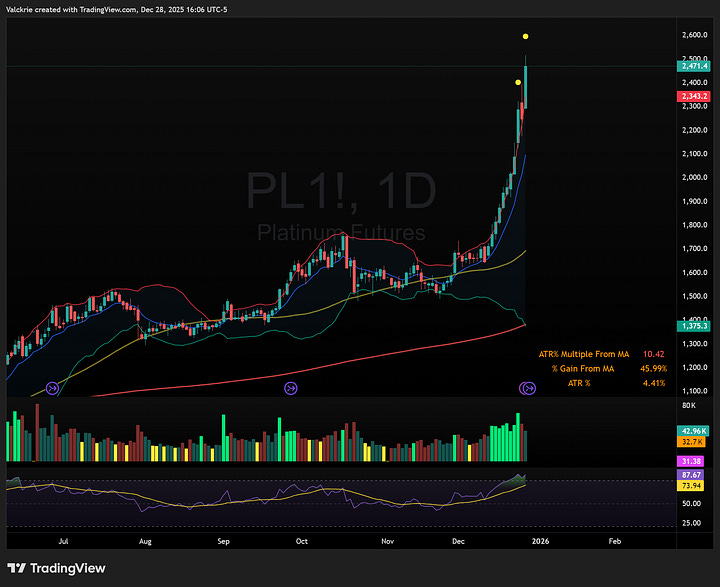

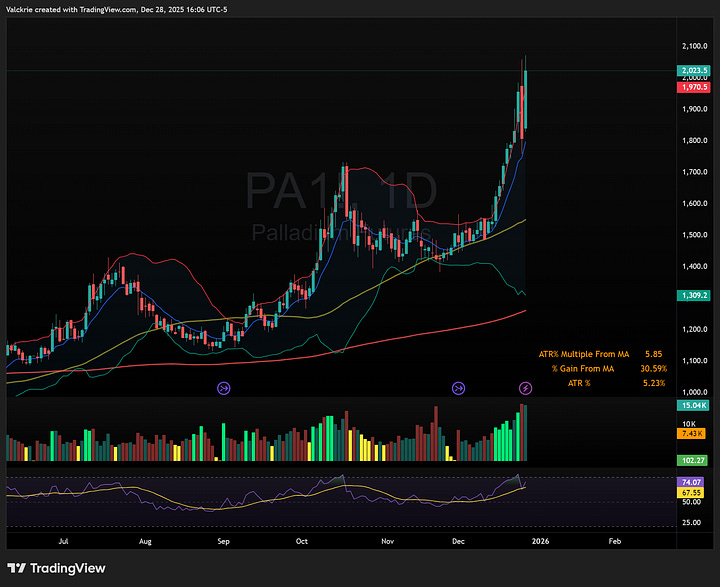

One of the most notable developments came from the precious metals space, where both platinum and silver futures posted sharp, almost parabolic moves. With that strength in mind, precious metals remain firmly on the watchlist in the week ahead.

Watchlist

With muted action in equities last week, silver takes centre stage as the most important asset to be tracking this week.

The main narratives driving price action include:

potential Chinese silver export restrictions set to take effect on January 1st

silver trading at higher prices on foreign exchanges such as Dubai and China

strong industrial demand - particularly from the solar industry, as renewable energy demand accelerates alongside AI-driven infrastructure buildouts

In addition, the CME increased margin requirements, adding another key factor influencing silver price action in the near term.

Below is a link to a detailed article on X which discusses many points of interest, including past margin hikes during Silver rallies:

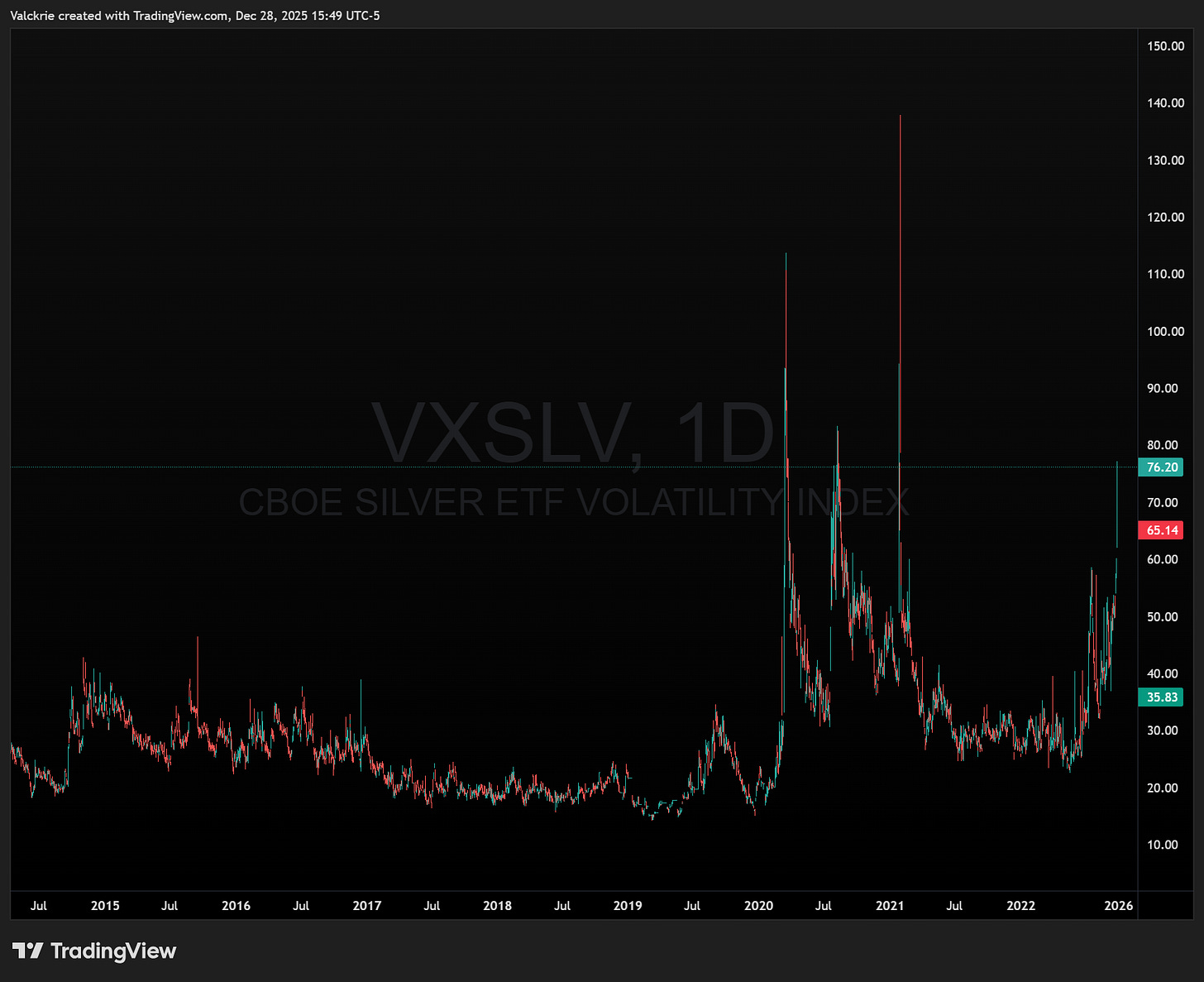

Volatility in silver has also started to increase dramatically:

Statistics on silver after 10% spikes:

Thoughts from a market wizard who has been trading commodities for decades:

While silver remains the most important asset to watch, platinum and palladium futures are also noteworthy after posting large rallies, though both saw a sharp pullback on Wednesday. If silver stages a reversal, it is highly likely the other metals will follow with similar pullbacks.

Trade Highlights

Platinum PLTM 0.00%↑ offered a short opportunity after being extremely extended short term on Wednesday:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: