Weekly Market Recap, Watchlist & Trade Highlights 07/28/25

Speculative rally cools off, short squeeze meme stocks, upcoming Fed decision & heavy earnings week

Market Recap

It was a quiet but bullish week in the markets as both the SPY 0.00%↑ and QQQ 0.00%↑ closed at new all-time highs. In contrast, the IWM 0.00%↑ lagged and Bitcoin pulled back to its 20-day EMA, pausing after the recent all time high breakout.

The broader indices remain in a record-setting uptrend, with a historic streak of consecutive closes above the 20-day EMA. This reflects strong underlying momentum, suggesting positive returns in the near term future:

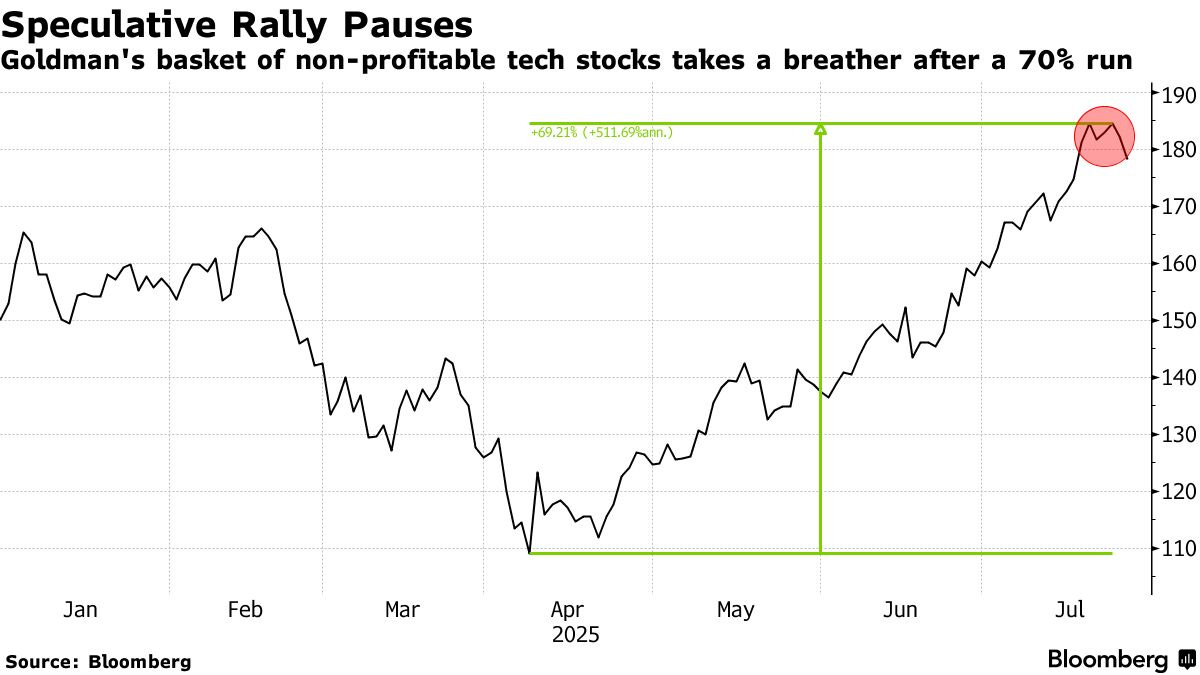

While the indices held strong, speculative names that had surged in recent weeks took a breather:

However, the week's standout theme was a wave of short squeezes, triggered by Opendoor Technologies (OPEN 0.00%↑) going parabolic and peaking on Monday.

Other high short interest names also participated in the squeeze, with strong upside moves and elevated volatility, offering intraday trading opportunities due to their wide ranges:

Kohl’s (KSS 0.00%↑_

Krispy Kreme (DNUT 0.00%↑)

GoPro (GPRO 0.00%↑)

Watchlist

A major focus will be the FOMC rate decision on Wednesday, with markets pricing in a 96% probability that rates remain unchanged at 4.25%–4.50%. Traders will be watching Chair Powell's press conference for clues about rate cuts later this year.

It will also be a heavy week for earnings, especially as four of the MAG 7 will be reporting, as they make up a large weighting of the QQQ 0.00%↑:

Wednesday: META 0.00%↑ MSFT 0.00%↑

Thursday: AAPL 0.00%↑ AMZN 0.00%↑

Other notable earnings in popular retail & momentum stocks include:

Apart from earnings, the watchlist remains relatively limited, as speculative stocks have cooled off. As we approach the end of July, historically one of the strongest months seasonally, some digestion and consolidation in August wouldn't be surprising. This would align with the current price action, where many names have pulled back or are in the process of forming new bases.

LIDR 0.00%↑ a smallcap stock that saw a huge move after news that “AEye Announces Its Apollo Lidar Has Been Integrated By NVIDIA Into The DRIVE AGX Platform”.

OKLO 0.00%↑ nuclear sector remained strong this week, following a positive reaction to GEV 0.00%↑ earnings. Other stocks SMR 0.00%↑ NNE 0.00%↑ also saw positive gains this week.

PONY 0.00%↑ is currently basing with a potential breakout above $16.

SERV 0.00%↑ is forming a cup and handle pattern and trading in a range from $10 to $12.

SMCI 0.00%↑ closed at new highs for the week as semiconductors rallied.

Trade Highlights

Many of the extended charts on the watchlist from last weeks post offered short trades as they pulled back this week:

OPEN 0.00%↑ parabolic short was a key watch from last weeks post:

QS 0.00%↑ finally saw some weakness as it broke the prior daily bar low:

JOBY 0.00%↑ saw some selling pressure on Monday afternoon and gapped down into Tuesday as the momentum basket pulled back:

KSS 0.00%↑ gapped up with other short squeezestocks and faded immediately from the open:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community: