Weekly Watchlist 10/27/25

Big week ahead with FOMC rate cut, megacap earnings, Trump-Xi meeting

Market Recap

Early in the week, gold attempted to rally on Monday before experiencing its biggest one day drop (-5.7%) since 2013. There were several clear signs pointing to a potential top in gold, many of which were discussed in last weeks watchlist:

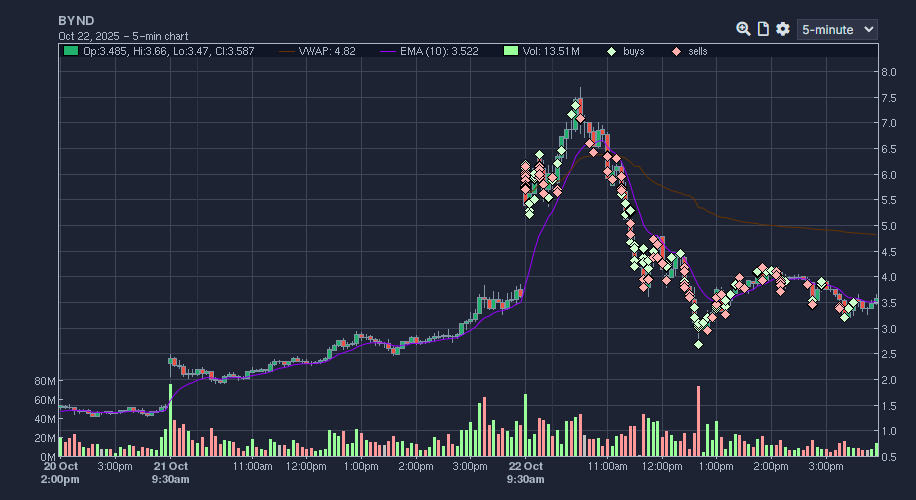

One of the standout trading opportunities this week was the parabolic squeeze in BYND 0.00%↑ which saw massive trading volumes over $2B shares on consecutive days. After the squeeze, the stock quickly faded into the end of the week.

Meanwhile, the CPI report came in cooler on Friday, triggering the indices to break to new all time highs in SPY 0.00%↑ and QQQ 0.00%↑, confirming continued strength in the broader market.

Watchlist

It will be a huge week ahead with megacap earnings, the Fed meeting, and the Trump-Xi meeting all on deck.

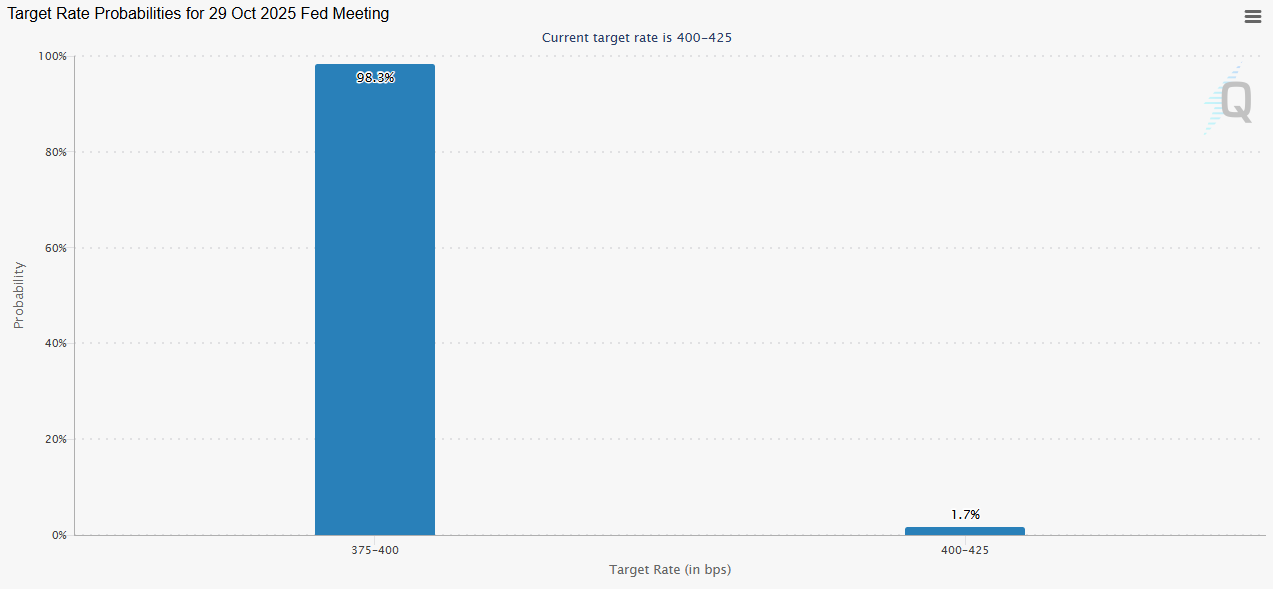

The market is closely watching the Fed’s announcement midweek, with a rate cut expected at 98% probability.

Megacap earnings as well as 20% of S&P 500 expected to report this week: MSFT 0.00%↑ GOOG 0.00%↑ META 0.00%↑ AAPL 0.00%↑ AMZN 0.00%↑

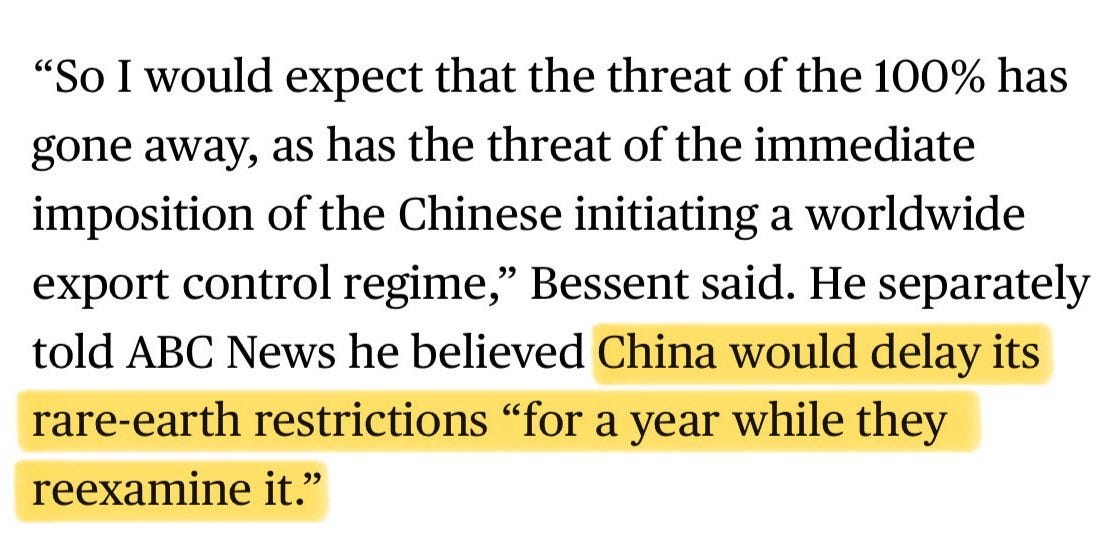

Over the weekend, reports of positive developments have already circulated after China’s Vice Minister of Commerce Li Chenggang announced that China and the United States reached a consensus on key trade issues after “candid and constructive” talks in Kuala Lumpur.

100% tariffs now appear unlikely.

Rare earth restrictions have been delayed for a year.

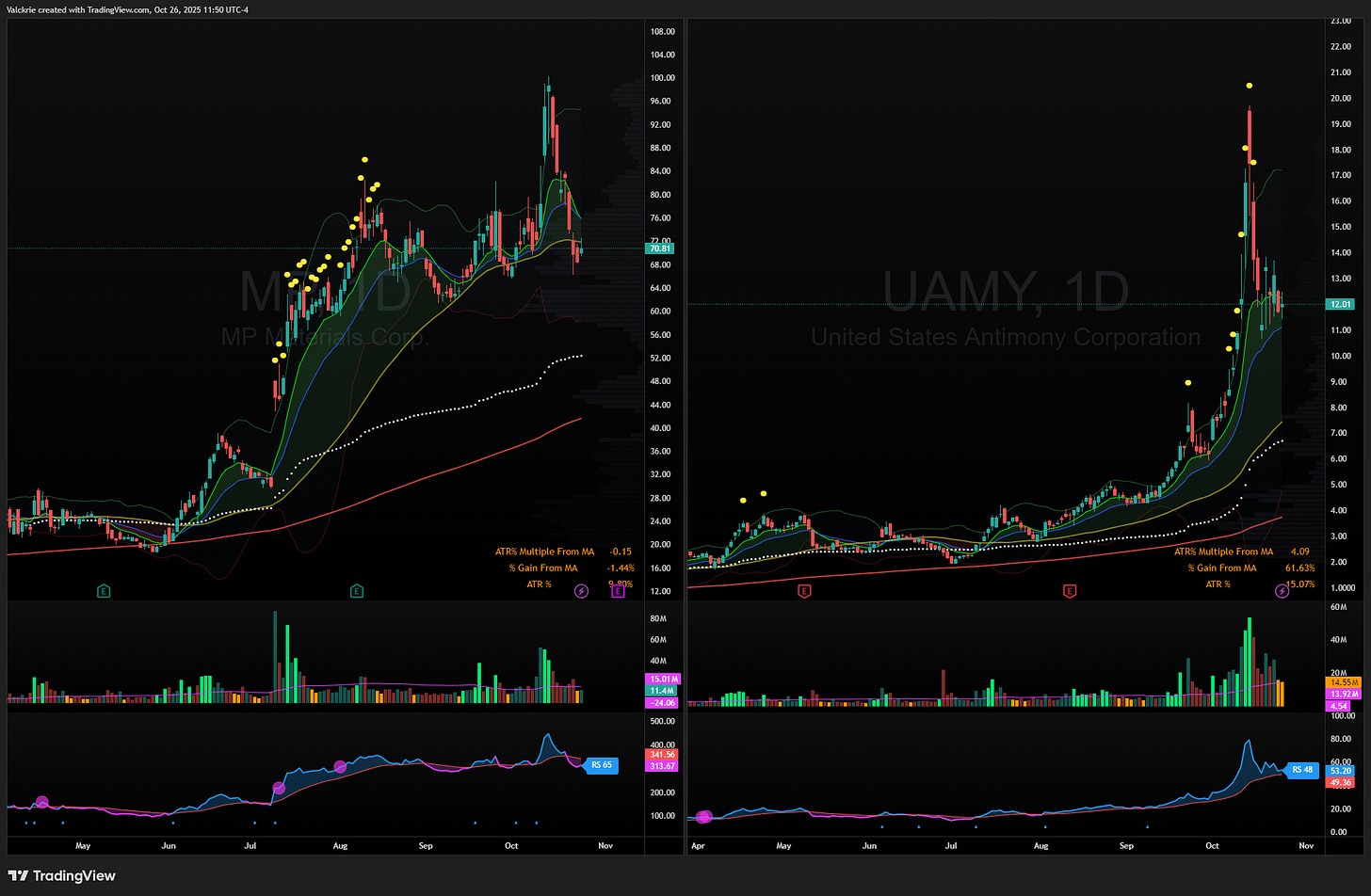

As a result of this news, there could be more potential downside in the rare-earth metals space: MP 0.00%↑ UAMY 0.00%↑

Extended stocks

SNDK 0.00%↑ has gained nearly 300% since breaking out from 50 in September. The rate of ascent has started to accelerate, with a potential parabolic reversal setting up.

MU 0.00%↑ is another stock in the same space but is not quite as extended.

Strong stocks

AMD 0.00%↑ broke out to all time highs on Friday after showing steady relative strength over the last few weeks, following their OpenAI partnership. Currently holding a position from the breakout on Friday.

PLTR 0.00%↑ has been trading in a range for over a month. A breakout over 190 should be watched closely, with the question being whether it moves before earnings or waits until afterward.

TSLA 0.00%↑ remains on watch after recovering its earnings gapdown. If it can clear the 450 range top, it could trigger another leg higher.

Datacenters

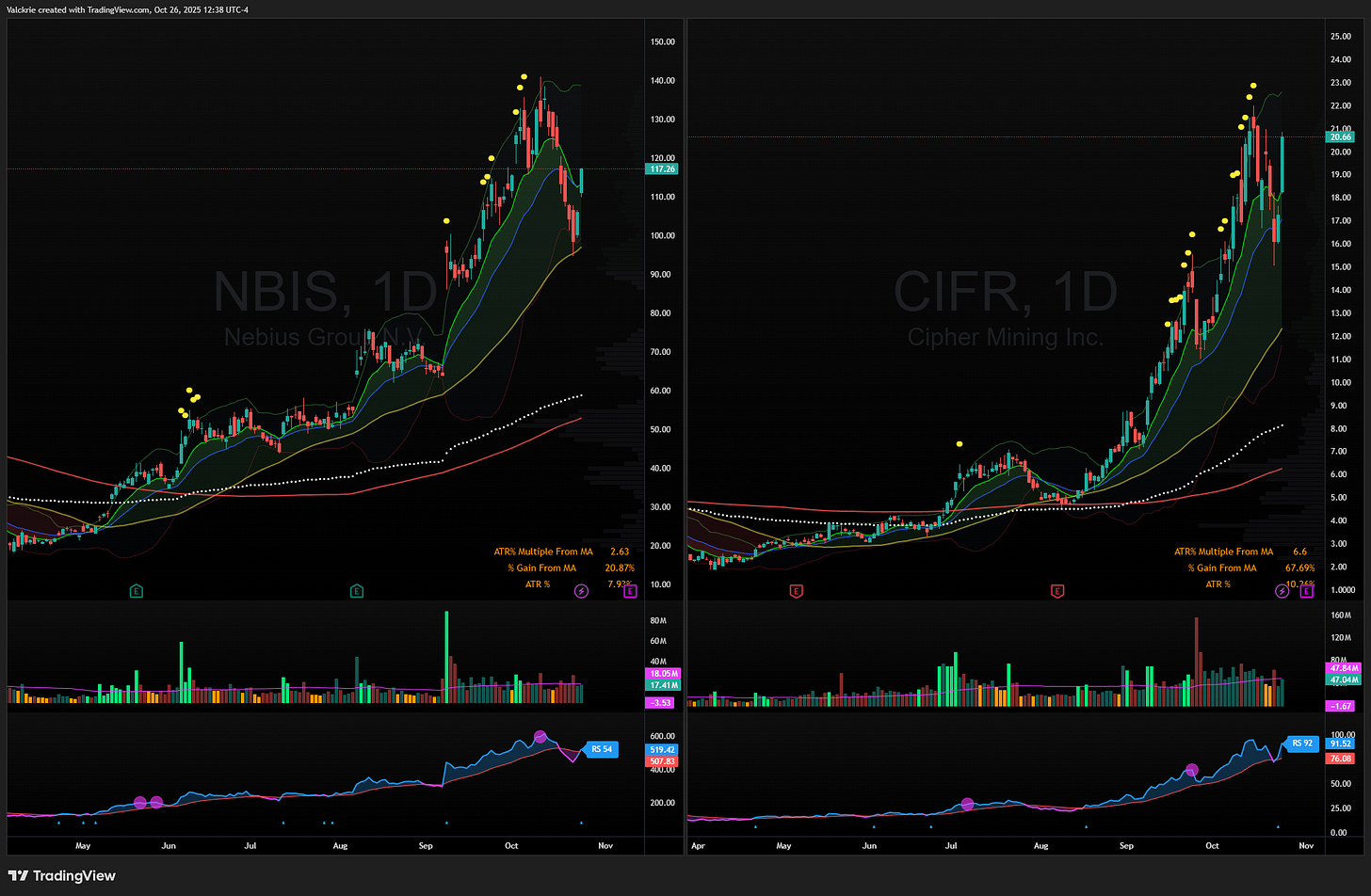

Datacenters remain a strong theme and one of the key backbones of the ongoing AI bull market. These stocks saw stronger bounces last week and could be setting up to continue their uptrends: CIFR 0.00%↑ IREN 0.00%↑ APLD 0.00%↑ NBIS 0.00%↑ HUT 0.00%↑

Some other stocks that had decent bounces this week: BE 0.00%↑ FLNC 0.00%↑ PATH 0.00%↑ QS 0.00%↑ OPEN 0.00%↑ RR 0.00%↑

Speculative weakness

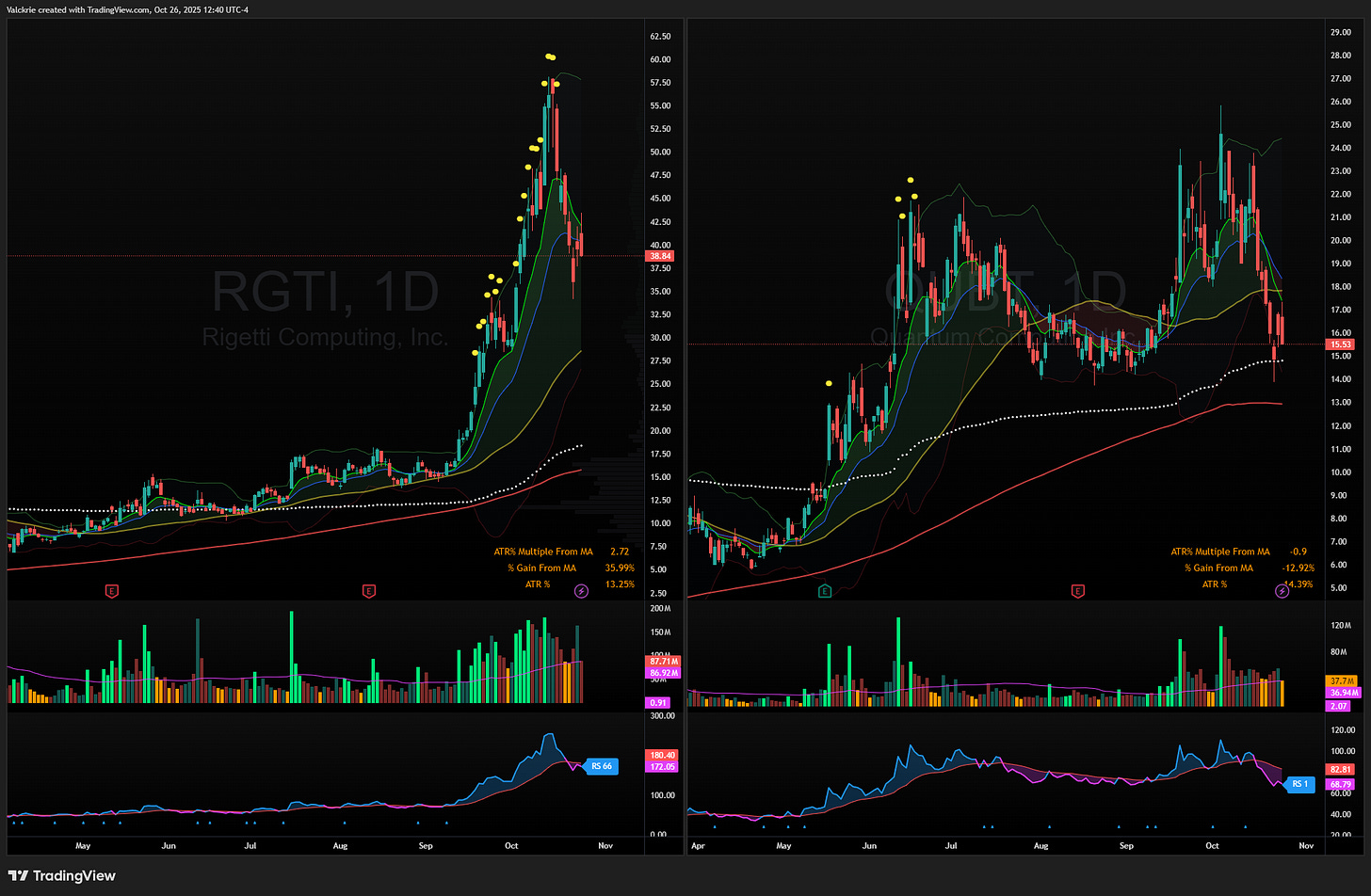

Quantum stocks did not bounce much last week and were sold off on the news of potential government stakes. This price action suggests they are forming lower highs and could be setting up for a move lower. RGTI 0.00%↑ QUBT 0.00%↑ IONQ 0.00%↑ QBTS 0.00%↑

Trade Highlights

Gold short on Tuesdays selloff:

BYND 0.00%↑ shorts on the pawrabolic day:

NBIS 0.00%↑ swing long from the 50-SMA and $100 retest:

For intraday updates and daily trade setups, including day and swing trades, check out the link below to join the community:

I like your take on the datacenter names. APLD has been one of my favorit plays in that space because they have more diversifed revenue than just pure crypto mining. The way they bounced last week after holding that mid teens support was actually pretty clean. You mention them setting up to continue uptrends, and I'm watching to see if we get a break above that recent high around $23 or if we need more time to digest the recent run. The AI infastructure narrative is still strong but some of these names are getting pricey.